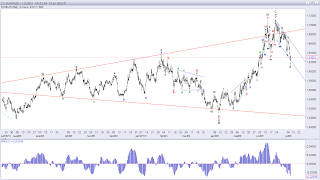

EUR/JPY

As I said yesterday, the price action that we saw Monday was not supportive for an imminent decline. Rather it did flash, that one more rally towards 130.59 was needed and that is what we saw. With a high at 130.56 (just 3 small pips below my target), we have seen a turnaround to the downside again. Of the ongoing c-wave we have now seen wave i and ii. Wave ii was an expanded flat correction and after an expanded flat correction we should expect an extended impulsive wave to follow, which in this case means a decline to at least 126.57 and possibly lower. Short term I expect minor resistance at 129.35 will be able to protect the upside, but if we does see a break above 129.35 we should see a continuation higher towards 129.61 before the next powerful decline is seen towards 126.57.

EUR/NZD

With the break below 1.6390 we knew, that the rally from 1.6390 to 1.6688 "only" was an x-wave and that a decline to 1.6249 was to be expected (we have seen a low at 1.6227). We now have a triple zig-zag combination from the top at 1.7111 and it is not possible to have more than a triple correction, therefore once this last zig-zag correction is over, we will see a powerful rally higher. I will now be looking for signs, that a bottom is in place and the first sign will be a break above resistance at 1.6331 however, we will need a break above 1.6552 to confirm the bottom and that a new rally towards at least 1.7111 is developing. That said, as long as the resistance at 1.6331 protects the upside we could see a bit more downside towards 1.6174 before the next rally higher should take over.

No comments:

Post a Comment