Thursday, September 27, 2012

Elliott wave analysis of EUR/USD; EUR/JPY; EUR/NZD and Gold

EUR/USD - The falling wedge resistance-line has been broken, but we have not broken above minor resistance at 1.2970 yet, but I do believe we should see a break above here soon.

Short term I'm looking for a break above 1.2850 and more importantly 1.2914, which will confirm a test of resistance at 1.2970 and a break above here confirms the bottom and a new rally past 1.3172 towards at least 1.3222 and maybe even 1.3466 before blue wave v finds its top.

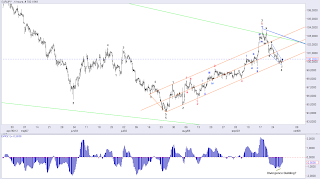

EUR/JPY - The picture is pretty much the same as for EUR/USD. The falling wedge resistance-line has been broken and we should soon see a break above minor resistance at 101.05, which will confirm the bottom and a rally past 103.85 towards the first possible target for wave 5 at 104.56 but more likely is a move higher towards 105.71 before the top of wave 5 is in place.

EUR/NZD - The correction from 1.5902 has become more complex that first anticipated and we will most likely see a deeper correction towards the 61.8% correction target of wave 1, which comes in at 1.5323, but remember that this is only a correction to a new long term uptrend and once this wave 2 is finished we should be looking for the Wonder to behold in wave 3 higher towards at least 1.6505

Gold - Is very close to break above resistance at 1,790.64 and once broken we should adopt a more bullish count call for wave 5 higher towards at least 2,158.84, but as we know that commodities tend to moon-spike in there fifth waves we should not be surprised to see a continuation higher even to 2,550.59 and maybe even 3,184.70 if wave 5 extends.

I'm sure, that I could come up with some kind of calculation that would give me a target of 5.000 or even 10.000, but in my view for gold to reach targets like that we should also be looking at some kind of hyper-inflation, which clearly is a possibility due to the recent FED-action, but for now I would go there and certainly not anticipate this outcome. Remember it's not more than a few months since most thought that Europe was going down the drain. Europe is nowhere looking good, but all talk now seem to focus around the U.S again. However that will come to and end too.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment