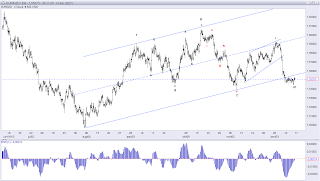

EUR/JPY

With a low at 108.63 yesterday (I had support at 108.60), we saw only a very small correction from the 109.54 high, before the next rally higher towards strong resistance near 111.43 began. That said, we have to consider the the possibility, that the ongoing price-action since the 109.54 high is part of a expanded flat correction. If this is the case we should not break above 109.85, but instead see a break below 109.03, which will confirm that an expanded flat correction is unfolding for a decline down to 108.34, from where the next powerful rally should unfold. However, a direct break above 109.85 will indicate, that the correction we saw down to 108.63 yesterday, was all the correction we are going to get this time and that a test of strong resistance near 111.43 is next. Longer term I'm are still looking for much higher levels.

EUR/NZD

The price-action here has been very compressed the week, which indicates, that once we break out of this consolidation we should see a very powerful move. I still prefer a break above resistance at 1.5528 for a quick run to important resistance at 1.5600 and higher. However, The risk is a break below 1.5390, which will change our view to a more bearish one and call for a much deeper decline towards at least 1.5244. As earlier said we do prefer an upside break above 1.5528 for a move higher towards 1.5927 as the first major target, but longer term we should see much higher levels, if our preferred count is correct.

No comments:

Post a Comment