EUR/USD - Is very close to confirm, that blue wave 4 is done at blue wave 5 is well under way. So what do we need to get the final confirmation? A break above 1.2960 would do it and confirm that a new impulsive rally towards 1.3197 and possibly even 1.3320 is developing.

The risk is, however, a break below 1.2803, that would call for one last move towards the 1.2725 - 1.2750 area before blue wave 4 finally finds its bottom.

EUR/JPY - Contrary to EUR/USD a new bottom wasn't seen in this cross and all we need now is a break above 101.05 to confirm that a new impulsive rally in wave 5 is under way.

Short term I expect a a small decline towards 100.35 - 100.45 before the next powerful rally above 101.05 sets in.

Only a break below 99.77 invalidates my bullish count.

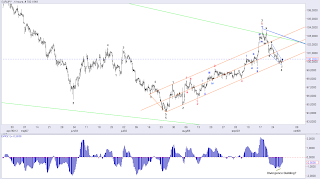

Gold - Do we need one more decline in red wave 4 close to 1,718 or did red wave 4 end already at 1,736.27 and red wave 5 is well under way by now? The rally from 1,736.27 does have a impulsive look to it and therefor we could see a move higher towards 1,821.40 and possibly even 1,874.40 before wave 1 of 5 tops out.

Facebook - Here we should soon see a powerful rally in wave 3 or c from 17.55. The first target for wave 3 or c is at 29.07.

The correction from 23.36 could turn into a more complex correction, but I'm more inclined to think that the correction ended already at 19.80 and a clear break above 23.36 will be seen soon.

Sunday, September 30, 2012

Thursday, September 27, 2012

Elliott wave analysis of EUR/USD; EUR/JPY; EUR/NZD and Gold

EUR/USD - The falling wedge resistance-line has been broken, but we have not broken above minor resistance at 1.2970 yet, but I do believe we should see a break above here soon.

Short term I'm looking for a break above 1.2850 and more importantly 1.2914, which will confirm a test of resistance at 1.2970 and a break above here confirms the bottom and a new rally past 1.3172 towards at least 1.3222 and maybe even 1.3466 before blue wave v finds its top.

EUR/JPY - The picture is pretty much the same as for EUR/USD. The falling wedge resistance-line has been broken and we should soon see a break above minor resistance at 101.05, which will confirm the bottom and a rally past 103.85 towards the first possible target for wave 5 at 104.56 but more likely is a move higher towards 105.71 before the top of wave 5 is in place.

EUR/NZD - The correction from 1.5902 has become more complex that first anticipated and we will most likely see a deeper correction towards the 61.8% correction target of wave 1, which comes in at 1.5323, but remember that this is only a correction to a new long term uptrend and once this wave 2 is finished we should be looking for the Wonder to behold in wave 3 higher towards at least 1.6505

Gold - Is very close to break above resistance at 1,790.64 and once broken we should adopt a more bullish count call for wave 5 higher towards at least 2,158.84, but as we know that commodities tend to moon-spike in there fifth waves we should not be surprised to see a continuation higher even to 2,550.59 and maybe even 3,184.70 if wave 5 extends.

I'm sure, that I could come up with some kind of calculation that would give me a target of 5.000 or even 10.000, but in my view for gold to reach targets like that we should also be looking at some kind of hyper-inflation, which clearly is a possibility due to the recent FED-action, but for now I would go there and certainly not anticipate this outcome. Remember it's not more than a few months since most thought that Europe was going down the drain. Europe is nowhere looking good, but all talk now seem to focus around the U.S again. However that will come to and end too.

Wednesday, September 26, 2012

Elliott wave analysis of EUR/USD; EUR/JPY; EUR/NZD and TLT

EUR/USD - Is break out of the falling wedge to the upside and all we need now to confirm a bottom fro blue wave 4 is a break above 1.2971. Once minor resistance at 1.2971 is broken we should see a new rally higher towards the first possible target for blue wave 5 at 1.3227 and if broken clearly we should see a continuation higher towards 1.3472.

EUR/JPY - Here too we have a falling wedge, which is on the wedge to be broken to the upside. Here we need a break above 101.05 to confirm the bottom, but once resistance at 101.05 is broken we should see wave 5 towards the first possible target at 104.54 and likely even higher towards the next target at 105.69.

EUR/NZD - This cross has once again surprised with the break below 1.5569, which does call for an even deeper correction towards the 50% retracement target of wave 1 at 1.5434 and we could even see a move towards the 61.8% retracement target at 1.5323 if we see a clear break below 1.5434.

Only a break above minor resistance at 1.5627 will ease the downside pressure, but a break above 1.5752 is need to confirm, that a bottom is in place.

TLT (Barclay's 20Y+ Bond Fund) - It's make or break time. We we see a clear break above the resistance-line at 125.09 the decline from the 132.21 high has only been a correction and a new high above 132.21 should bee seen. However if resistance at 125.09 protects the upside for a break below 120.67 we should look for a continuation towards the 110.00 area.

Tuesday, September 25, 2012

Elliott wave analysis of EUR/USD: EUR/JPY; EUR/NZD; and the Dow

EUR/USD - Having review the decline from 1.3172 it looks like a wedge has developed and we should be very close to the end of it. The big question is of cause if this was only wave a of a more complex correction in blue wave 4? For now it really doesn't matter, because we should soon see a rally higher and a break above 1.2913 will be the first indication that we have seen a bottom for a rally higher towards 1.2970 and a break above here will confirm that a bottom is in place for a move back towards the 1.3172 high.

EUR/JPY - The picture is pretty much the same here. A bottom is most likely just at hand and a new rally higher towards the 103.85 should be seen soon. As first indication of a bottom a break above 100.46 will be need, while a break above 101.05will confirm the bottom for the rally back towards the top at 103.85. I still think this wave 4 correction needs more time to finish, but price-wise we most likely have reached the limit.

EUR/NZD - The move higher from 1.5569 is in no way convincing and a break above resistance at 1.5773 is need to ease the downside pressure. That said I do think that the bottom at 1.5569 should be safe for now and a rally above 1.5773 should be seen soon for a move higher towards 1.5902 and much higher longer term.

Dow Jones Industrial Index - Do we finally have a top in place? It could well be, but then central bankers QE 3 (FED) and QE1 (ECB) and QE (what do I know) is do their most to keep the rally going. Will they win? I hope not, because if they do the will destroy their currencies. So please let the Markets do their thing and correct the imbalances that FED has created during the last 25 years.

S at which point do we know a deeper correction is coming? we need a break below 13,251 to give a good indication that a top might be in place, but only a break below 12,977 confirms a decline towards important support at 12,035.

The risk to the upside seems limited to 13,935 (I don't think we will reach this high, but as long as we haven't seen a break below 13,251 it can't be excluded.

Elliott wave analysis of EUR/USD; EUR/JPY; Facebook and Crude Oil

EUR/USD - With the decline to 1.2886 we might have seen wave a of y and should be looking for a minor rally in wave b towards 1.3000 and maybe even 1.3048 before the next downside pressure sets in. I'm still looking for a decline closer to the base channel mid-line near 1.2801. That said we are looking at a correction and anything can happen.

EUR/JPY - Has meet its ideal correction target at 100.13 (the low has been 100.16) and we should now be looking for a break above 101.44 and more importantly 102.10 which will confirm a rally back towards the top at 103.85. That said I still think the correction from 103.85 is only partly done and we need more time to finish the correction. Price-wise the correction has done enough, but not time-wise.

Facebook - Has rally nicely from 17.55 and has ended a minor five rally at 23.37 however we should see more upside once the minor correction from 23.37 is done. Actually it could already be done as it has corrected 50% of blue wave i. A break above 21.21 will ease the downside pressure, but we need a break above 22.61 to confirm the bottom for the next rally higher towards at least 26.11, but I still expect a rally back closer to the B-wave high at 33.45 longer term.

Crude Oil - Is wave 2 already finished? We have seen a nice back-test of the broken support-line and this former support-line turned into resistance once broken. However we need a clear break below 90.97 to confirm that wave 3 down is well under way. As long as support at 90.97 protects the downside we could see one last rally to just above 93.84 before the next move lower.

Longer term I'm still looking for a break below the 77.27 low.

EUR/JPY - Has meet its ideal correction target at 100.13 (the low has been 100.16) and we should now be looking for a break above 101.44 and more importantly 102.10 which will confirm a rally back towards the top at 103.85. That said I still think the correction from 103.85 is only partly done and we need more time to finish the correction. Price-wise the correction has done enough, but not time-wise.

Facebook - Has rally nicely from 17.55 and has ended a minor five rally at 23.37 however we should see more upside once the minor correction from 23.37 is done. Actually it could already be done as it has corrected 50% of blue wave i. A break above 21.21 will ease the downside pressure, but we need a break above 22.61 to confirm the bottom for the next rally higher towards at least 26.11, but I still expect a rally back closer to the B-wave high at 33.45 longer term.

Crude Oil - Is wave 2 already finished? We have seen a nice back-test of the broken support-line and this former support-line turned into resistance once broken. However we need a clear break below 90.97 to confirm that wave 3 down is well under way. As long as support at 90.97 protects the downside we could see one last rally to just above 93.84 before the next move lower.

Longer term I'm still looking for a break below the 77.27 low.

Sunday, September 23, 2012

Elliott wave analysis of EUR/USD; EUR/JPY; EUR/NZD; Gold and DJI

EUR/USD - The break back into the base channel indicates that the correction will deeper and we should look for a continuation towards the base channel mid-line near 1.2814 as the next target. Only a break above 1.3048 will ease the downside pressure and call for a new rally towards 1.3172 and higher.

EUR/JPY - Right now the decline from 103.85 doesn't look shallow, but we haven't even retraced 38.2% of wave 3 yet, so in that context it's a still a shallow correction. Is it complex? Yes in my view it is, but as long as resistance at 101.28 protects the upside we should be looking for a continuation towards the 38.2% retracement of wave 3 at 100.13 before we should expect a new rally.

EUR/NZD - Here I'm looking for a break above 1.5810 to confirm that wave 2 did indeed end at 1.5569 for a new impulsive rally higher towards at least 1.6505 and likely even much higher.

Only a break below 1.5594 will invalidate my bullish count and call for a new test of 1.5569.

Gold - Tried to break above resistance at 1,790.22 without success. Depending on which scenario is the correct one we should look for a large decline in the bearish case, while the bullish case will call for a correction towards the 1,709 - 1,739 area before the next rally higher sets in.

Dow Jones Industrial Index - Is hoovering just below resistance at 13,709 and with a serious divergence on the indicator some kind of top could be building, but it will take a break below 12,977 to confirm the top.

Thursday, September 20, 2012

Elliott wave analysis of EUR/USD; GBP/USD; EUR/JPY and EUR/NZD

EUR/USD - Having tested the base channel former resistance-line, which is now acting as support, we should see a rally back to the top of blue wave iii at 1.3172. The decline from 1.3172 to 1.2919 could be all of blue wave iv, but I favor, that this decline only was the first part of a more complex correction.

Short term I will look for a break above 1.3047 and more importantly 1.3085 to confirm the rally back towards the top at 1.3172.

GBP/USD - Is hoovering just below resistance at 1.6305 and a break above here will add more confidence to the bullish count I presented on September 14 (see it here: http://theelliottwavesufer.blogspot.dk/2012/09/cable-is-big-rally-just-ahead.html)

We could be in some kind of giant triangle calling for a rally wave D.

All that said we need a break above 1.6747 to invalidate the bearish triangle count, that previously has been my working count, but has lost more and more validity as we have worked our way higher.

EUR/JPY- Has found support and the base channel mid-line and we should now see a rally back towards the top of black wave 3 at 103.85. Even though the decline from 103.85 is clearly in three waves I only regard this decline as the first leg of a more complex correction. It could be a triangle of some kind of flat correction, but no matter which outcome turns out to be the correct one. I would be focused towards the upside and look for a move back towards the top of black wave 3 at 103.85.

If the triangle scenario is the correct one we will not make it all the way back to 103.85, but we should see a move higher towards the 102.75 - 103.00 area.

EUR/NZD - We broke slightly below 1.5578 during the day, which means that black wave 2 most likely ended at 1.5569 (today's low) and we should now for a rally above 1.5667 as the first indication, that a bottom is in place, while a break above 1.5810 will confirm the bottom for a new rally above 1.5902 towards the next target at 1.6498 and most likely even higher.

However if we unexpectedly breaks below 1.5569 we will likely see a deeper correction towards 1.5438 and maybe even 1.5328, but I don't prefer this scenario.

Elliott wave analysis of AUD/USD and GPB/JPY

AUD/USD - The triangle that has been building since July 2011 is most likely still in progres, however a break above the top of red wave D at 1.0613 will indicate, that red wave E ended already at 1.0167. However a break below 1.0328 will call for a new decline to below 1.0167.

GBP/JPY - Just a quick follow-up to my post from August 24 (see here http://theelliottwavesufer.blogspot.dk/2012/08/gbpjpy-long-term-elliott-wave-analysis.html)

If the bullish count I called for on August 24 is the correct count we should soon a powerful rally high through 1.2883 towards 1.3348 and higher.

A break below 1.2368 will invalidate my count.

GBP/JPY - Just a quick follow-up to my post from August 24 (see here http://theelliottwavesufer.blogspot.dk/2012/08/gbpjpy-long-term-elliott-wave-analysis.html)

If the bullish count I called for on August 24 is the correct count we should soon a powerful rally high through 1.2883 towards 1.3348 and higher.

A break below 1.2368 will invalidate my count.

Wednesday, September 19, 2012

Elliott wave analysis of EUR/USD; EUR/JPY; EUR/NZD and Crude Oil

EUR/USD - Blue wave iv seems to be well under way. The first target at 1.2955 has almost been touched, but I would not be surprised to see a deeper decline towards 1.2815, before blue wave iv finally finds its bottom. That said, we should expect this correction to be complex in nature as blue wave ii was a simple but deep correction.

EUR/JPY - Here we are working on black wave 4, which I expect will decline towards 101.53 as the first target, but we could see a deeper decline towards 100.13. The correction should be a complex correction as black wave 2 was a simple deep correction.

EUR/NZD - I do expect a break above 1.5902 soon. A break which will confirm that wave 3 is well under way. A break above 1.5902 will confirm the next rally towards at least 1.6522. As long as resistance at 1.5902 hasn't been broken the risk is, that we are looking at flat correction which will call for one more decline to just below 1.5578, before wave 2 is complete.

Crude Oil - With the break below 93.95 the odds now favor, that wave 2 ended at 100.43 and that we should now see a powerful decline to below 77.29 longer term.

EUR/JPY - Here we are working on black wave 4, which I expect will decline towards 101.53 as the first target, but we could see a deeper decline towards 100.13. The correction should be a complex correction as black wave 2 was a simple deep correction.

EUR/NZD - I do expect a break above 1.5902 soon. A break which will confirm that wave 3 is well under way. A break above 1.5902 will confirm the next rally towards at least 1.6522. As long as resistance at 1.5902 hasn't been broken the risk is, that we are looking at flat correction which will call for one more decline to just below 1.5578, before wave 2 is complete.

Crude Oil - With the break below 93.95 the odds now favor, that wave 2 ended at 100.43 and that we should now see a powerful decline to below 77.29 longer term.

Tuesday, September 18, 2012

Elliott Wave analysis of EUR/USD; DJI and Crude Oil

I will try to update more later today.

EUR/USD - Correction in blue wave iv towards the 1.2815 - 1.2955 area, before the next impulsive rally higher towards 1.3362.

Dow Jones Industrial Index - Closing in on strong resistance and a massive divergence indicates a possible top soon.

Crude Oil - The triple zig-zag correction from 77.29 is likely finished. All we need is a break below 93.95. The risk is, that we only have seen wave a of Z, which would call for one last rally higher towards 101.95.

EUR/USD - Correction in blue wave iv towards the 1.2815 - 1.2955 area, before the next impulsive rally higher towards 1.3362.

Dow Jones Industrial Index - Closing in on strong resistance and a massive divergence indicates a possible top soon.

Crude Oil - The triple zig-zag correction from 77.29 is likely finished. All we need is a break below 93.95. The risk is, that we only have seen wave a of Z, which would call for one last rally higher towards 101.95.

Elliott wave anlysis of EUR/USD; EUR/JPY and EUR/NZD

Sorry no text today, but the charts should give you a idea of what I think, is going to happen next.

EUR/USD

EUR/JPY

EUR/NZD

EUR/USD

EUR/JPY

EUR/NZD

Elliott wave analysis of EUR/CAD - Short term

EUR/CAD - I was asked to look at this cross today. I would normally analyse the long term chart and work my way down to the 4 hourly or hourly chart, but as I'm very busy these days. I will only have time to give you a quick update of the short term picture.

The base channel has defined the rally from the 1.2129 perfectly till now. The failure to break above the base channel resistance-line does leave us with two options.

1: The rally from 1.2129 is an A-B-C correction, however wave C is longer than wave A, which is of cause okay, but it could indicate, that a more bullish count could be in the works

2: The rally from 1.2129 is the start of an impulsive rally. For this count to stay valid we can not break below 1.2499 at any time. However a clear break above the base channel resistance-line will add confidence in the more bullish count for a continuation higher towards resistance at 1.3445

The base channel has defined the rally from the 1.2129 perfectly till now. The failure to break above the base channel resistance-line does leave us with two options.

1: The rally from 1.2129 is an A-B-C correction, however wave C is longer than wave A, which is of cause okay, but it could indicate, that a more bullish count could be in the works

2: The rally from 1.2129 is the start of an impulsive rally. For this count to stay valid we can not break below 1.2499 at any time. However a clear break above the base channel resistance-line will add confidence in the more bullish count for a continuation higher towards resistance at 1.3445

Friday, September 14, 2012

Cable - Is a big rally just ahead?

GBP/USD - I know I have be calling for a big decline in Cable, but when I was working with the long term picture yesterday I noticed that all the ups and downs has been in three waves. At the same time it looks as we are building a giant triangle of which we have seen wave A-B and C, if this count is correct we should now see a new massive rally higher in wave D towards 1.9465. All that said we have some very tough hurdles we have to clear, but if they are cleared then no much is in the way for the rally higher. The first hurdle is at 1.6306 and then at 1.6495, but if they are cleared we should consider this count to be the preferred one.

I'm beginning to have the same felling that I did with EUR/USD, as it just broke right through all resistance I could calculate. At some point you just have to realise that the Market is telling you something different than you thought and this might just be the case here too.

I'm beginning to have the same felling that I did with EUR/USD, as it just broke right through all resistance I could calculate. At some point you just have to realise that the Market is telling you something different than you thought and this might just be the case here too.

EUR/JPY and EUR/NZD pushing higher

EUR/JPY - Here too we are seeing the effects of the push higher in EUR/USD. As I said in my post earlier today, that we should expect an extension higher towards 101.95 and more likely even 103.46. With 101.95 behind us already we should focus on the next target at 103.46.

We have seen another important message from the Market today, as we have seen a break above the base channel resistance-line, which tell us, that the rally from 94.09 is extending higher. As if that wasn't enough we have also seen a break above the previous wave 4 top at 101.62, which confirms that we saw an important bottom at 94.09 and that we should look for much higher levels.

EUR/NZD - earlier today I very much doubted that the support-line at 1.5578 would protect the downside, but I did and the rally of the 1.5578 low does look impulsive in character and a break above 1.5820 does indicates that wave 3 is well under way already.

I have drawn a new bigger base channel and if/when the resistance-line break we should a powerful acceleration in wave 3 higher towards at least 1.6508, but I find it more likely that we will see and extension higher towards the 1.6835 - 1.6969 area.

We have seen another important message from the Market today, as we have seen a break above the base channel resistance-line, which tell us, that the rally from 94.09 is extending higher. As if that wasn't enough we have also seen a break above the previous wave 4 top at 101.62, which confirms that we saw an important bottom at 94.09 and that we should look for much higher levels.

EUR/NZD - earlier today I very much doubted that the support-line at 1.5578 would protect the downside, but I did and the rally of the 1.5578 low does look impulsive in character and a break above 1.5820 does indicates that wave 3 is well under way already.

I have drawn a new bigger base channel and if/when the resistance-line break we should a powerful acceleration in wave 3 higher towards at least 1.6508, but I find it more likely that we will see and extension higher towards the 1.6835 - 1.6969 area.

The EUR/USD rally is extending

EUR/USD - As I promised earlier today I would look closer at EUR/USD later today, so here it comes.

The game changer was the break above 1.3004. With this important resistance broken my previous working count broke one of R.N. Elliott's three rules, the rules that states that wave four isn't allowed to overlap with wave one. Once this rule was broken I knew positively that my count was wrong and that I needed to adopt a new more bullish working count, which is just what I have done. I have tried to tell the market, that it was wrong, but I have never won that battle...

So by adopting a more bullish count, does that mean we are in a new long term uptrend? By no means. It just means that the triangle I thought ended February still is ongoing and we still need wave E to finish. Where can we expect wave E to end? That is the tricky part as wave E can end anywhere, but often end at a fibo-retracement target and often at the 61.8% retracement of the D-leg, which comes in at 1.3838.

However the legs in a triangle is normally zig-zags, but again the exception is the E-leg, that can itself turn into a triangle. It will not be the case here, but rather I expect a zig-zag, where we currently are working on the a-leg of this zig-zag (impulsive five wave move in a followed by a three wave correction in wave b followed by a five wave rally in wave c to end wave E).

If we look at the four hourly chart we can see a very clear extension when the resistance-line of the base channel broke. However we should expect strong resistance here at 1.3167 where blue wave iii will be 3 times blue wave i, that means we could see a shallow correction here before the next rally higher towards 1.3359, where I expect blue wave iii to end. But lets see how it works out....

The important message from me is, that the break above 1.3004 has changed the short term direction from a bearish picture to a bullish picture and we should be flexible and respect what the Market is telling us.

Thursday, September 13, 2012

Elliott wave analysis of EUR/USD; EUR/JPY and EUR/NZD

This will just be a quick update, but I will update more in details later today. The break above 1.3004 in EUR/USD has changed the picture to a more bullish one and we can see that it spills over to the other EUR-crosses too.

EUR/USD - The break above 1.3004 has invalidated my count, that we where in a red wave 4 correction waiting for a decline in red wave 5 to below 1.2042. With the break above 1.3004 we have to look for a more bullish count, which is shown above, this count is now my preferred count. It tells us to look for an A-B-C correction higher towards 1.3490 and likely even 1.3827 before wave E of the B-wave triangle is finished.

EUR/JPY - The failure to follow through on the decline from 100.62 indicates, that red wave 5 is extending and therefore we should look for much higher levels before red wave 5 and black wave 3 is finally in place. The first target for red wave 5 is now at 101.95, but I would expect it to rally higher towards 103.46 before it finally runs out of steam.

EUR/NZD - The failure to rally again from the base channel mid-line is of concern. Yes we are currently testing the base channel support-line, but odds do favor that we saw the the first impulsive wave end at 1.5902 and is currently in wave 2 towards the 1.5323 - 1.5434 area, from where we can expect the next impulsive rally to begin.

EUR/NZD - The failure to rally again from the base channel mid-line is of concern. Yes we are currently testing the base channel support-line, but odds do favor that we saw the the first impulsive wave end at 1.5902 and is currently in wave 2 towards the 1.5323 - 1.5434 area, from where we can expect the next impulsive rally to begin.

Subscribe to:

Comments (Atom)