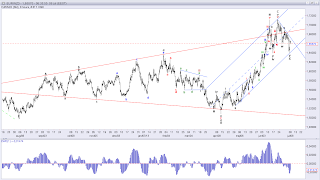

On Friday we saw a failure to break below important support at 128.65. the failure caused a new rally, but this rally is most likely part of wave ii of iii of A lower. However, to confirm this count we need for resistance at 130.28 to protect the upside for a break below support at 129.64. A break below 129.64 will confirm that wave c of the expanded flat wave ii is over and that wave iii of iii of A is developing. After an expanded flat wave ii we should always expect an extender wave iii, which in this case means a decline to at least 127.81 and possibly lower. That said, as long as support has not been broken the risk is a break above 130.28, which will change my count slightly, but only to wave i down from 131.12 to 128.65 and wave ii will be ongoing towards 130.39 before down in wave iii.

EUR/NZDWith a decline to 1.6390 and a very powerful rally to follow this drop my scenario has played out almost to perfection. I'm now looking for support near 1.6578 to protect the downside for a break above 1.6625, which will confirm the next rally higher. However, we need a break above the resistance line back from the 1.7112 high, which comes in at around 1.6730 to confirm a new rally back to 1.7111 and possibly higher. Even though the rally from the 1.6390 has all the earmarks of an impulsive rally, there is a risk, that it is "only" a new X-wave rally and a new decline will follow, but that is not my preferred count at this point in time.

No comments:

Post a Comment