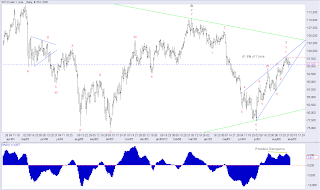

EUR/USD - We should soon see a break above the 1.2590 higher for a move towards 1.2693 and likely even into the 1.2635 - 1.2673 area for the final top of the red wave 4 correction that began at 1.2040. Once we have red wave 4 in place we should see red wave 5 take over for a move below 1.2040. I will calculate the targets for red wave 5 once we have the red wave 4 high in place.

USD/JPY - As long as important support at 78.15 holds I will keep the bullish count. Short term a break above 78.70 and more importantly 78.84 is needed to ease the downside pressure, but a break above 79.42 is needed to confirm, that the decline from 79.66 only was a correction.

A break below 78.15 by just one tick will invalidate the bullish count and call for a deeper decline.

GBP/USD - We have most likely seen wave i down from the 1.5912 high and should expect a wave ii correction higher towards 1.5866 before red wave iii down takes over for a decline towards at least 1.5581.

EUR/JPY - Red wave 5 towards 99.59 and possibly even 100.60 has begun. Short term we should soon see a break above 78.82 for a continuation higher towards 99.18 and 99.59.

EUR/NZD - The lack of corrective power has forced my back to my original much more bullish count of a series of wave one's and two's, which means that we should see a much higher rally in the coming days towards 1.5942 and likely even 1.6090 as a series of waves three's and four's unfolds.

Gold - Ideally we will see a break below 1,656.55, which will confirm that wave C ended at 1,676.79 and a new decline towards strong support near 1,521 is unfolding.

Crude Oil - Most likely have seen its peak for wave 2 at 98.30 and we should soon see a break below 94.43 to confirm the top for the next powerful decline to below 77.29.

No comments:

Post a Comment