Happy Easter to you all!

Friday, March 29, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

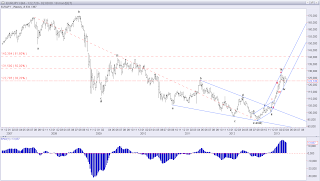

It seems that we finally have found a bottom, of wave ii of 5, at 119.74. The rally of 119.74 clearly has impulsive characters, which adds confidence in our call, that wave iii of 5 higher have begun. Short term we would like to see support at 120.35 protect the downside for a rally above 120.85, which confirms the next rally higher towards at least 121.50 and preferable higher towards 123.90 in a powerful rally higher. Only a break below 119.74 will invalidate our bullish call and indicate, that wave ii still is ongoing.

Today I would like to introduce my alternate count, which is, that a wave 4 triangle is unfolding. If this is the case we will see a rally higher towards 124.50 in wave D and then the final decline in wave E towards 121.59 from where the trust out of triangle towards the upside is expected to take place. It should be noted, that no matter which of my counts is the correct one, the outcome will be the same, which is that one more rally above 127.70 is to be expected in wave 5.

EUR/NZD

It seems like we have seen the final bottom of the expanding triangle, which has been unfolding since September 2012, at 1.5227 just above my ideal target at 1.5209. The rally of 1.5227 does have impulsive characters and if this is the case we should ideally see support at 1.5279 protect the downside for a break above 1.5342 for the next powerful rally higher towards at least 1.5409 and ideally higher towards 1.5623 as the next long term rally starts to unfold. Short term only a break below 1.5227 will invalidate our bullish call, but even if a break below 1.5227 is seen, the downside potential should be very limited.

It seems that we finally have found a bottom, of wave ii of 5, at 119.74. The rally of 119.74 clearly has impulsive characters, which adds confidence in our call, that wave iii of 5 higher have begun. Short term we would like to see support at 120.35 protect the downside for a rally above 120.85, which confirms the next rally higher towards at least 121.50 and preferable higher towards 123.90 in a powerful rally higher. Only a break below 119.74 will invalidate our bullish call and indicate, that wave ii still is ongoing.

Today I would like to introduce my alternate count, which is, that a wave 4 triangle is unfolding. If this is the case we will see a rally higher towards 124.50 in wave D and then the final decline in wave E towards 121.59 from where the trust out of triangle towards the upside is expected to take place. It should be noted, that no matter which of my counts is the correct one, the outcome will be the same, which is that one more rally above 127.70 is to be expected in wave 5.

EUR/NZD

It seems like we have seen the final bottom of the expanding triangle, which has been unfolding since September 2012, at 1.5227 just above my ideal target at 1.5209. The rally of 1.5227 does have impulsive characters and if this is the case we should ideally see support at 1.5279 protect the downside for a break above 1.5342 for the next powerful rally higher towards at least 1.5409 and ideally higher towards 1.5623 as the next long term rally starts to unfold. Short term only a break below 1.5227 will invalidate our bullish call, but even if a break below 1.5227 is seen, the downside potential should be very limited.

Thursday, March 28, 2013

Is Crude Oil about to stage a major rally?

Crude Oil

Crude oil has been a major bore for way to long, but it seems that we might finally get some action here. A clear break above the triangle resistance-line should stage a major rally to at least the 123 - 124 area. However if this is a triangle, then we also know that this is the last rally before a a new major decline sets in.

Sorry for not having any Elliott Wave Count on this chart, but that should not be important as the chart speak its own clear language.

Crude oil has been a major bore for way to long, but it seems that we might finally get some action here. A clear break above the triangle resistance-line should stage a major rally to at least the 123 - 124 area. However if this is a triangle, then we also know that this is the last rally before a a new major decline sets in.

Sorry for not having any Elliott Wave Count on this chart, but that should not be important as the chart speak its own clear language.

Elliott wave analysis on Facebook - Have wave 4 bottomed?

Facebook

Please see my last post here first: http://theelliottwavesufer.blogspot.dk/2013/03/elliott-wave-analysis-of-facebook.html

It seems like we we finally saw the bottom of wave 4 with yesterdays low at 24.72 slightly below my long term target at 25.60. If we have seen the bottom we will soon see a break out of the Falling channel towards the upside and more importantly we will see a break above 28.58. It might only be a minor break before a downside reactions sets in, but it will send us an important message, which is that wave 4 is done and wave 5 higher towards the possible extended wave 5 target at 40.35 is developing.

The only real demand we have for this wave 4 is, that is doesn't break into the territory of wave 1, which means a break below 23.37 as that would invalidate my bullish Count and indicate, that the rally since the 17.55 only has been a correction.

Please see my last post here first: http://theelliottwavesufer.blogspot.dk/2013/03/elliott-wave-analysis-of-facebook.html

It seems like we we finally saw the bottom of wave 4 with yesterdays low at 24.72 slightly below my long term target at 25.60. If we have seen the bottom we will soon see a break out of the Falling channel towards the upside and more importantly we will see a break above 28.58. It might only be a minor break before a downside reactions sets in, but it will send us an important message, which is that wave 4 is done and wave 5 higher towards the possible extended wave 5 target at 40.35 is developing.

The only real demand we have for this wave 4 is, that is doesn't break into the territory of wave 1, which means a break below 23.37 as that would invalidate my bullish Count and indicate, that the rally since the 17.55 only has been a correction.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

As support at 120.75 could not protect the downside we knew, that a new low slightly below 120.08 was to be expected and that is exactly what we have seen. We are closing in on the bottom and we do see a clear loss of downside momentum, but at long as minor resistance at 120.78 and more importantly as long as resistance at 121.88 protects the upside we must accept slightly new lows. That said, at no time can a break below 118.73 be accepted as, that will invalidate my bullish count. A break above minor resistance at 120.78 will ease the downside pressure, but only a break above resistance at 121.80 will confirm that a bottom is in place for the next powerful rally higher.

EUR/NZD

As support at 120.75 could not protect the downside we knew, that a new low slightly below 120.08 was to be expected and that is exactly what we have seen. We are closing in on the bottom and we do see a clear loss of downside momentum, but at long as minor resistance at 120.78 and more importantly as long as resistance at 121.88 protects the upside we must accept slightly new lows. That said, at no time can a break below 118.73 be accepted as, that will invalidate my bullish count. A break above minor resistance at 120.78 will ease the downside pressure, but only a break above resistance at 121.80 will confirm that a bottom is in place for the next powerful rally higher.

EUR/NZD

We are now very close to my ideal target at 1.5209 and we should prepear our self for a major rally to begin soon. Short term I'm looking for minor resistance at 1.5309 to protect the upside for the last decline towards our ideal target at 1.5209 from where I expect the next major rally to take place. The long term upside for the coming rally is at least at 1.6602, but likely much higher. A break above minor resistance at 1.5309 will be the first good indication that a bottom is in place, while a break above 1.5427 and more importantly a break above 1.5627 is needed to confirm the bottom and confirm the next major rally higher.

Tuesday, March 26, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We have seen a break above minor resistance at 121.56, which was the first good indication, that a bottom might be in place with the test of 120.08. That said the rally of the 120.08 low is not yet convincing and we need more prof in form of a break above 122.84 and more importantly a break above 123.38 to confirm the bottom and that wave iii of 5 is developing. Short term I would like to see support at 121.58 and more importantly support at 120.75 protect the downside for the next rally higher. A break below 120.75 will open up for a new test of 120.08 and possibly slightly below.

EUR/NZDI'm still looking for the last part of this e wave, of the large expanding triangle, to reach close to 1.5200, before a bottom is in place. Short term I expect resistance in the 1.5357 - 1.5364 area to protect the upside for the next decline towards 152.41 and ideally 1.5209 before this decline is finally over. A break above 1.5364 will weaken the downside pressure, but only a break above 1.5379 and more importantly a break above 1.5426 will indicate that a bottom might already be in place for a new major rally.

Monday, March 25, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The decline became slightly deeper than expected, but we have likely seen the bottom or is very close to the final bottom of wave ii of 5 now. To confirm the bottom we need support at 120.71 to protect the downside for a break above 121.56, which will be the first good indication that the bottom is in place for a rally higher towards 123.38 and a break above here confirms the bottom and that wave iii of 5 is developing. However, if we break below 120.71 we must accept, that one last new low is needed before wave ii of 5 is over. The only demand I have to this wave ii is, that at no point do we see a break below the starting point of wave i at 118.73, if that was to happen my bullish count is invalidated.

EUR/NZD

We have finally seen the break below support at 1.5390, that means that all demands for wave e of the expanding triangle now is fulfilled. That said we would like to see this e wave decline a little further towards 1.5200 before bottoming out for the next rally higher. However, we should be aware, that a break above 1.5469 could be a first warning that the bottom is in place, but we need a break above 1.5560 and more importantly a break above 1.5627 to confirm the bottom and a new major rally.

The decline became slightly deeper than expected, but we have likely seen the bottom or is very close to the final bottom of wave ii of 5 now. To confirm the bottom we need support at 120.71 to protect the downside for a break above 121.56, which will be the first good indication that the bottom is in place for a rally higher towards 123.38 and a break above here confirms the bottom and that wave iii of 5 is developing. However, if we break below 120.71 we must accept, that one last new low is needed before wave ii of 5 is over. The only demand I have to this wave ii is, that at no point do we see a break below the starting point of wave i at 118.73, if that was to happen my bullish count is invalidated.

EUR/NZD

We have finally seen the break below support at 1.5390, that means that all demands for wave e of the expanding triangle now is fulfilled. That said we would like to see this e wave decline a little further towards 1.5200 before bottoming out for the next rally higher. However, we should be aware, that a break above 1.5469 could be a first warning that the bottom is in place, but we need a break above 1.5560 and more importantly a break above 1.5627 to confirm the bottom and a new major rally.

Sunday, March 24, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With the break below 121.83 my bullish count was invalidated and at the same time telling me, that wave ii of 5 is still ongoing. We expect resistance at 124.09 to protect the upside for one last decline towards 120.66 before this zig-zag combination is over and wave iii of 5 will be ready to take over. That said, a break above 124.86 will clearly ease the downside pressure and indicate a new rally towards 126.04, but we need a break above here to confirm, that wave iii of 5 is well under way already.

EUR/NZD

The correction from 1.5454 has been larger that we anticipated, but we should be close to a top here in the 1.5623 - 1.5650 area for a break below 1.5575, which indicates that wave C down towards at least 1.5390 and ideally down to 1.5200 is well under way. As long as support at 1.5575 protect the downside we must accept a move closer to 1.5650, but any break above 1.5709 will be a warning that wave e could have fallen short of it's ideal target, while a break above 1.5770 will confirm that a call for a new rally higher.

With the break below 121.83 my bullish count was invalidated and at the same time telling me, that wave ii of 5 is still ongoing. We expect resistance at 124.09 to protect the upside for one last decline towards 120.66 before this zig-zag combination is over and wave iii of 5 will be ready to take over. That said, a break above 124.86 will clearly ease the downside pressure and indicate a new rally towards 126.04, but we need a break above here to confirm, that wave iii of 5 is well under way already.

EUR/NZD

The correction from 1.5454 has been larger that we anticipated, but we should be close to a top here in the 1.5623 - 1.5650 area for a break below 1.5575, which indicates that wave C down towards at least 1.5390 and ideally down to 1.5200 is well under way. As long as support at 1.5575 protect the downside we must accept a move closer to 1.5650, but any break above 1.5709 will be a warning that wave e could have fallen short of it's ideal target, while a break above 1.5770 will confirm that a call for a new rally higher.

Saturday, March 23, 2013

Long term Elliott wave analysis of EUR/JPY; EUR/NZD; USD/JPY; Gold and Nat. Gas

EUR/JPY

Just as a reminder, I would like show you the long term Pictures and Counts this weekend. I feel confident that wave 4 ended at 118.73 and that wave 5 is developing. We don't have the final confirmations yet, but a higher low above 118.73 and a break above 126.04 should do the job and confirm that wave 5 is indeed developing and take us to at least 131.59. However a rally higher to 140.59 should not come as a surprise.

EUR/NZD

I still think that we have seen a important long term bottom at 1.4966 and that the next major rally should be seen soon. Looking at the long term Count we have seen a major flat correction developing since August 1992 a flat correction that ended with the low at 1.4966 in August 2012, that's a 20 year correction. The perfect Fibonacci time sequence would be a low in August 2013, where the flat correction would have taken 21 years, but I would gladly accept the 20 year low as the perfect termination of the flat correction. The big question is of cause whether we should be looking for a rally towards the channel resistance way up there near 2.5000. I would expect a rally like that, but it could take many years to reach that target.

USD/JPY

I'm sure that many are looking for a top in this cross as they think the rally from the low at 75.57 is close to climax. I don't think we are anywhere near a top other than maybe a short term top. If my Count is correct we have only just begun correcting the major decline from 1976 and it will take years for this correction to run its course. At a absolute minimum for this correction I'm looking for a rally to the top of wave 4, which was at 147.63, that is a 56% rally from the current level.

Gold

We might have seen the bottom of wave 4 and is in the very early stages of wave 5 to above 1,920.70. That said we still need more Prof. Short term a break above resistance at 1,626 would be a first clue, that we might have seen the bottom, while a break above the Falling channel resistance-line near 1,675 is need to confirm that wave 4 is indeed over and wave 5 is developing.

Natural Gas

It has been a long time since I last looked at Nat. Gas, but my long term view for a rally towards 5.00 and likely even 6.00 is still very much intact. A break above the resistance-line here at 3.96 will confirm the next rally higher towards 5.00 and as I see it, it should just be a question of time before we break above this resistance-line.

Just as a reminder, I would like show you the long term Pictures and Counts this weekend. I feel confident that wave 4 ended at 118.73 and that wave 5 is developing. We don't have the final confirmations yet, but a higher low above 118.73 and a break above 126.04 should do the job and confirm that wave 5 is indeed developing and take us to at least 131.59. However a rally higher to 140.59 should not come as a surprise.

EUR/NZD

I still think that we have seen a important long term bottom at 1.4966 and that the next major rally should be seen soon. Looking at the long term Count we have seen a major flat correction developing since August 1992 a flat correction that ended with the low at 1.4966 in August 2012, that's a 20 year correction. The perfect Fibonacci time sequence would be a low in August 2013, where the flat correction would have taken 21 years, but I would gladly accept the 20 year low as the perfect termination of the flat correction. The big question is of cause whether we should be looking for a rally towards the channel resistance way up there near 2.5000. I would expect a rally like that, but it could take many years to reach that target.

USD/JPY

I'm sure that many are looking for a top in this cross as they think the rally from the low at 75.57 is close to climax. I don't think we are anywhere near a top other than maybe a short term top. If my Count is correct we have only just begun correcting the major decline from 1976 and it will take years for this correction to run its course. At a absolute minimum for this correction I'm looking for a rally to the top of wave 4, which was at 147.63, that is a 56% rally from the current level.

Gold

We might have seen the bottom of wave 4 and is in the very early stages of wave 5 to above 1,920.70. That said we still need more Prof. Short term a break above resistance at 1,626 would be a first clue, that we might have seen the bottom, while a break above the Falling channel resistance-line near 1,675 is need to confirm that wave 4 is indeed over and wave 5 is developing.

Natural Gas

It has been a long time since I last looked at Nat. Gas, but my long term view for a rally towards 5.00 and likely even 6.00 is still very much intact. A break above the resistance-line here at 3.96 will confirm the next rally higher towards 5.00 and as I see it, it should just be a question of time before we break above this resistance-line.

Thursday, March 21, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The decline from 124.50 has become much bigger than I anticipated and that is of cause of concern, but, and that is of the utmost importance, support at 121.83 has not been broken. Only a break below 121.83 will invalidate my bullish call and tell me, that the rally from 121.56 was and X-wave and that a new zig-zag combination lower towards 120.05 is to be expected. However, as long as important support stays intact, we might only be looking at a very deep wave ii of iii of 5, but if this is the case we should soon see a impulsive rally above 123.44 and more importantly a break above 124.50, which will confirm that wave iii of 5 is indeed developing towards 133.54.

EUR/NZD

We finally got the thrust out of the triangle and as expected it was towards the downside. I'm looking for a continuation towards at least 1.5312 in wave iii of C, then wave iv of C towards 1.5535 and the final decline towards 1.5200 to finish the major expanded triangle that has been developing since September 2012. Once this expanded triangle is finished we should expect a very powerful rally.

The decline from 124.50 has become much bigger than I anticipated and that is of cause of concern, but, and that is of the utmost importance, support at 121.83 has not been broken. Only a break below 121.83 will invalidate my bullish call and tell me, that the rally from 121.56 was and X-wave and that a new zig-zag combination lower towards 120.05 is to be expected. However, as long as important support stays intact, we might only be looking at a very deep wave ii of iii of 5, but if this is the case we should soon see a impulsive rally above 123.44 and more importantly a break above 124.50, which will confirm that wave iii of 5 is indeed developing towards 133.54.

EUR/NZD

We finally got the thrust out of the triangle and as expected it was towards the downside. I'm looking for a continuation towards at least 1.5312 in wave iii of C, then wave iv of C towards 1.5535 and the final decline towards 1.5200 to finish the major expanded triangle that has been developing since September 2012. Once this expanded triangle is finished we should expect a very powerful rally.

Wednesday, March 20, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We still need a break above 124.87 to confirm that wave iii of 5 is developing. As long as resistance at 124.87 is not broken we have to accept the possibility, that the rally from 121.56 only is a correction and more corrective action is needed. That said, I do favor the scenario, telling us that wave iii of 5 is developing and if this is the case, then we should expect support at 123.48 and more likely support at in the 122.85 - 123.15 area to protect the downside for the rally above 124.87 and even more importantly a break above 125.79 to confirm wave iii of 5 towards 133.54.

EUR/NZD

We clearly needed more filling of the gap and with the gap more of less filled now we should be looking for a powerful decline below 1.5584 soon. As minor wave ii of red wave C was an expanded flat we should expect an extended wave iii down, which will call for a decline to 1.5312 and if this is the case we should expect the final wave v of red wave C to end close to our ideal target at 1.5200. Short term I'm looking for resistance in the 1.5691 - 1.5708 area to protect the upside for a break below 1.5620 and more importantly below 1.5584 to confirm the decline towards 1.5312.

We still need a break above 124.87 to confirm that wave iii of 5 is developing. As long as resistance at 124.87 is not broken we have to accept the possibility, that the rally from 121.56 only is a correction and more corrective action is needed. That said, I do favor the scenario, telling us that wave iii of 5 is developing and if this is the case, then we should expect support at 123.48 and more likely support at in the 122.85 - 123.15 area to protect the downside for the rally above 124.87 and even more importantly a break above 125.79 to confirm wave iii of 5 towards 133.54.

EUR/NZD

We clearly needed more filling of the gap and with the gap more of less filled now we should be looking for a powerful decline below 1.5584 soon. As minor wave ii of red wave C was an expanded flat we should expect an extended wave iii down, which will call for a decline to 1.5312 and if this is the case we should expect the final wave v of red wave C to end close to our ideal target at 1.5200. Short term I'm looking for resistance in the 1.5691 - 1.5708 area to protect the upside for a break below 1.5620 and more importantly below 1.5584 to confirm the decline towards 1.5312.

Tuesday, March 19, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The rally from 121.56 exhausted already at 124.13 followed by a deep correction to 121.83. If wave iii of 5 has begun we can not accept a break below 121.56 at any time. If we break below 121.56 we know that wave ii of 5 still is ongoing, but the downside should be limited. On the other hand a break above 122.75 and more importantly a break above 123.70 will indicate, that wave iii is indeed unfolding and we should expect a powerful rally higher towards 133.54 to develop.

EUR/NZD

The gap from 1.5776 down to 1.5704 has not been closed, that could be another sign of major underlying weakness here. That said, we still need a clear break below 1.5600 to confirm that weakness. Short term we are looking for resistance at 1.5673 and again at 1.5689. We would like to see one of these resistance levels protect the upside for the clear break below 1.5600 for a continuation down towards at least 1.5390 and ideally close to 1.5200. However, if we break above 1.5689 we should expect more filling of the gap towards 1.5776.

The rally from 121.56 exhausted already at 124.13 followed by a deep correction to 121.83. If wave iii of 5 has begun we can not accept a break below 121.56 at any time. If we break below 121.56 we know that wave ii of 5 still is ongoing, but the downside should be limited. On the other hand a break above 122.75 and more importantly a break above 123.70 will indicate, that wave iii is indeed unfolding and we should expect a powerful rally higher towards 133.54 to develop.

EUR/NZD

The gap from 1.5776 down to 1.5704 has not been closed, that could be another sign of major underlying weakness here. That said, we still need a clear break below 1.5600 to confirm that weakness. Short term we are looking for resistance at 1.5673 and again at 1.5689. We would like to see one of these resistance levels protect the upside for the clear break below 1.5600 for a continuation down towards at least 1.5390 and ideally close to 1.5200. However, if we break above 1.5689 we should expect more filling of the gap towards 1.5776.

Monday, March 18, 2013

Elliott wave analysis of EYR/JPY and EUR/NZD

EUR/JPY

I'm still looking for yesterdays gap to be closed, which means I'm still looking for a rally higher towards 1.5776 as long as support at 1.5656 protects the downside. From 1.5776 or upon a break below 1.5656 I expects a new firm test of the triangle support near 1.5600 and a break below here confirms the downside thrust towards at least 1.5390 and likely even lower towards the ideal target near 1.5200. It will take a break above 1.5807 and more importantly a break above 1.5917 to invalidate our call for one last decline.

As expected the gap from yesterday is almost closed. We should expect resistance at 124.21 to protect the upside for a minor correction back to the 122.57 - 122.87 area from where we expect the next rally higher. That said we still need more confirmation, that wave iii of 5 is developing. A break above 124.84 and of cause more important a break above 125.79 will confirm, that wave iii of 5 is indeed ongoing. The target for wave iii of 5 is at 133.54, where wave iii will be 1.618 times the length of wave i, but until the break above 124.84 we must accept the possibility of a small set-back towards the 122.57 - 122.87 area first.

EUR/NZDI'm still looking for yesterdays gap to be closed, which means I'm still looking for a rally higher towards 1.5776 as long as support at 1.5656 protects the downside. From 1.5776 or upon a break below 1.5656 I expects a new firm test of the triangle support near 1.5600 and a break below here confirms the downside thrust towards at least 1.5390 and likely even lower towards the ideal target near 1.5200. It will take a break above 1.5807 and more importantly a break above 1.5917 to invalidate our call for one last decline.

Sunday, March 17, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The week started with a large gap down from 124.21 to 122.71. I expect support at 121.52 will protect the downside as this gap is closed. Gaps are not that common in the foreign exchange market and they are almost always closed immediately. As we regard the decline from 126.04 as wave ii of 5 it should also warrant a close of the gap soon as wave iii of 5 higher takes over. The only demand we have to wave ii of 5 is, that it does not break below the start of wave i of 5 at 118.73 as that would invalidate our bullish count. On the opposite side we would like to see a break above 124.21 and more importantly a break above 125.79, which will confirm the next rally higher in wave iii of 5 towards 133.54.

EUR/NZD

Here too we saw a big gap down in this cross and the trading week began. I expect the gap down from 1.5776 to 1.5704 will be closed soon. That said, the failure to hold the break above 1.5878 is a sign of underlying weakness as we should watch out for renewed weakness once the gap is closed. The failure break towards the upside keeps the triangle scenario alive and therefore a trust out of the triangle towards the downside is still the most likely outcome here. A break below 1.5600 will call for a decline to at least 1.5390 and likely even down closer to 1.5200. To change this scenario it will take a break above resistance at 1.5934.

The week started with a large gap down from 124.21 to 122.71. I expect support at 121.52 will protect the downside as this gap is closed. Gaps are not that common in the foreign exchange market and they are almost always closed immediately. As we regard the decline from 126.04 as wave ii of 5 it should also warrant a close of the gap soon as wave iii of 5 higher takes over. The only demand we have to wave ii of 5 is, that it does not break below the start of wave i of 5 at 118.73 as that would invalidate our bullish count. On the opposite side we would like to see a break above 124.21 and more importantly a break above 125.79, which will confirm the next rally higher in wave iii of 5 towards 133.54.

EUR/NZD

Here too we saw a big gap down in this cross and the trading week began. I expect the gap down from 1.5776 to 1.5704 will be closed soon. That said, the failure to hold the break above 1.5878 is a sign of underlying weakness as we should watch out for renewed weakness once the gap is closed. The failure break towards the upside keeps the triangle scenario alive and therefore a trust out of the triangle towards the downside is still the most likely outcome here. A break below 1.5600 will call for a decline to at least 1.5390 and likely even down closer to 1.5200. To change this scenario it will take a break above resistance at 1.5934.

Elliott wave analysis on Gold

Gold

Is still locked within the boarders of strong support at 1,526 and strong resistance at 1,796. Short term the falling channel from 1,796 is determining the direction for gold, which is still to the downside, with the possibility of testing strong support at 1.526 or even slightly below before wave 4 finally comes to an end and wave 5 higher takes over.

Short term a break above 1,620 will be the first indication that wave Z and wave 4 might be over, but it will take a break above 1,695 to confirm, that wave 4 has indeed bottomed and that wave 5 is developing. So for now we should stay humble for a possible move closer to 1.526, but we are also closing in on a nice low risk buying opportunity, but remember no trades without a stop loss...

Is still locked within the boarders of strong support at 1,526 and strong resistance at 1,796. Short term the falling channel from 1,796 is determining the direction for gold, which is still to the downside, with the possibility of testing strong support at 1.526 or even slightly below before wave 4 finally comes to an end and wave 5 higher takes over.

Short term a break above 1,620 will be the first indication that wave Z and wave 4 might be over, but it will take a break above 1,695 to confirm, that wave 4 has indeed bottomed and that wave 5 is developing. So for now we should stay humble for a possible move closer to 1.526, but we are also closing in on a nice low risk buying opportunity, but remember no trades without a stop loss...

Saturday, March 16, 2013

Elliott wave analysis of Facebook

Facebook

Please see my last post on Facebook here first: http://theelliottwavesufer.blogspot.dk/2013/03/facebook-has-bottomed.html, but you should also take a look at my long term Elliott Wave count for Facebook here, to get the right perspective: http://theelliottwavesufer.blogspot.dk/2012/08/facebook-monthely-close-basis-facebook.html

The failue to break above important resistance at 28.94 followed by the break break below important support at 26.83 yesterday told us, that wave 4 wasn't over and that my original target near 25.60, where wave 4 will have corrected 38.2% of wave 3, still is in play. At 25.72 wave c of 4 will also be 2.618 times longer than wave a of 4, so we should expect strong support as we close in on this area.

More important wave 4 is an expanded flat correction (wave b went beyond the beginning of wave a and wave c has move way below the end of wave a) and that tells us, that we should expect a very powerful wave 5 once it takes over. We should even expect wave 5 to be an extended wave and if that will be the case, then we should see wave 5 rally to 40.35, where wave 5 will be equal in length to the distance traveled from the bottom of wave 1 top the top of wave 3. That would be a rally of more that 56% if it comes true.

Please see my last post on Facebook here first: http://theelliottwavesufer.blogspot.dk/2013/03/facebook-has-bottomed.html, but you should also take a look at my long term Elliott Wave count for Facebook here, to get the right perspective: http://theelliottwavesufer.blogspot.dk/2012/08/facebook-monthely-close-basis-facebook.html

The failue to break above important resistance at 28.94 followed by the break break below important support at 26.83 yesterday told us, that wave 4 wasn't over and that my original target near 25.60, where wave 4 will have corrected 38.2% of wave 3, still is in play. At 25.72 wave c of 4 will also be 2.618 times longer than wave a of 4, so we should expect strong support as we close in on this area.

More important wave 4 is an expanded flat correction (wave b went beyond the beginning of wave a and wave c has move way below the end of wave a) and that tells us, that we should expect a very powerful wave 5 once it takes over. We should even expect wave 5 to be an extended wave and if that will be the case, then we should see wave 5 rally to 40.35, where wave 5 will be equal in length to the distance traveled from the bottom of wave 1 top the top of wave 3. That would be a rally of more that 56% if it comes true.

Thursday, March 14, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

Wave ii of 5 most likely ended at 124.05 and this support should not be broken at any time now. I'm looking for a break above resistance at 125.78 as the confirmation, that wave ii is indeed over and wave iii of 5 is developing for a rally higher to at least 130.72 and more likely we will see wave iii of 5 move even higher towards 134.58. At 134.58 wave iii will be 1.618 times longer than wave i. I'm also looking for a very powerful rally in wave iii, therefore resistance should be broken without mush of a fight. Only a surprise break below 124.05 will delay the expected upside pressure for a move closer to 123.80 before the next upside rally can be expected.

EUR/NZD

The price-action since the impulsive rally from 1.5670 to 1.5871 is clearly corrective in character, which indicates, that we soon will see a break above important resistance at 1.5878. A break above resistance at 1.5878 will signal, that wave e of the expanding triangle fell short of its ideal target and that a new powerful rally has begun. However, as long as resistance at 1.5878 protects the upside we should expect a minor decline towards 1.5807, but will likely not see anything lower than 1.5765 before the next test of important resistance at 1.5878 sets in and a break above 1.5878 will call for a powerful rally higher towards 1.6134 and 1.6253.

Wave ii of 5 most likely ended at 124.05 and this support should not be broken at any time now. I'm looking for a break above resistance at 125.78 as the confirmation, that wave ii is indeed over and wave iii of 5 is developing for a rally higher to at least 130.72 and more likely we will see wave iii of 5 move even higher towards 134.58. At 134.58 wave iii will be 1.618 times longer than wave i. I'm also looking for a very powerful rally in wave iii, therefore resistance should be broken without mush of a fight. Only a surprise break below 124.05 will delay the expected upside pressure for a move closer to 123.80 before the next upside rally can be expected.

EUR/NZD

The price-action since the impulsive rally from 1.5670 to 1.5871 is clearly corrective in character, which indicates, that we soon will see a break above important resistance at 1.5878. A break above resistance at 1.5878 will signal, that wave e of the expanding triangle fell short of its ideal target and that a new powerful rally has begun. However, as long as resistance at 1.5878 protects the upside we should expect a minor decline towards 1.5807, but will likely not see anything lower than 1.5765 before the next test of important resistance at 1.5878 sets in and a break above 1.5878 will call for a powerful rally higher towards 1.6134 and 1.6253.

Wednesday, March 13, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

I'm still looking for a minor decline towards 123.80 in wave ii of 5. At 123.80 wave ii of 5 will have reached the bottom of wave four of one lessor degree, which is a very common target for second waves. That said, we could see wave ii move lower towards 122.62 and even 121.82, where wave ii would have corrected 61.8% of wave i, but the Market has been really impatient with this cross, therefore we would not expect such a deep correction. Once this wave ii correction is over we should expect a powerful rally in wave iii of 5 towards at least 130.72, but a more likely target will be 134.58, where wave iii will be 1.618 times the length of wave i.

EUR/NZD

We did see a break below important support at 1.5718, but only a very brief break and the following rally does look very impulsive. This is another warning that this wave e likely will fall short of its ideal target. That said, we need a break above 1.5878 and more importantly a break above 1.5934 to confirm, that we have seen a bottom at 1.5592 and that a new rally higher has begun. As long as resistance at 1.5878 protects the upside we are still very cautiously bearish, but we need some serious prof, in form of a break below support at 1.5739 and more importantly a break below 1.5657 to confirm renewed downside pressure.

Tuesday, March 12, 2013

Elliott wave analysis on Shanghai Composite and Novo Nordisk

Shanghai Composite

Is locked in a well defined downtrend. In early December 2012 we saw a bottom, of a five wave decline from 3.187, at 1.949 which marked the end of wave A and we have eigther seen the end of wave B or is correcting wave a of B before one last rise higher towards the channel resistance-line near 2.700. However a break below 2.225 will add pressure towards the downside for a continuation down to 2.050.

Novo Nordisk

Please see my last update on Novo Nordisk here first: http://theelliottwavesufer.blogspot.dk/2013/02/novo-nordisk-as-textbook-elliott-wave.html

Novo has likely just ended its b wave and wave c down is under way. Short term we could see a move towards 1.030 before the next real downside pressure takes over for decline down to at least

858, but we will likely see even lower levels near 710 tested.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

There was no time for one last minor rally higher yesterday, which means that wave i of 5 ended at 126.04 and wave ii of 5 currently is developing. The minimum we expect of wave ii is to reach the bottom of wave four of one lessor degree, which is at 123.80, but the decline in wave ii of 5 could be deeper. A correction towards the 50% corrective target at 122.62 or even down to the 61.8% corrective target at 121.82 should not be ruled out, but the Market seems to be very impatient and therefore we should not expect to much of this correction. Once this correction is over we should expect a very powerful rally higher towards at least 130.72, but more likely we will see it move higher towards 134.58.

EUR/NZD

I'm still looking for resistance at 1.5832 and more importantly resistance at 1.5878 to protect the upside for a break below support at 1.5767 and more importantly support at 1.5718, which will call for a test of the triangle support-line at 1.5600. A break below the support-line will open up the downside for the final thrust lower towards 1.5390 and likely even lower towards 1.5200 before the entire correction from early September 2012 finally comes to an end. That said, we should be aware that e-waves of triangle can fall short of there ideal targets and a break above 1.5878 will be a first warning that this is the case here.

There was no time for one last minor rally higher yesterday, which means that wave i of 5 ended at 126.04 and wave ii of 5 currently is developing. The minimum we expect of wave ii is to reach the bottom of wave four of one lessor degree, which is at 123.80, but the decline in wave ii of 5 could be deeper. A correction towards the 50% corrective target at 122.62 or even down to the 61.8% corrective target at 121.82 should not be ruled out, but the Market seems to be very impatient and therefore we should not expect to much of this correction. Once this correction is over we should expect a very powerful rally higher towards at least 130.72, but more likely we will see it move higher towards 134.58.

EUR/NZD

I'm still looking for resistance at 1.5832 and more importantly resistance at 1.5878 to protect the upside for a break below support at 1.5767 and more importantly support at 1.5718, which will call for a test of the triangle support-line at 1.5600. A break below the support-line will open up the downside for the final thrust lower towards 1.5390 and likely even lower towards 1.5200 before the entire correction from early September 2012 finally comes to an end. That said, we should be aware that e-waves of triangle can fall short of there ideal targets and a break above 1.5878 will be a first warning that this is the case here.

Monday, March 11, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With the break above my invalidation point at 125.89, I have to conclude that wave 4 did indeed terminate at 118.73, short of the ideal target at 117.28. So my focus will again be towards the upside as wave 5 develops. The first target for wave 5 is at 131.39, where wave 5 will have traveled 38.2% of the distance from the bottom of wave 1 to the top of wave 3. That said, I do think that eight the 50% or even the 61.8% targets at 135.36 and 139.32 will more likely be seen. For the short term we should be looking for wave ii of 5, which should be our entry for the next powerful rally higher. Before we see wave ii of 5 begin we will likely see one last minor rally higher towards 126.75, from where wave ii down to at least 123.80 should be expected.

EUR/NZD

Resistance near 1.5880 rejected the test once again yesterday and I'm still looking for a break below 1.5718 to confirm a test of the triangle support-line at 1.5600, once the triangle support at 1.5600 breaks we are looking for the final thrust towards the downside in the major expanding triangle, which has been developing since early September 2012. The ideal downside target for this last decline is near 1.5200, but we must accept the possibility that a break below 1.5390 will be enough to fulfil all requirements for the expanding triangle. Short term we should expect to see minor resistance at 1.5801 will protect the upside for a break below 1.5752 for the next move lower towards important support at 1.5718.

With the break above my invalidation point at 125.89, I have to conclude that wave 4 did indeed terminate at 118.73, short of the ideal target at 117.28. So my focus will again be towards the upside as wave 5 develops. The first target for wave 5 is at 131.39, where wave 5 will have traveled 38.2% of the distance from the bottom of wave 1 to the top of wave 3. That said, I do think that eight the 50% or even the 61.8% targets at 135.36 and 139.32 will more likely be seen. For the short term we should be looking for wave ii of 5, which should be our entry for the next powerful rally higher. Before we see wave ii of 5 begin we will likely see one last minor rally higher towards 126.75, from where wave ii down to at least 123.80 should be expected.

EUR/NZD

Resistance near 1.5880 rejected the test once again yesterday and I'm still looking for a break below 1.5718 to confirm a test of the triangle support-line at 1.5600, once the triangle support at 1.5600 breaks we are looking for the final thrust towards the downside in the major expanding triangle, which has been developing since early September 2012. The ideal downside target for this last decline is near 1.5200, but we must accept the possibility that a break below 1.5390 will be enough to fulfil all requirements for the expanding triangle. Short term we should expect to see minor resistance at 1.5801 will protect the upside for a break below 1.5752 for the next move lower towards important support at 1.5718.

Sunday, March 10, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

I'm still looking for a B-wave triangle to end soon for a break below 1.5800 and more importantly a break below 1.5718, which confirms that wave e of the triangle ended at 1.5874 and red wave c down close to 1.5200 is developing. That said a break above the triangle green wave c at 1.5934 will invalidated the expected decline and call for a new rally higher towards 1.6024 and higher towards 1.6359.

My invalidation point at 125.89 was tested on Friday, but did not give away, so it is still an open question whether we have seen wave 4 end a double zig-zag combination at 118.73 and wave 5 is developing or the current rally is an other x-wave, before we will see the third and last zig-zag combination down to 117.28. If we do break clearly above 125.89 the rally from 118.73 is wave i of 5 and we will soon see wave ii of 5 down to 122.33 before the next rally higher. However, if the invalidation point at 125.89 holds firm for a direct break below 123.80 the rally from 118.73 must be counted as an x-wave and we should then expect one last zig-zag combination down to the ideal correction target at 117.28, where wave 4 will have corrected 38.2% of wave 3.

EUR/NZD

I'm still looking for a B-wave triangle to end soon for a break below 1.5800 and more importantly a break below 1.5718, which confirms that wave e of the triangle ended at 1.5874 and red wave c down close to 1.5200 is developing. That said a break above the triangle green wave c at 1.5934 will invalidated the expected decline and call for a new rally higher towards 1.6024 and higher towards 1.6359.

TLT Breaking lower

TLT (Barclays 20+ Year Bond Fund)

It has been quite a while since I last spoke about TLT (please see my last post here: http://theelliottwavesufer.blogspot.dk/2012/10/elliott-wave-analysis-of-tlt.html)

I have change my count somewhat, but never the less the target from October 2012 at 109.76 still stands. The rise in bond yilds could indicate, that the Market believes that the economy is getting better. That would also fit in with the new all time high in the stock market.

From a tecnical point of view, Fridays close was very important as the break-down incicates that the next powerful decline is well under way and we should soon see 111 tested if not lower.

It has been quite a while since I last spoke about TLT (please see my last post here: http://theelliottwavesufer.blogspot.dk/2012/10/elliott-wave-analysis-of-tlt.html)

I have change my count somewhat, but never the less the target from October 2012 at 109.76 still stands. The rise in bond yilds could indicate, that the Market believes that the economy is getting better. That would also fit in with the new all time high in the stock market.

From a tecnical point of view, Fridays close was very important as the break-down incicates that the next powerful decline is well under way and we should soon see 111 tested if not lower.

Thursday, March 7, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

Yesterdays rally was much bigger than I expected. The break past resistance at 122.75 was a warning that we should expect more upside, but is our call for one last decline towards 117.28 dead? No not yet. It will take a break above 125.89 to confirm (I think I have mentioned 125.22 as the invalidation-point, but it is at 125.89. I'm sorry for the confusion), that wave 4 ended already at 118.73 in a double zig-zag. What I don't like about this rally is the very start of it. It was messy with lots of overlaps and even a minor triangle can be seen and that is not what we should expect at the beginning of an impulse rally like wave 5. Therefore as long as resistance at 125.89 protects the upside I will be looking for a new decline and a break below 124.19 will be the first indication that the x-wave have peaked. That said a break above 125.22 will invalidate the possible x-wave and indicate that wave 5 is indeed developing for a rally towards 127.70 and higher towards 131.38 as the first possible target for wave 5.

EUR/NZDThe break past 1.5739 has forced me to change the short term count to a running triangle. However, the final outcome will still be the same as I'm still are looking for one more decline to just below 1.5390 and more likely even closer to support at 1.5200. That said a break above green wave c of the triangle at 1.5934 will invalidate the downside scenario and call for a new rally higher towards 1.6024 and even higher towards 1.6359. I expect green wave e of the triangle to stall shortly close to 1.5883, but must allow for a move closer to 1.5934, before a break below 1.5800 which confirms the next decline lower towards 1.5597 and lower.

Wednesday, March 6, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We are still locked in a narrow range, but it seems like this x-wave correction from 118.73 is coming to an end soon. As long as support at 121.54 and more importantly support at 121.11 protects the downside we are looking for one last minor rally higher towards 122.75 to end this x-wave. However a direct break below 121.54 will be the first indication, that this x-wave correction already has terminated, while a break below 121.11 will confirm it and call for a new decline to 118.73 on the way down to the ideal target at 117.28, where I expect this larger wave 4 correction to end.

EUR/NZD

The expected decline seems to be a harder fight than I expected. That said, we continue to make progress towards the downside and for the short term, I expect to see resistance at 1.5739 protect the upside for a break below 1.5644, which confirms the next decline to 1.5597 and lower towards 1.5550. My ideal target for this decline is near 1.5200, but we could see a lower just below support at 1.5390.

We are still locked in a narrow range, but it seems like this x-wave correction from 118.73 is coming to an end soon. As long as support at 121.54 and more importantly support at 121.11 protects the downside we are looking for one last minor rally higher towards 122.75 to end this x-wave. However a direct break below 121.54 will be the first indication, that this x-wave correction already has terminated, while a break below 121.11 will confirm it and call for a new decline to 118.73 on the way down to the ideal target at 117.28, where I expect this larger wave 4 correction to end.

EUR/NZD

The expected decline seems to be a harder fight than I expected. That said, we continue to make progress towards the downside and for the short term, I expect to see resistance at 1.5739 protect the upside for a break below 1.5644, which confirms the next decline to 1.5597 and lower towards 1.5550. My ideal target for this decline is near 1.5200, but we could see a lower just below support at 1.5390.

Tuesday, March 5, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/JPY has been trading in a very narrow range 121.12 - 122.18 the last couple of days, but we know that this type of range-trading normally is followed by high volatility. The big question is of cause which way we are going to break out of this range. I'm still looking for one last rally higher to 122.75 followed by renewed weakness down to the ideal corrective target at 117.28. However a break below 121.12 will open for the possibility of a direct decline towards the ideal target and a break below support at 120.36 will confirm this outcome.

EUR/JPY has been trading in a very narrow range 121.12 - 122.18 the last couple of days, but we know that this type of range-trading normally is followed by high volatility. The big question is of cause which way we are going to break out of this range. I'm still looking for one last rally higher to 122.75 followed by renewed weakness down to the ideal corrective target at 117.28. However a break below 121.12 will open for the possibility of a direct decline towards the ideal target and a break below support at 120.36 will confirm this outcome.

EUR/NZD

We finally saw the daily close below 1.5685, which is the first close below the channel support-line since the low at 1.4966 in early August 2012. This should open for a continuation towards the expanded triangle support-line near 1.5200. The absolute minimum I expect to see is a break below 1.5390, which marked the bottom of wave c. This monster correction seems to come to an end soon, but we are not there yet. Short term we expect support at 1.5727 to protect the upside for the next decline towards support at 1.5593 and at 1.5550.

Subscribe to:

Comments (Atom)