EUR/USD - I'm still looking for one last rally higher towards 1.2650 or slightly higher before the correction from 1.2040 ends and red wave 5 to down below 1.2040 takes over.

As we have failed to break above the red wave iii top at 1.2590 we have a couple of options here. One is that the red wave iv is developing into a minor triangle and if this is the case we need a couple of squiggles more before we can take of in red wave v. However if we breaks below 1.2465 and more importantly 1.2430 in a impulsive wave we could have seen a fifth failure. Let me be clear here. I'm not calling for the fifth failure as there is no way you can tell in advance that a fifth failure is about to occur. I'm just pointing out the options for now.

USD/JPY - I'm still very very much in doubt was is going on here, but as I have said previously as long as important support at 78.15 protects the downside I will keep my bullish count. But just one tick below 78.15 and my bullish count is out of the door and a decline to below 77.90 and likely even below 77.65 should be expected.

It will take a rally above 78.84 and more importantly above 79.42 to confirm that light green wave iii is under way.

GBP/USD - The correction from 1.5754 ended at 1.5874 just 9 small pips above the correction target I sat on August 28 (see my post here: http://theelliottwavesufer.blogspot.dk/2012/08/elliott-wave-analysis-of-eurusd-usdjpy_28.html). The reaction from 1.5874 is clearly impulsive in character and we should soon see the next decline towards at least 1.5634 in blue wave iii down.

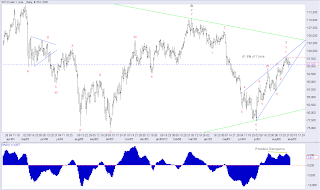

USD/CAD - It has been some time since I have last spoken about this pair, but we most likely saw an important low on August 20 with the test of 0.9841, which was followed by wave i higher to 0.9948 and then a deep correction down to 0.9842 (almost a 100% retracement of wave i) and I'm now looking for wave iii to take us clearly above 0.9948 towards the 1.0054 - 1.0075 area before a shallow wave iv takes over. But be aware that this wave iii could be much more powerful than I expects and overall we are looking at much higher levels well beyond 1.0657 longer term. So buying a break above 0.9948 with a stop just below 0.9841 offers a very nice risk/rewards opportunity.

EUR/JPY - again failed to break above resistance at 98.82, but it still takes a break below 97.80 to invalidated the bullish count here. So as long as important support at 97.80 holds firm I will be looking for a break above 98.39 and more importantly 98.82 for a rally higher towards 99.59 and maybe even 100.60 in red wave 5.

EUR/NZD - Maroon wave iii did not end at 1.5671 as I said yesterday, but at 1.5706 (just to tiny pips below my 1.5708 target) and now we should be looking for maroon wave iv down to the 1.5545 - 1.5583 area before maroon wave v sets in for a rally towards 1.5764, but remember this is only the first wave three and four in a series of waves three's and four's that we should see over the coming days and ideally takes us up to the 1.5942 - 1.6090 area.

VIX and Dow Jones Industrial Index - Can anyone tell me whats going on here? VIX is up by some 21% while the DJI is down by a mer of 2.5%. Something is clearly wrong here. Which is right?

Looking at the massive divergence that we saw at the 13,330.44 top in the DJI I believe that the VIX is telling us the real story, but we have seen a lot of wired stuff since the March 2009 low and with the Jackson Hole Symposium coming up today most are looking for/ hoping for the announcement of QE3. I do think the the market will be disappointed and the Jackson Hole will be a non event at least that is what the charts tells me, but what do I know....

Gold - Continues to back off from the 1,676.79 high and I expect the top of the correction that began at 1,526.80 to be in place and the next decline towards strong support near 1,521.00 to be under way.

Jackson Hole non event outcome. However if you go that way you know where your stop should be, but nobody will trade up to an event like Jackson Hole without a stop no matter what way their believes go...

Crude Oil - An almost perfect 61.8% retracement of wave 1 at 97.82 and now a break below the wedge support, a formation which normally has about 2/3 validity of playing out. It's clearly time to quit any longs and shift your focus to the downside for a break below 92.60 on the way below 77.29 longer term. Selling Crude Oil here with a stop just above the top at 98.30 will leave you with a 3.55% risk against a reward of 18.6% if we see 77.29 a risk/reward ratio of over 5. You just don't get it much better than that. But if you expect Benanke to announce QE3 today, that is of cause not the way you want to trade. I'm just going with what the charts is telling me....

Friday, August 31, 2012

Thursday, August 30, 2012

Elliott Wave analysis of EUR/USD; NZD/USD; EUR/JPY; EUR/NZD and Gold

EUR/USD - I'm still looking for a slightly higher high here towards 1.2650 before the red wave 4 correction from 1.2040 comes to an end and red wave 5 to below 1.2040 can begin.

NZD/USD - Starting with the bigger picture, there question here is whether a large triangle is developing as wave wave 4 or we are in a complex correction that eventually will take us be important support at 0.7454. Time will show. However for now we should be looking for a continuation down towards support near 0.7839 as wave 3 progresses.

EUR/JPY - It should only be a matter of time before we break above resistance at 78.82 for a move above 99.18 towards the first possible target for red wave 5 near 99.59.

It's still only a break below 79.80 that would invalidate this count.

EUR/NZD - Maroon wave iii most likely ended at 1.5671 slightly below the ideal target near 1.5708, but we should only expect a minor correction in maroon wave iv towards 1.5568 before the next rally higher towards 1.5764 in maroon wave v and green wave iii

Gold - Even though we have seen the resistance-line be broken I don't expect gold to extends its rally much further. Ideally we will see a break below 1,652.45 to confirm that the correction from 1,526.95 is over and a new decline towards strong support near 1,521.00 is on.

NZD/USD - Starting with the bigger picture, there question here is whether a large triangle is developing as wave wave 4 or we are in a complex correction that eventually will take us be important support at 0.7454. Time will show. However for now we should be looking for a continuation down towards support near 0.7839 as wave 3 progresses.

EUR/JPY - It should only be a matter of time before we break above resistance at 78.82 for a move above 99.18 towards the first possible target for red wave 5 near 99.59.

It's still only a break below 79.80 that would invalidate this count.

EUR/NZD - Maroon wave iii most likely ended at 1.5671 slightly below the ideal target near 1.5708, but we should only expect a minor correction in maroon wave iv towards 1.5568 before the next rally higher towards 1.5764 in maroon wave v and green wave iii

Gold - Even though we have seen the resistance-line be broken I don't expect gold to extends its rally much further. Ideally we will see a break below 1,652.45 to confirm that the correction from 1,526.95 is over and a new decline towards strong support near 1,521.00 is on.

Wednesday, August 29, 2012

Elliott Wave analysis of EUR/USD; USD/JPY; GBP/USD; EUR/JPY; EUR/NZD; Gold and Crude Oil

EUR/USD - We should soon see a break above the 1.2590 higher for a move towards 1.2693 and likely even into the 1.2635 - 1.2673 area for the final top of the red wave 4 correction that began at 1.2040. Once we have red wave 4 in place we should see red wave 5 take over for a move below 1.2040. I will calculate the targets for red wave 5 once we have the red wave 4 high in place.

USD/JPY - As long as important support at 78.15 holds I will keep the bullish count. Short term a break above 78.70 and more importantly 78.84 is needed to ease the downside pressure, but a break above 79.42 is needed to confirm, that the decline from 79.66 only was a correction.

A break below 78.15 by just one tick will invalidate the bullish count and call for a deeper decline.

GBP/USD - We have most likely seen wave i down from the 1.5912 high and should expect a wave ii correction higher towards 1.5866 before red wave iii down takes over for a decline towards at least 1.5581.

EUR/JPY - Red wave 5 towards 99.59 and possibly even 100.60 has begun. Short term we should soon see a break above 78.82 for a continuation higher towards 99.18 and 99.59.

EUR/NZD - The lack of corrective power has forced my back to my original much more bullish count of a series of wave one's and two's, which means that we should see a much higher rally in the coming days towards 1.5942 and likely even 1.6090 as a series of waves three's and four's unfolds.

Gold - Ideally we will see a break below 1,656.55, which will confirm that wave C ended at 1,676.79 and a new decline towards strong support near 1,521 is unfolding.

Crude Oil - Most likely have seen its peak for wave 2 at 98.30 and we should soon see a break below 94.43 to confirm the top for the next powerful decline to below 77.29.

USD/JPY - As long as important support at 78.15 holds I will keep the bullish count. Short term a break above 78.70 and more importantly 78.84 is needed to ease the downside pressure, but a break above 79.42 is needed to confirm, that the decline from 79.66 only was a correction.

A break below 78.15 by just one tick will invalidate the bullish count and call for a deeper decline.

GBP/USD - We have most likely seen wave i down from the 1.5912 high and should expect a wave ii correction higher towards 1.5866 before red wave iii down takes over for a decline towards at least 1.5581.

EUR/JPY - Red wave 5 towards 99.59 and possibly even 100.60 has begun. Short term we should soon see a break above 78.82 for a continuation higher towards 99.18 and 99.59.

EUR/NZD - The lack of corrective power has forced my back to my original much more bullish count of a series of wave one's and two's, which means that we should see a much higher rally in the coming days towards 1.5942 and likely even 1.6090 as a series of waves three's and four's unfolds.

Gold - Ideally we will see a break below 1,656.55, which will confirm that wave C ended at 1,676.79 and a new decline towards strong support near 1,521 is unfolding.

Crude Oil - Most likely have seen its peak for wave 2 at 98.30 and we should soon see a break below 94.43 to confirm the top for the next powerful decline to below 77.29.

Tuesday, August 28, 2012

Elliott Wave analysis of EUR/USD; USD/JPY; GBP/USD; EUR/JPY and Gold

EUR/USD - We have a new unconfirmed break below 1.2482 and the spike up from 1.2465 does make the decline from 1.2590 look corrective and therefore only wave iv of wave c. That means we should expect one last rally to just above the 1.2590 high. The 1.2593 ideal target would be enough, but we must accept if this rally extends beyond that target for a move towards 1.2650, but we are in the absolute last part of the correction from 1.2040 and a top could be found soon after we break into new territory after 1.2590.

USD/JPY - I'm still very much in doubt here. As I have said the last couple of days I will keep my bullish count as long as we don't break below key-support at 78.15, but just one tick below and the bullish count is invalidated.

Looking at the bullish count the only possible bullish count is the one shown above, where red wave i of green wave iii has to be a leading diagonal and we are currently in wave ii of green wave ii, which should find it's bottom in the 78.44 - 78.49 area for the next rally above 78.84 and more important 79.32, which will confirm the bullish count above.

GBP/USD - Here we most likely saw wave i down from 1.5912 to 1.5754 and are currently working on wave ii towards resistance near 1.5865 before wave iii down takes over for a decline towards at least 1.5609 and much lower in the big picture.

EUR/JPY - (This chart was downloaded earlier this morning and therefore don't show the latest spike higher). Important support at 97.80 still protects the downside and I now looking for a break above 98.82 for a break above 99.18 towards the first target for red wave 5 near 99.59 and possibly even a move higher towards 100.60. At this point I would not bet on the 100.60 target, but a clear break above 99.59 would call for 100.60 to be tested.

Gold - The correction from 1,526.80 most likely ended at 1,676.79 just a few ticks above the ideal target at 1.676.44. We should now see resistance at 1.669 for the next decline below 1,656.55 towards important support at 1,625.

To turn the picture bullish it will take a break above 1,700.

USD/JPY - I'm still very much in doubt here. As I have said the last couple of days I will keep my bullish count as long as we don't break below key-support at 78.15, but just one tick below and the bullish count is invalidated.

Looking at the bullish count the only possible bullish count is the one shown above, where red wave i of green wave iii has to be a leading diagonal and we are currently in wave ii of green wave ii, which should find it's bottom in the 78.44 - 78.49 area for the next rally above 78.84 and more important 79.32, which will confirm the bullish count above.

GBP/USD - Here we most likely saw wave i down from 1.5912 to 1.5754 and are currently working on wave ii towards resistance near 1.5865 before wave iii down takes over for a decline towards at least 1.5609 and much lower in the big picture.

EUR/JPY - (This chart was downloaded earlier this morning and therefore don't show the latest spike higher). Important support at 97.80 still protects the downside and I now looking for a break above 98.82 for a break above 99.18 towards the first target for red wave 5 near 99.59 and possibly even a move higher towards 100.60. At this point I would not bet on the 100.60 target, but a clear break above 99.59 would call for 100.60 to be tested.

Gold - The correction from 1,526.80 most likely ended at 1,676.79 just a few ticks above the ideal target at 1.676.44. We should now see resistance at 1.669 for the next decline below 1,656.55 towards important support at 1,625.

To turn the picture bullish it will take a break above 1,700.

Monday, August 27, 2012

Elliott Wave analysis of EUR/USD; USD/JPY; GBP/USD; EUR/JPY; EUR/NZD; DJI and Gold

EUR/USD - We have seen a decline to 1.2481, but this does not constitute a break below 1.2482 and therefore it's still open whether we have seen the top with the test of 1.2589 or we do need one last new higher slightly higher.

That said looking at the larger picture there should be no doubt that we are in a clear downtrend and that we should soon see a new downside pressure below the red wave 3 low at 1.2040.

USD/JPY - Here we should be more in doubt... It the count shown above valid? The jury is still out there, but as long as important support at 78.15 hasn't been broken to the downside I will keep the count above as my preferred count, but just 1 tick below 78.15 and a change to a more bearish count will take place.

GBP/USD - Even though we have seen a slightly more convincing break below support at 1.5816 here we are not yet quite out of the woods. We could still one more rally higher but if we does I doubt it will be much above resistance at 1.5912. However a new break below 1.5792 and more importantly 1.5742 will close the case a call for wave 3 down below 1.5268.

EUR/JPY - Ideally we have seen red wave 4 end at 96.97 and should soon see a break above 98.82 for a move higher towards 99.59 as the first possible target for red wave 5. At 99.59 red wave 5 will be 38.2% of the distance traveled from the bottom of red wave 1 to the top of red wave 3. If we break clearly above 99.59 the next target will be at 100.60 where red wave 5 will be 61.8% of red 1 through red wave 3. As long as we haven't broken above 99.18 we should not see a break below important support at 97.80 as that would break one of only three rules of the Elliott Wave Principle - The one which says, that wave one and wave four must not overlap each other.

EUR/NZD - The best count here is, that we are in an expanded flat wave 2 correction, which calls for a decline towards 1.5142, which is both a 50% retracement of wave 1 and the bottom of wave iv of one lessor degree, which is a normal target for a correction. Once this correction is over we should see a new powerful rally in wave 3.

Dow Jones Industrial Index - Ideally we should see wave ii correct to 13,193 before renewed downside pressure takes over for the next push lower towards at least 12,753, but likely we will see a much deeper decline towards 12,479.

Gold - Here we saw a tiny correction followed by a new move to 1,676.79 (the ideal target was at 1,676.44) and all we need now is a break below support at 1,662.40 to confirm that the correction from 1,526.80 is over and a new downside pressure towards important support at 1,521 has begun.

Friday, August 24, 2012

GBP/JPY long term Elliott wave analysis

GBP/JPY - I have had an request to look at GBP against JPY. When I analysis a cross-rate I normally don't look at, I always begin looking at the big picture. The longer back I can come the better. Therefore I will normally start looking at the monthly chart and then zoom in on the price-action down to the 4 hourly chart or lower.

I have added some text to the monthly and weekly charts, so please take a look at them first.

My preferred count (shown on the charts) points to an important bottom being in place and that we should soon see a major rally higher. If this view is correct we should soon see a break above resistance at 125.82 for a rally higher towards at least 129.81.

Short term I would expect support at 128.08 would protect the downside for a break above 125.00 for a test of important resistance at 125.82 and most likely a break above this time.

My long term target is a rally back to the top of wave A at 163.08 so in that context we are only at the very beginning of a major new rally.

What would bring by bullish view in jeopardy? a break below 123.25 would make me suspicious, while a break below 121.07 would have me to really reconsider whether the bottom is in place or not.

Elliott Wave analysis of EUR/USD; USD/JPY; GBP/USD; DJI; Gold; Crude Oil and Natural Gas

EUR/USD - Have we seen the top with the test of 1.2590 or do we need one slightly new high just above 1.2590? I would not be overly surprised if we would see one last small spike above 1.2590, but I wouldn't expect to much of it and I certainly wouldn't bet on it. Red wave 5 down can start any time now and should bring us below 1.2044 towards 1.1677. A break below 1.2482 will be the first good indication that we have seen the end of red wave 4.

USD/JPY - I'm very very much in doubt here... Is this a boy or a girl? The very impulsive decline from 79.66 is not good for my bullish view, but on the other hand important support at 78.15 hasn't been violated yet, so I will keep my count, but just one tick below 78.15 will invalidated this count and turn the picture bearish for a new move below 77.90.

GBP/USD - Even though the decline from 1.5912 does look slightly more impulsive than does the decline in EUR/USD a break below 1.5816 is needed to indicate, that we found the top of wave 2 at 1.5912. As long as support at 1.5816 isn't broken one last minor spike above 1.5912 towards 1.5998 can't be ruled out, but here too we are very close to the top and it's just a question of time before wave 3 down will be under way.

Dow Jones Industrial Index - The decline from 13,330.76 does look impulsive in character and the break below support at 13,094 is the first good indication that wave 2 is over. For now I would hate to see a break back above 13,194 as that would call for a new rally towards the 13,330.76 high, while a break below 12,778 will the last hope for the bulls.

Gold - Is the top in place or do we need one last small spike above 1,679.84? Again we are close to the top, but we need a break below 1,657.19 before we get the first good indication that the top is in place, while a break below 1,634.14 is need to confirm the top and a new decline towards the strong support near 1,521

Crude Oil - It has been some time since I have last looked at Crude Oil. The correction from 77.29 has become bigger than I expected, but overall the picture hasn't changed. The correction from turned into a double zig-zag correction, which corrected 61.8 of the decline from 110.56 down to 77.29 and we should soon see renewed downside pressure for a break below 91.70 and more importantly 86.86, which will confirm a new decline below 77.29 towards 64.97 as the first ideal target.

Natural Gas - Here too it have been some time since I have looked at it, but nothing in the bigger picture has changed. We have a nice big bottom in place and we should soon see renewed strength for a rally above resistance at 3.12, which will confirm the next rally higher towards 3.78 as the next target, but longer term I'm still looking for a rally back up to the 4.90 high.

USD/JPY - I'm very very much in doubt here... Is this a boy or a girl? The very impulsive decline from 79.66 is not good for my bullish view, but on the other hand important support at 78.15 hasn't been violated yet, so I will keep my count, but just one tick below 78.15 will invalidated this count and turn the picture bearish for a new move below 77.90.

GBP/USD - Even though the decline from 1.5912 does look slightly more impulsive than does the decline in EUR/USD a break below 1.5816 is needed to indicate, that we found the top of wave 2 at 1.5912. As long as support at 1.5816 isn't broken one last minor spike above 1.5912 towards 1.5998 can't be ruled out, but here too we are very close to the top and it's just a question of time before wave 3 down will be under way.

Dow Jones Industrial Index - The decline from 13,330.76 does look impulsive in character and the break below support at 13,094 is the first good indication that wave 2 is over. For now I would hate to see a break back above 13,194 as that would call for a new rally towards the 13,330.76 high, while a break below 12,778 will the last hope for the bulls.

Gold - Is the top in place or do we need one last small spike above 1,679.84? Again we are close to the top, but we need a break below 1,657.19 before we get the first good indication that the top is in place, while a break below 1,634.14 is need to confirm the top and a new decline towards the strong support near 1,521

Crude Oil - It has been some time since I have last looked at Crude Oil. The correction from 77.29 has become bigger than I expected, but overall the picture hasn't changed. The correction from turned into a double zig-zag correction, which corrected 61.8 of the decline from 110.56 down to 77.29 and we should soon see renewed downside pressure for a break below 91.70 and more importantly 86.86, which will confirm a new decline below 77.29 towards 64.97 as the first ideal target.

Natural Gas - Here too it have been some time since I have looked at it, but nothing in the bigger picture has changed. We have a nice big bottom in place and we should soon see renewed strength for a rally above resistance at 3.12, which will confirm the next rally higher towards 3.78 as the next target, but longer term I'm still looking for a rally back up to the 4.90 high.

Thursday, August 23, 2012

Elliott Wave analysis of EUR/USD; USD/JPY; GBP/USD; EUR/JPY; EUR/NZD and Gold

EUR/USD - Have broken slightly above my ideal target at 1.2550, but we should be very close to a top here. We might prices to back-off a bit and then one more rally to new highs closer to 1.2593, but not much more than that. A break below 1.2482 will indicate that red wave 4 is in place and red wave 5 down towards at least 1.2017 and more likely 1.1677 where red wave 5 will be 61.8% of the distance traveled from the top of red wave 1 to the bottom of red wave 3.

USD/JPY - The big very impulsive decline yesterday is of great concern and very much questions the my count, but as long as important support at 78.15 hasn't broken. That said any break below 78.15 would invalidate my count and call for a decline below 77.65 and likely even down towards the 77.14 - 77.40 area.

To gain confidence in my bullish count we need as said support at 78.15 to hold firm for a break above 79.53, which seems to be a long way away right now. However seen from a trading point of view buying EUR here with a stop just below 78.15 will give you the most ideal risk/rewards opportunity and a possibility to enter very near the lows, if the bullish count is valid?

GBP/USD - Here too we have exceeded the ideal target at 1.5805, but I have calculated two new possible targets and we have reached the first target which is at 1.5907, but as is the case for EUR/USD we could see a minor set-back followed by one last rally towards 1.5998 before the top is finally in place for a break below support at 1.5744 confirms that wave 3 down is under way.

EUR/JPY - Found resistance just below my ideal target at 99.42. We should now see a shallow correction towards the 97.80 - 97.95 area before the next rally higher towards at least 99.62 and more likely 100.61 in red wave 5 and black wave 3.

The risk is a break below 97.47 which will leave a very overlapping look to the rally from 94.09 and call for a deeper correction towards the 96.73 - 97.07 area.

EUR/NZD - The rally from the 1.4968 low, is overlapping and the only impulsive structure that will suite this shape is a Leading Diagonal. If this count is correct we should see a deeper correction towards 1.5148 in red wave 2 before the next rally in red wave 3 takes over.

Gold - The break above 1,663.33 invalidated the possible ending diagonal and I have had to change my count accordingly. That said I still regard the price-action since the low at 1,526.80 in May as corrective. The next possible target for this correction is at 1,676.44 from where the risk again tunes to the downside, but we need a break below 1,634.14 to confirm that the correction is over and a new test of strong support near 1.521 is in the cards.

USD/JPY - The big very impulsive decline yesterday is of great concern and very much questions the my count, but as long as important support at 78.15 hasn't broken. That said any break below 78.15 would invalidate my count and call for a decline below 77.65 and likely even down towards the 77.14 - 77.40 area.

To gain confidence in my bullish count we need as said support at 78.15 to hold firm for a break above 79.53, which seems to be a long way away right now. However seen from a trading point of view buying EUR here with a stop just below 78.15 will give you the most ideal risk/rewards opportunity and a possibility to enter very near the lows, if the bullish count is valid?

GBP/USD - Here too we have exceeded the ideal target at 1.5805, but I have calculated two new possible targets and we have reached the first target which is at 1.5907, but as is the case for EUR/USD we could see a minor set-back followed by one last rally towards 1.5998 before the top is finally in place for a break below support at 1.5744 confirms that wave 3 down is under way.

EUR/JPY - Found resistance just below my ideal target at 99.42. We should now see a shallow correction towards the 97.80 - 97.95 area before the next rally higher towards at least 99.62 and more likely 100.61 in red wave 5 and black wave 3.

The risk is a break below 97.47 which will leave a very overlapping look to the rally from 94.09 and call for a deeper correction towards the 96.73 - 97.07 area.

EUR/NZD - The rally from the 1.4968 low, is overlapping and the only impulsive structure that will suite this shape is a Leading Diagonal. If this count is correct we should see a deeper correction towards 1.5148 in red wave 2 before the next rally in red wave 3 takes over.

Gold - The break above 1,663.33 invalidated the possible ending diagonal and I have had to change my count accordingly. That said I still regard the price-action since the low at 1,526.80 in May as corrective. The next possible target for this correction is at 1,676.44 from where the risk again tunes to the downside, but we need a break below 1,634.14 to confirm that the correction is over and a new test of strong support near 1.521 is in the cards.

Subscribe to:

Comments (Atom)