I would like to wise you all a Happy New Year and a prosperous 2013

Sunday, December 30, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

We didn't see a break above resistance at 1.6155, but instead support at 1.6075 was taken out, which raises the risk of an even deeper correction towards 1.5962 and possibly even 1.5922 before the next rally higher can be expected. That said, as we are in wave iii this correction could suddenly terminate short of the ideal target for the next swing higher. However, to confirm that the correction from 1.6218 is over we need a break above 1.6103 and more importantly 1.6160. A break above resistance at 1.6160 will call for a new rally higher towards 1.6218 on the way to 1.6387.

With a high at 114.69 wave iii of 3 might be over just shy of our ideal target area between 114.99 - 115.11. The decline from 114.69 does have impulsive characters (five wave decline), which tells us, that a zig-zag or a combination of corrections is under way. Therefore we will be looking for a correction that is no less than 199 pips large, that would mean a correction, which needs to break below 112.70. We think that the first possible target for this correction is at 112.27, That said we expect a minor rally up to 114.10 short term before the next decline down to our target at 112.27. Once this wave iv of 3 correction is over, we should see the next powerful rally higher towards 117.36.

We didn't see a break above resistance at 1.6155, but instead support at 1.6075 was taken out, which raises the risk of an even deeper correction towards 1.5962 and possibly even 1.5922 before the next rally higher can be expected. That said, as we are in wave iii this correction could suddenly terminate short of the ideal target for the next swing higher. However, to confirm that the correction from 1.6218 is over we need a break above 1.6103 and more importantly 1.6160. A break above resistance at 1.6160 will call for a new rally higher towards 1.6218 on the way to 1.6387.

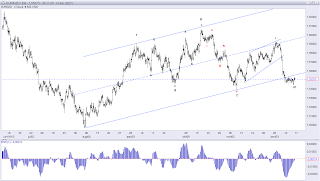

Elliott wave analysis on USD/CAD long term

USD/CAD

The above count is my preferred long term count, which is calling for a new rally higher in USD/CAN soon. The first target is the resistance-line near 1.0450 and a break above here will call for a much larger rally towards at least 1.3500. What is the risk to this scenario? a break below support at 0.9633 and more importantly 0.9406 will call for a new decline towards 0.9056 and likely even lower. But I think that outcome is a very low risk scenario.

The above count is my preferred long term count, which is calling for a new rally higher in USD/CAN soon. The first target is the resistance-line near 1.0450 and a break above here will call for a much larger rally towards at least 1.3500. What is the risk to this scenario? a break below support at 0.9633 and more importantly 0.9406 will call for a new decline towards 0.9056 and likely even lower. But I think that outcome is a very low risk scenario.

Elliott wave analysis of AUD/USD - Bullish or Bearish Triangle?

AUD/USD

Please see my long term Bullish/Bearish counts here first: http://theelliottwavesufer.blogspot.dk/2012/07/audusd-in-long-term-bullish-or-bearish.html

My long term count from July 21 - 2012 is still valid, but are we in a bullish configuration or is it a bearish configuration? The fact that we have seen a 61.8% retracement of the five wave decline from 1974 to 2001 makes me prefer the bearish configuration above the bullish count. That said, as long as we are trading inside the Triangle (be it a B- wave Triangle or a wave 4 Triangle) we will have to respect the boundaries until we get the thrust out of the Triangle. Therefore we should look to the downside for the next couple of month as wave d or wave e of the Triangle develops. A break below 1.0287 will confirm a test of important support at 1.0149 and a break below here will confirm a decline towards the Triangle support line near 0.9800.

Please see my long term Bullish/Bearish counts here first: http://theelliottwavesufer.blogspot.dk/2012/07/audusd-in-long-term-bullish-or-bearish.html

My long term count from July 21 - 2012 is still valid, but are we in a bullish configuration or is it a bearish configuration? The fact that we have seen a 61.8% retracement of the five wave decline from 1974 to 2001 makes me prefer the bearish configuration above the bullish count. That said, as long as we are trading inside the Triangle (be it a B- wave Triangle or a wave 4 Triangle) we will have to respect the boundaries until we get the thrust out of the Triangle. Therefore we should look to the downside for the next couple of month as wave d or wave e of the Triangle develops. A break below 1.0287 will confirm a test of important support at 1.0149 and a break below here will confirm a decline towards the Triangle support line near 0.9800.

Elliott wave analysis on USD/CHF - Long term too

USD/CHF

On Thursday December 27 I posted my preferred views on the major USD-corsses (you can see it here: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-of-eurusd-usdchf.html)

However I would like to show you my top alternate count on USD/CHF as this easily could have been my preferred count.

Instead of a wave 1 top at 0.9584 in early January 2012. Wave 1 might first have ended in late July at 0.9972 and the present ongoing correction is wave 2. The question is of cause whether wave 2 has ended already or a deeper correction is needed? As we have seen a correction to the Triangle apex wave 2 could be over. It's very common for wave 2 to terminate at the Triangle apex (where the two lines meet). If wave 2 is over we should soon see a break above 0.9245 and more importantly a break above 0.9383, which will confirm the bottom of the double zig-zag correction from 0.9972 and a new test of resistance at 0.9972. Looking at the long term picture of USD/CHF (see the monthly chart below) a break above resistance at 0.9972 is needed to confirm a more bullish long term view.

I have no count on the monthly chart, but you will likely be able to see my drift, without any difficulties.

On Thursday December 27 I posted my preferred views on the major USD-corsses (you can see it here: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-of-eurusd-usdchf.html)

However I would like to show you my top alternate count on USD/CHF as this easily could have been my preferred count.

Instead of a wave 1 top at 0.9584 in early January 2012. Wave 1 might first have ended in late July at 0.9972 and the present ongoing correction is wave 2. The question is of cause whether wave 2 has ended already or a deeper correction is needed? As we have seen a correction to the Triangle apex wave 2 could be over. It's very common for wave 2 to terminate at the Triangle apex (where the two lines meet). If wave 2 is over we should soon see a break above 0.9245 and more importantly a break above 0.9383, which will confirm the bottom of the double zig-zag correction from 0.9972 and a new test of resistance at 0.9972. Looking at the long term picture of USD/CHF (see the monthly chart below) a break above resistance at 0.9972 is needed to confirm a more bullish long term view.

I have no count on the monthly chart, but you will likely be able to see my drift, without any difficulties.

Thursday, December 27, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With the rally clearly above 113.76 I have adopted an even more bullish long term count, as can be seen on the chart above. This count "only" calls for a top in wave iii of 3 near the 114.99 - 115.11 area. Looking at the chart above we can also see a negative divergence building on the EWO-indicator, which tells me, that the ongoing rally is loosing momentum and a correction soon should be seen. This correction should not be smaller than 199 pips and will likely decline towards 111.27 and possibly even to 110.59 before the next rally higher towards 117.36.

EUR/NZD

With the rally clearly above 113.76 I have adopted an even more bullish long term count, as can be seen on the chart above. This count "only" calls for a top in wave iii of 3 near the 114.99 - 115.11 area. Looking at the chart above we can also see a negative divergence building on the EWO-indicator, which tells me, that the ongoing rally is loosing momentum and a correction soon should be seen. This correction should not be smaller than 199 pips and will likely decline towards 111.27 and possibly even to 110.59 before the next rally higher towards 117.36.

EUR/NZD

The correction from the 1.6207 high could already be over with the sub-normal test of 1.6098. However, to confirm that the correction from 1.6207 is already over we need a break above 1.6155. As long as minor resistance at 1.6155 is protecting the upside we could still see one last decline towards 1.6075 before the next rally higher sets in. From 1.6075 or a direct break above 1.6155 we should see a new test of the 1.6207 high on the way towards 1.6387 as the next upside target. Long term I expect this ongoing wave iii of 3 to break above the resistance-line of the base channel an accelerate its rally much higher.

Elliott wave analysis of EUR/USD; USD/CHF; USD/JPY and GBP/USD

EUR/USD

The overall picture is still the same. I'm tracking a big running Triangle, which has been developing since late 2008. Within the Triangle we are currently in wave E, which I expect will make it to at least 1.3491 and likely even to the 1.3795 - 1.3835 where wave c of E will be equal in length to wave a of E.

The break out of the bearish channel has confirmed that wave E is developing.

USD/CHF

The count I have shown is my preferred count at this point, but we need a break above 0.9513 to confirm, that wave ii of 3 is over and the powerful wave iii of 3 developing. The risk is of cause a break below 0.8930 which will indicate a deeper correction towards 0.8622 before the next rally higher.

A break above 0.9513 will call for a new rally towards 0.9972 on the way to 1.0715.

USD/JPY

Closed well above important resistance at 85.52 and our focus should now towards the upside for a continuation higher towards 92.38 and likely even higher towards 101.82 as the next major target.

I would not bet on the downside at this point in time, but that doesn't mean a set-back towards the low 83 levels couldn't be seen, but as I said I would not bet on that outcome.

GBP/USD

We are still locked within the B-wave Triangle, but time is running out and we will likely see a break out of the Triangle very soon. I'm still looking for a break towards the upside and a break above 1.6305 will be the first good indication, that a upside break will be seen for a powerful rally higher towards the 1.97 - 1.98 area.

The alter my bullish view a break below 1.5234 is need, which would call for an equally powerful decline to well below 1.3514.

The overall picture is still the same. I'm tracking a big running Triangle, which has been developing since late 2008. Within the Triangle we are currently in wave E, which I expect will make it to at least 1.3491 and likely even to the 1.3795 - 1.3835 where wave c of E will be equal in length to wave a of E.

The break out of the bearish channel has confirmed that wave E is developing.

USD/CHF

The count I have shown is my preferred count at this point, but we need a break above 0.9513 to confirm, that wave ii of 3 is over and the powerful wave iii of 3 developing. The risk is of cause a break below 0.8930 which will indicate a deeper correction towards 0.8622 before the next rally higher.

A break above 0.9513 will call for a new rally towards 0.9972 on the way to 1.0715.

USD/JPY

Closed well above important resistance at 85.52 and our focus should now towards the upside for a continuation higher towards 92.38 and likely even higher towards 101.82 as the next major target.

I would not bet on the downside at this point in time, but that doesn't mean a set-back towards the low 83 levels couldn't be seen, but as I said I would not bet on that outcome.

GBP/USD

We are still locked within the B-wave Triangle, but time is running out and we will likely see a break out of the Triangle very soon. I'm still looking for a break towards the upside and a break above 1.6305 will be the first good indication, that a upside break will be seen for a powerful rally higher towards the 1.97 - 1.98 area.

The alter my bullish view a break below 1.5234 is need, which would call for an equally powerful decline to well below 1.3514.

Wednesday, December 26, 2012

Elliott wave analysis on EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

There was no time for a correction here as the rally higher towards the next target near 1.6206 took place. With a high at 1.6217 we could have seen a top, but to confirm that we need a break below support at 1.6083 and more importantly a break below 1.5962, which will confirm, that a deeper correction towards 1.5923 is taking place. We have to remember, that we are in wave 3 higher and corrections in wave 3 tend to be small and even sub-normal. As support at 1.6083 protects the downside we could see a continuation slightly higher towards 1.6261, but this rally is clearly becoming stretched and we should expect a bigger correction soon.

As it is usual in wave 3 there was no time for a correction and the rally just kept moving higher towards the next target at 113.76. We could potentially be near the top for wave 3 but need a break below 113.02 and more importantly below 112.00 to confirm that wave 3 is over. As long as support at 113.02 has not been broken the uptrend in wave 3 is intact, and a test of 113.76 should be seen with potential for a move even higher towards 114.17 and 114.73. That said, this move is clearly becoming stretched and we should expect a relatively big correction soon.

EUR/NZD

There was no time for a correction here as the rally higher towards the next target near 1.6206 took place. With a high at 1.6217 we could have seen a top, but to confirm that we need a break below support at 1.6083 and more importantly a break below 1.5962, which will confirm, that a deeper correction towards 1.5923 is taking place. We have to remember, that we are in wave 3 higher and corrections in wave 3 tend to be small and even sub-normal. As support at 1.6083 protects the downside we could see a continuation slightly higher towards 1.6261, but this rally is clearly becoming stretched and we should expect a bigger correction soon.

Tuesday, December 25, 2012

Elliott wave analysis of USD/JPY

USD/JPY

Please see my previouse post on USD/JPY here first: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-of-usdjpy.html

With the break above 84.18 we knew, that the possible bearish triangle was invalidated and the bullish count was the correct one. We are just a few pips from the next important confirmation as a break above 85.52 will confirm the the rally higher towards 92.38 as the next major target. However I would expect this rally to be much bigger and could make it all the way to 101.82 before the next bigger correction is seen. That said we might only be in the very early start of a new major rally, that will have its first major target at 124.16.

Please see my previouse post on USD/JPY here first: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-of-usdjpy.html

With the break above 84.18 we knew, that the possible bearish triangle was invalidated and the bullish count was the correct one. We are just a few pips from the next important confirmation as a break above 85.52 will confirm the the rally higher towards 92.38 as the next major target. However I would expect this rally to be much bigger and could make it all the way to 101.82 before the next bigger correction is seen. That said we might only be in the very early start of a new major rally, that will have its first major target at 124.16.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

I have made a slight adjustment to our count, but that does not alter our overall call for a continuation higher towards the next targets at 1.6127 and 1.6206. Short term however, we might still see a minor set-back towards the 1.5930 - 1.5960 area before the next rally through 1.6085 for the continuation higher towards 1.6127. Looking at the larger perspective a close on a daily basis will establish the series of higher highs and higher lows and thereby set the underlying major trend as up.

With the break above minor resistance at 111.51 we knew, that the correction from 112.49 was over and a new test of this high was developing. We have already exceeded the high at 112.49 slightly, but there still remains a minor risk, that we are in an expanded flat correction. However, instead of looking for a risk scenario, I think the main focus should be on the next possible target for the ongoing uptrend. The next target for this uptrend is at 113.15 and more importantly at 113.76, which could potentially mark the top of wave 3. Short term support will be found at 112.14 and again at 111.48.

EUR/NZD

I have made a slight adjustment to our count, but that does not alter our overall call for a continuation higher towards the next targets at 1.6127 and 1.6206. Short term however, we might still see a minor set-back towards the 1.5930 - 1.5960 area before the next rally through 1.6085 for the continuation higher towards 1.6127. Looking at the larger perspective a close on a daily basis will establish the series of higher highs and higher lows and thereby set the underlying major trend as up.

Monday, December 24, 2012

Sunday, December 23, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With a low at 110.60 we could have seen the bottom of wave iv, but if this is the case we need a break above 111.51. A break above 111.51 will confirm a continuation higher towards 112.49 and higher towards 113.15 as the next target. That said, as long as minor resistance at 111.51 protects the upside we must accept the possibility of a slightly deeper correction towards 110.47 and maybe even 110.00 before the ongoing correction terminates and the next rally higher can take place. The is also a possibility of this correction to become more complex, but we need to see how things develops from here. However, one thing is clear, that we are in a correction and higher highs should be seen once this correction is finished.

EUR/NZD

With the direct break above 1.5917 we knew, that the correction was already over and a new rally higher towards 1.6004 was ongoing. However, even 1.6004 was not enough and we have seen a minor high at 1.6059. This high should soon be broken for a move to the next target near 1.6127. However, longer term we should be looking for much higher levels as wave 3 progresses with 1.6314 as a minimum target. Short term we should see 1.6010 protect the downside for a break above 1.6059 for a move towards 1.6127 as the next target. Once we have tested 1.6127 expect a new correction down to the 1.5792 - 1.5915 area, but remember that correction in wave 3 tend to be small and even sub-normal.

With a low at 110.60 we could have seen the bottom of wave iv, but if this is the case we need a break above 111.51. A break above 111.51 will confirm a continuation higher towards 112.49 and higher towards 113.15 as the next target. That said, as long as minor resistance at 111.51 protects the upside we must accept the possibility of a slightly deeper correction towards 110.47 and maybe even 110.00 before the ongoing correction terminates and the next rally higher can take place. The is also a possibility of this correction to become more complex, but we need to see how things develops from here. However, one thing is clear, that we are in a correction and higher highs should be seen once this correction is finished.

EUR/NZD

With the direct break above 1.5917 we knew, that the correction was already over and a new rally higher towards 1.6004 was ongoing. However, even 1.6004 was not enough and we have seen a minor high at 1.6059. This high should soon be broken for a move to the next target near 1.6127. However, longer term we should be looking for much higher levels as wave 3 progresses with 1.6314 as a minimum target. Short term we should see 1.6010 protect the downside for a break above 1.6059 for a move towards 1.6127 as the next target. Once we have tested 1.6127 expect a new correction down to the 1.5792 - 1.5915 area, but remember that correction in wave 3 tend to be small and even sub-normal.

Thursday, December 20, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The ongoing correction is the "biggest" correction we have seen since the 105.97 low, that tells us that we have likely seen the top of wave iii with the test of 112.49 and should now look for a correction towards the 38.2% retracement level of wave iii. This retracement target comes in at 110.00. However, looking at the internal structure of the correction. we might just need a slightly deeper correction towards 110.47 before this correction is over and the next rally higher towards 113.15. Short term we expect a move to 111.08 before the last downswing towards 110.47 and maybe even 110.00 before this correction terminates and the next rally higher can begin. Only a direct break above 111.51 will tell us, that the correction is already over and a new upswing is developing.

EUR/NZD

The ongoing correction is the "biggest" correction we have seen since the 105.97 low, that tells us that we have likely seen the top of wave iii with the test of 112.49 and should now look for a correction towards the 38.2% retracement level of wave iii. This retracement target comes in at 110.00. However, looking at the internal structure of the correction. we might just need a slightly deeper correction towards 110.47 before this correction is over and the next rally higher towards 113.15. Short term we expect a move to 111.08 before the last downswing towards 110.47 and maybe even 110.00 before this correction terminates and the next rally higher can begin. Only a direct break above 111.51 will tell us, that the correction is already over and a new upswing is developing.

EUR/NZD

We have seen a new high, but this is not enough to say that the correction from 1.5915 is over, is to early to tell. The correction from 1.5915 could be an expanding flat correction, which could take us down to 1.5775 before the next rally higher. If it turns out to be an expanded flat correction, we can be almost certain, that the next wave higher will be an extended wave. That said, if minor support at 1.5856 protects the downside for a new rally above 1.5917, then we should turn our focus towards the upside again for the next rally higher towards 1.6004 as the next target.

Wednesday, December 19, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

After another speedy ride higher to 112.49 a new minor correction has been seen. This correction is likely already over, with its fall to 110.80, but we need a break above 111.93 to confirm that and give us a new push towards 112.49 as the first minor target, followed by a continuation higher towards the 113.47 - 113.68 area, where we will find the next target. Looking at the technical indicator, you can say, that this market is very overbought and yes it is, but some of the biggest moves happens in very overbought territory. So we should not let our self be fooled by overbought indicators, because the risk is that we are taken out and will have a difficult time getting into the market again. Traders trying to pick the top and selling short in the most powerful part of the trend like this, is actually one of the things that keep feeding the trend. Short term support is at 110.91 and important support at 110.14. The later support should not be broken at any time, as that will tell us, that a bigger correction is unfolding.

EUR/NZD

As expected the trend has picked up speed after the break above 1.5600 and we are already back testing the top at 1.5923. The first try to break 1.5923 was no success and has caused a minor correction, which could already be over at this point and if it is, the next attempt to break above resistance at 1.5923 will likely prove much more successful. A break above 1.5923 will confirm that a move much higher is building and will open for a run towards 1.6311 as the next major target. That said, as long as minor resistance at 1.5875 protect the upside, we must accept the possibility of a deeper correction towards 1.5772 before the next push higher.

After another speedy ride higher to 112.49 a new minor correction has been seen. This correction is likely already over, with its fall to 110.80, but we need a break above 111.93 to confirm that and give us a new push towards 112.49 as the first minor target, followed by a continuation higher towards the 113.47 - 113.68 area, where we will find the next target. Looking at the technical indicator, you can say, that this market is very overbought and yes it is, but some of the biggest moves happens in very overbought territory. So we should not let our self be fooled by overbought indicators, because the risk is that we are taken out and will have a difficult time getting into the market again. Traders trying to pick the top and selling short in the most powerful part of the trend like this, is actually one of the things that keep feeding the trend. Short term support is at 110.91 and important support at 110.14. The later support should not be broken at any time, as that will tell us, that a bigger correction is unfolding.

EUR/NZD

As expected the trend has picked up speed after the break above 1.5600 and we are already back testing the top at 1.5923. The first try to break 1.5923 was no success and has caused a minor correction, which could already be over at this point and if it is, the next attempt to break above resistance at 1.5923 will likely prove much more successful. A break above 1.5923 will confirm that a move much higher is building and will open for a run towards 1.6311 as the next major target. That said, as long as minor resistance at 1.5875 protect the upside, we must accept the possibility of a deeper correction towards 1.5772 before the next push higher.

Elliott wave analysis of Natural Gas

Natural Gas

It has been quite a while since I have last written about Natural Gas. Please see my last post here:

http://theelliottwavesufer.blogspot.dk/2012/10/elliott-wave-analysis-of-eurusd-eurjpy_12.html

I have change my count to a double zig-zag, because of the overlapping structure. Even though I'm still looking for a move higher towards the 4.70 - 5.00 area once the ongoing wave B-correction is finished. This B-wave might already have finished at 3.27, but a break above 3.45 and more importantly 3.67 is need to confirm, that wave C higher towards 4.70 is developing.

The above scenario is my preferred count at this point, but there is an even more bullish alternative. This alternate count suggest that the entire structure from 1.99 to 4.00 is a leading diagonal as wave A or 1 and the ongoing correction wave B or 2, which will leave us with wave C or 3 once wave B is over. If we have seen a leading diagonal, then we will likely see a deeper correction towards at least 2.96 (50% retracement target) or even 2.71 (61.8% retracement target) before the next move higher.

It has been quite a while since I have last written about Natural Gas. Please see my last post here:

http://theelliottwavesufer.blogspot.dk/2012/10/elliott-wave-analysis-of-eurusd-eurjpy_12.html

I have change my count to a double zig-zag, because of the overlapping structure. Even though I'm still looking for a move higher towards the 4.70 - 5.00 area once the ongoing wave B-correction is finished. This B-wave might already have finished at 3.27, but a break above 3.45 and more importantly 3.67 is need to confirm, that wave C higher towards 4.70 is developing.

The above scenario is my preferred count at this point, but there is an even more bullish alternative. This alternate count suggest that the entire structure from 1.99 to 4.00 is a leading diagonal as wave A or 1 and the ongoing correction wave B or 2, which will leave us with wave C or 3 once wave B is over. If we have seen a leading diagonal, then we will likely see a deeper correction towards at least 2.96 (50% retracement target) or even 2.71 (61.8% retracement target) before the next move higher.

Elliott wave analysis of EUR/USD and Gold

EUR/USD

As it can be seen, on the chart above, the bearish channel clearly has been broken, which add confidence in my call for a continuation higher towards 1.3491 and likely even to the 1.3778 - 1.3833 area in wave c of E. C-waves resemble third waves in wave personality and can quite relentless in there moves. I think the ideal target for this wave c is at 1.3778, where wave c will be equal in length to wave a. The form resistance at 1.3172 has now shifted to become support, but even a slight break below 1.3172 will not alter my bullish call.

Gold

We are at important support in form of the channel support-line. This support should ideally protect the downside for the next rally higher, but it will take a break below 1,629.50 to invalidate my bullish bias to a more neutral outlook and call for a new test of the very strong support near 1,528.00. However to really get things going here we need either a break below support at 1,528.00 or a break above resistance at 1,796.00 until the break I will maintain a more or less neutral bias. Longer term I'm still bullish for one last rally to new all time highs.

As it can be seen, on the chart above, the bearish channel clearly has been broken, which add confidence in my call for a continuation higher towards 1.3491 and likely even to the 1.3778 - 1.3833 area in wave c of E. C-waves resemble third waves in wave personality and can quite relentless in there moves. I think the ideal target for this wave c is at 1.3778, where wave c will be equal in length to wave a. The form resistance at 1.3172 has now shifted to become support, but even a slight break below 1.3172 will not alter my bullish call.

Gold

We are at important support in form of the channel support-line. This support should ideally protect the downside for the next rally higher, but it will take a break below 1,629.50 to invalidate my bullish bias to a more neutral outlook and call for a new test of the very strong support near 1,528.00. However to really get things going here we need either a break below support at 1,528.00 or a break above resistance at 1,796.00 until the break I will maintain a more or less neutral bias. Longer term I'm still bullish for one last rally to new all time highs.

Tuesday, December 18, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With the break above 111.43 we have had the next long term confirmation, that a very important long term bottom is in place at 94.10. With the break above 111.43 we should also be looking forward to a test of the next major resistance at 113.68 soon. Will 113.68 mark a top? Not likely it will rather mark a short term top for yet another minor or even sub-normal correction before the next advance higher towards 116.38 and likely even 117.17, where wave 3 is 1.618 times longer than wave 1. I have said for quiet some time now, that I expected this wave 3 to be an extended wave and with the break above 111.43, that seems to be the case. Short term support will be at 111.26 and again at 110.81.

EUR/NZD

Once resistance at 1.5600 finally gave away there was no looking back and we are now well on the way to test strong resistance at 1.5927. However, resistance 1.5927 should only be able to put up a fight for so long and once it is broken the next target is 1.6011. Short term support should be found at 1.5771 and a more solid support at 1.5739. That said, it should be remembered that we are in wave iii of 3 and corrections during wave 3 tend to be small and even sub-normal, so do not expect too much price-action towards the downside.

With the break above 111.43 we have had the next long term confirmation, that a very important long term bottom is in place at 94.10. With the break above 111.43 we should also be looking forward to a test of the next major resistance at 113.68 soon. Will 113.68 mark a top? Not likely it will rather mark a short term top for yet another minor or even sub-normal correction before the next advance higher towards 116.38 and likely even 117.17, where wave 3 is 1.618 times longer than wave 1. I have said for quiet some time now, that I expected this wave 3 to be an extended wave and with the break above 111.43, that seems to be the case. Short term support will be at 111.26 and again at 110.81.

EUR/NZD

Once resistance at 1.5600 finally gave away there was no looking back and we are now well on the way to test strong resistance at 1.5927. However, resistance 1.5927 should only be able to put up a fight for so long and once it is broken the next target is 1.6011. Short term support should be found at 1.5771 and a more solid support at 1.5739. That said, it should be remembered that we are in wave iii of 3 and corrections during wave 3 tend to be small and even sub-normal, so do not expect too much price-action towards the downside.

Monday, December 17, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

As expected the gap between 109.92 and 111.03 was filled at once. With a low at 109.93 we could be headed for the next serious test of strong resistance in the 111.30 - 111.43 area, but once this area is overcome we will see the next rally higher towards at least 113.68. That said, short term we need to clear a minor resistance at 110.79, before a more firm test of strong resistance in the 111.30 - 111.45 area will be seen. As long as 110.79 protects the upside, we must accept the possibility of a more complex correction down to 109.56. As always it should be worth to remember, that we are in wave iii of 3 and corrections tend to small and even sub-normal.

EUR/NZD

Resistance at 1.5600 has put up quite a fight, but it should only be a matter of time before it is cleared and the next powerful rally higher towards 1.5650 and 1.5709 is seen, with the next major target being 1.5927. However, as long as resistance at 1.5600 has not been cleared we could see more consolidation just below, but I would be surprised to see any price-action below 1.5534 now. So stay tuned for a break above 1.5600, which indicates that the test of 1.5445 marked an important bottom. However it will still take a break below 1.5390 to invalidate my bullish count.

As expected the gap between 109.92 and 111.03 was filled at once. With a low at 109.93 we could be headed for the next serious test of strong resistance in the 111.30 - 111.43 area, but once this area is overcome we will see the next rally higher towards at least 113.68. That said, short term we need to clear a minor resistance at 110.79, before a more firm test of strong resistance in the 111.30 - 111.45 area will be seen. As long as 110.79 protects the upside, we must accept the possibility of a more complex correction down to 109.56. As always it should be worth to remember, that we are in wave iii of 3 and corrections tend to small and even sub-normal.

EUR/NZD

Resistance at 1.5600 has put up quite a fight, but it should only be a matter of time before it is cleared and the next powerful rally higher towards 1.5650 and 1.5709 is seen, with the next major target being 1.5927. However, as long as resistance at 1.5600 has not been cleared we could see more consolidation just below, but I would be surprised to see any price-action below 1.5534 now. So stay tuned for a break above 1.5600, which indicates that the test of 1.5445 marked an important bottom. However it will still take a break below 1.5390 to invalidate my bullish count.

Sunday, December 16, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR-JPY

Trading in the Far East began with a gap. Gaps are rare in the Currency Market and have a tendency to be closed almost at once, that could mean a small set-back towards 109.92 before the next attempt to break above strong resistance in the 111.30 - 111.43 area. Once resistance at 111.43 is cleared the next major target is 113.68. However, even 113.68 should not be too big of an obstacle as we expect the ongoing wave iii of 3 to extend and take us even higher to 117.44. That said as long as major resistance at 111.43 holds firm we should expect a correction towards 109.92 before the next rally can be expected. Only a break below 109.03 will call for a more serious correction taking place.

EUR/NZD

Trading in the Far East began with a gap. Gaps are rare in the Currency Market and have a tendency to be closed almost at once, that could mean a small set-back towards 109.92 before the next attempt to break above strong resistance in the 111.30 - 111.43 area. Once resistance at 111.43 is cleared the next major target is 113.68. However, even 113.68 should not be too big of an obstacle as we expect the ongoing wave iii of 3 to extend and take us even higher to 117.44. That said as long as major resistance at 111.43 holds firm we should expect a correction towards 109.92 before the next rally can be expected. Only a break below 109.03 will call for a more serious correction taking place.

EUR/NZD

As we have broken above the first resistance at 1.5528, we have also gotten the first clue, that an important bottom is in place. However, we would like to see a break above resistance at 1.5600 soon to gain even more confidence, that an important bottom is in place for the next powerful rally towards 1.5927. Because of the speed of the decline in wave ii we will not have to many good resistance points on the way up again, but we will find resistance at 1.5675 and again at 1.5780. Support is now found at 1.5530, which ideally will hold any set-backs, but it will still take a break below 1.5390 to invalidate our bullish count.

Elliott wave analysis for DJI - Long term view - Update

Dow Jones Industrial Index

First take a look at my long term count here: http://theelliottwavesufer.blogspot.dk/2012/03/dow-jones-industrial-index-interesting.html

I haven't changed my long term view and is still looking for a new all time high sometime during 2013 (wave D) followed by a massive decline into 2016 (wave E).

Looking at the weekly chart I would expect the first half of 2013 to be a hard period for the bulls, with a decline towards 9.611. While the second half should prove to be a nice ride to a new all time high probably near the 16.450 level. Before everybody is taken by surprise with the a new massive decline. The is two option for wave E. It could make a new low below the March 2009 low, but it could as well stay above the March 2009 low and end close to the wave X low near 9.600, from where the next big rally higher cloud set in.

Cloud I be wrong? Yes of cause! We could stages a direct rally towards a new all time high, but I'm equally sure it will not last for too long and within the 2-3 years we have experienced a new massive decline once again. No rally of cycle degree has ever happend when the VIX was in the complacency area where it has been for quite some time now.

Elliott wave analysis of EUR/USD and GBP/USD

EUR/USD

We have finally seen a break out of the bearish channel confirming that we are in wave c of E of the long term running triangle, that has been building since late 2008. The break above the channel resistance-line means a rally higher towards at least 1.3491 and more likely closer to the 1.3778 - 1.3833 area before wave E terminates, but time will show. However, for now we should concentrate our focus towards the upside for move to 1.3347 as the next target on the way to 1.3491.

Short term we should not see a break below 1.3110 as that would delay the upside.

GBP/USD

I'm still looking for a break above the B-triangle resistance-line at 1.6460 to be the first good indication, that a much higher rally is to be seen. Short term I will look for a break above 1.6175 and more importantly a break above 1.6310 as confirmation, that a serious test of 1.6460 is next. A break above 1.6470 should cause a massive rally higher towards at least 1.8898.

I have seen many call the downside as the think this is a wave 4 triangle and I have to admit it could be, but if my long term count is correct, and I think it is, then the odds for a break towards the upside is greater, than a break towards the downside, but again time will show how's right.

We have finally seen a break out of the bearish channel confirming that we are in wave c of E of the long term running triangle, that has been building since late 2008. The break above the channel resistance-line means a rally higher towards at least 1.3491 and more likely closer to the 1.3778 - 1.3833 area before wave E terminates, but time will show. However, for now we should concentrate our focus towards the upside for move to 1.3347 as the next target on the way to 1.3491.

Short term we should not see a break below 1.3110 as that would delay the upside.

GBP/USD

I'm still looking for a break above the B-triangle resistance-line at 1.6460 to be the first good indication, that a much higher rally is to be seen. Short term I will look for a break above 1.6175 and more importantly a break above 1.6310 as confirmation, that a serious test of 1.6460 is next. A break above 1.6470 should cause a massive rally higher towards at least 1.8898.

I have seen many call the downside as the think this is a wave 4 triangle and I have to admit it could be, but if my long term count is correct, and I think it is, then the odds for a break towards the upside is greater, than a break towards the downside, but again time will show how's right.

Thursday, December 13, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With a low at 108.63 yesterday (I had support at 108.60), we saw only a very small correction from the 109.54 high, before the next rally higher towards strong resistance near 111.43 began. That said, we have to consider the the possibility, that the ongoing price-action since the 109.54 high is part of a expanded flat correction. If this is the case we should not break above 109.85, but instead see a break below 109.03, which will confirm that an expanded flat correction is unfolding for a decline down to 108.34, from where the next powerful rally should unfold. However, a direct break above 109.85 will indicate, that the correction we saw down to 108.63 yesterday, was all the correction we are going to get this time and that a test of strong resistance near 111.43 is next. Longer term I'm are still looking for much higher levels.

EUR/NZD

The price-action here has been very compressed the week, which indicates, that once we break out of this consolidation we should see a very powerful move. I still prefer a break above resistance at 1.5528 for a quick run to important resistance at 1.5600 and higher. However, The risk is a break below 1.5390, which will change our view to a more bearish one and call for a much deeper decline towards at least 1.5244. As earlier said we do prefer an upside break above 1.5528 for a move higher towards 1.5927 as the first major target, but longer term we should see much higher levels, if our preferred count is correct.

With a low at 108.63 yesterday (I had support at 108.60), we saw only a very small correction from the 109.54 high, before the next rally higher towards strong resistance near 111.43 began. That said, we have to consider the the possibility, that the ongoing price-action since the 109.54 high is part of a expanded flat correction. If this is the case we should not break above 109.85, but instead see a break below 109.03, which will confirm that an expanded flat correction is unfolding for a decline down to 108.34, from where the next powerful rally should unfold. However, a direct break above 109.85 will indicate, that the correction we saw down to 108.63 yesterday, was all the correction we are going to get this time and that a test of strong resistance near 111.43 is next. Longer term I'm are still looking for much higher levels.

EUR/NZD

The price-action here has been very compressed the week, which indicates, that once we break out of this consolidation we should see a very powerful move. I still prefer a break above resistance at 1.5528 for a quick run to important resistance at 1.5600 and higher. However, The risk is a break below 1.5390, which will change our view to a more bearish one and call for a much deeper decline towards at least 1.5244. As earlier said we do prefer an upside break above 1.5528 for a move higher towards 1.5927 as the first major target, but longer term we should see much higher levels, if our preferred count is correct.

Wednesday, December 12, 2012

Elliott wave analysis of USD/JPY - Important break above 83.00

USD/JPY

First see my post on the bullish contra the bearish scenario from December 7 here: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-on-eurusd-and.html

I think the most important development in the Currency Market yesterday was the break above 83.00. With that break we have gotten the first serious clue, that the bullish scenario I described on December 7 is the right scenario, but we still need a break above 84.17 to get the real confirmation. If we do break above 84.17 as I expect we should be looking for much higher levels in the coming weeks and months. If red wave iii of iii has indeed begun we should expect this wave to be extended and the target for red wave iii could be at 101.73.

Short term 83.00 will now act as support, with a more important support at 81.69.

First see my post on the bullish contra the bearish scenario from December 7 here: http://theelliottwavesufer.blogspot.dk/2012/12/elliott-wave-analysis-on-eurusd-and.html

I think the most important development in the Currency Market yesterday was the break above 83.00. With that break we have gotten the first serious clue, that the bullish scenario I described on December 7 is the right scenario, but we still need a break above 84.17 to get the real confirmation. If we do break above 84.17 as I expect we should be looking for much higher levels in the coming weeks and months. If red wave iii of iii has indeed begun we should expect this wave to be extended and the target for red wave iii could be at 101.73.

Short term 83.00 will now act as support, with a more important support at 81.69.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

There was no time for even a minor correction yesterday and if there was any doubt left, that wave iii of 3 is developing, There is absolutely no doubt any more. The major rally we saw yesterday is exactly the price-behavior we expect from wave iii of 3. It is tempting to cash in some nice profit, after yesterdays run, but that will likely just mean, that we misses the next rally higher towards the 110.84 to 111.43 area. Even though resistance at 111.43 seems to be a major resistance, the risk is, that this resistance will be broken without any trouble for a continuation higher towards 113.53. Short term we now have support at 109.45 and again at 108.60.

EUR/NZD

Resistance at 1.5528 keeps protecting the upside, but I do think it is only a matter of time before this resistance level will be broken and a major bullish potential is released. Once we break above 1.5528 we should quickly see resistance at 1.5600 broken too for a continuation higher, towards the next strong resistance near 1.5904. That said, we must be aware of the downside risk as long as resistance at 1.5528 has not been broken. We do not prefer the option of a quick spike below 1.5457, but of cause can not rule out the possibility. However, one this is for sure. a break below 1.5390 can not be allowed at any point, as that would call for a more bearish scenario.

There was no time for even a minor correction yesterday and if there was any doubt left, that wave iii of 3 is developing, There is absolutely no doubt any more. The major rally we saw yesterday is exactly the price-behavior we expect from wave iii of 3. It is tempting to cash in some nice profit, after yesterdays run, but that will likely just mean, that we misses the next rally higher towards the 110.84 to 111.43 area. Even though resistance at 111.43 seems to be a major resistance, the risk is, that this resistance will be broken without any trouble for a continuation higher towards 113.53. Short term we now have support at 109.45 and again at 108.60.

EUR/NZD

Resistance at 1.5528 keeps protecting the upside, but I do think it is only a matter of time before this resistance level will be broken and a major bullish potential is released. Once we break above 1.5528 we should quickly see resistance at 1.5600 broken too for a continuation higher, towards the next strong resistance near 1.5904. That said, we must be aware of the downside risk as long as resistance at 1.5528 has not been broken. We do not prefer the option of a quick spike below 1.5457, but of cause can not rule out the possibility. However, one this is for sure. a break below 1.5390 can not be allowed at any point, as that would call for a more bearish scenario.

Tuesday, December 11, 2012

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The rally from the 105.97 is clearly impulsive in its character, which is the first indication, that wave iii of 3 is developing. At the same time we are breaking through resistances as was they made of hot butter, which is the next good indication, that this rally is impulsive. That said, we are getting close to the 107.96 top and should expect some kind of correction before the this resistance is broken for the a move higher towards 110.84 as the next major target. Short term we expect resistance in the 107.52 - 107.67 area will protect the upside for a correction down to 106.92 and maybe even 106.56 before the next powerful rally sets in.

EUR/NZD

We still need a rally above 1.5543 and more importantly 1.5602 before I feel confident that an important bottom is in place. That said, the small rally from the 1.5457 low does display impulsive characters, which is a good sign, but more evidence is needed to feel sure, that 1.5457 was an important low. A break above 1.5602 will do the trick and indicate that wave iii of 3 has begun for a new powerful rally higher. The first major target for this wave iii is at 1.5927. However, as long as minor resistance at 1.5602 stays intact the risk is still towards the downside, but at no point can a break below 1.5390 be allowed, as the will force me to shift towards a more bearish count.

The rally from the 105.97 is clearly impulsive in its character, which is the first indication, that wave iii of 3 is developing. At the same time we are breaking through resistances as was they made of hot butter, which is the next good indication, that this rally is impulsive. That said, we are getting close to the 107.96 top and should expect some kind of correction before the this resistance is broken for the a move higher towards 110.84 as the next major target. Short term we expect resistance in the 107.52 - 107.67 area will protect the upside for a correction down to 106.92 and maybe even 106.56 before the next powerful rally sets in.

EUR/NZD

We still need a rally above 1.5543 and more importantly 1.5602 before I feel confident that an important bottom is in place. That said, the small rally from the 1.5457 low does display impulsive characters, which is a good sign, but more evidence is needed to feel sure, that 1.5457 was an important low. A break above 1.5602 will do the trick and indicate that wave iii of 3 has begun for a new powerful rally higher. The first major target for this wave iii is at 1.5927. However, as long as minor resistance at 1.5602 stays intact the risk is still towards the downside, but at no point can a break below 1.5390 be allowed, as the will force me to shift towards a more bearish count.

Monday, December 10, 2012

Elliott wave analysis of EUR/USD and Gold

EUR/USD

Did blue wave 4 end with the test of 1.2877? I think there is a very good chance that this is the case. It's not uncommon that wave 4 will correct towards wave iv of one lessor degree, which in this case meant a correction to 1.2880. The minor rally since the 1.2877 low does look impulsive and I would be looking for a break above 1.3075 as the next clue, that we are moving higher towards 1.3290 and possibly even towards 1.3491.

Gold

I think there is a very good chance, that we are ready to take on important resistance in the 1,795 - 1,803 area again. The first clues will be a break above 1,734 and more importantly a break above 1,754, which will confirm a test of important resistance at the 1,795 - 1,803 area. That said we need a break above here to really release the impulsive power for the next move higher towards 2,158.84 and possibly even 2,550.59 and 3,184.70.

Did blue wave 4 end with the test of 1.2877? I think there is a very good chance that this is the case. It's not uncommon that wave 4 will correct towards wave iv of one lessor degree, which in this case meant a correction to 1.2880. The minor rally since the 1.2877 low does look impulsive and I would be looking for a break above 1.3075 as the next clue, that we are moving higher towards 1.3290 and possibly even towards 1.3491.

Gold

I think there is a very good chance, that we are ready to take on important resistance in the 1,795 - 1,803 area again. The first clues will be a break above 1,734 and more importantly a break above 1,754, which will confirm a test of important resistance at the 1,795 - 1,803 area. That said we need a break above here to really release the impulsive power for the next move higher towards 2,158.84 and possibly even 2,550.59 and 3,184.70.

Elliott Wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We saw a new low at 105.98 yesterday followed by a rally to resistance near 106.67 (The high was at 106.73). This rally could well be the start of wave iii of 3 higher. If this is the case we should see a minor correction towards the 106.26 - 106-35 area from where the next rally higher should break above 106.73 without much trouble, for a continuation higher towards 107.98 and much higher longer term. The risk is of cause a break below 105.98 that will tell us, that a deeper correction towards 105.28 is need before wave iii of 3 is ready to take off. Event though correction in wave 3 tend to be small and even sub-normal, they can develop into something more complex only time will show.

EUR/NZD

We have seen a small rally since the 1.5463 low to 1.5526, but we need a break above minor resistance at 1.5543 and more importantly 1.5602 before we feel more confident, that wave ii is over and a new powerful rally is developing. As long as resistance at 1.5543 protects the upside we must allow for a deeper correction closer to the invalidation point at 1.5390, but at no point can we go below, as that would tilt the picture towards a more bearish count. That said, I don't expect the all important support at 1.5390 to yield at any time and is more focused on a break above 1.5543 and 1.5602 for a rally higher towards 1.5927 as the first major resistance.

We saw a new low at 105.98 yesterday followed by a rally to resistance near 106.67 (The high was at 106.73). This rally could well be the start of wave iii of 3 higher. If this is the case we should see a minor correction towards the 106.26 - 106-35 area from where the next rally higher should break above 106.73 without much trouble, for a continuation higher towards 107.98 and much higher longer term. The risk is of cause a break below 105.98 that will tell us, that a deeper correction towards 105.28 is need before wave iii of 3 is ready to take off. Event though correction in wave 3 tend to be small and even sub-normal, they can develop into something more complex only time will show.

EUR/NZD

We have seen a small rally since the 1.5463 low to 1.5526, but we need a break above minor resistance at 1.5543 and more importantly 1.5602 before we feel more confident, that wave ii is over and a new powerful rally is developing. As long as resistance at 1.5543 protects the upside we must allow for a deeper correction closer to the invalidation point at 1.5390, but at no point can we go below, as that would tilt the picture towards a more bearish count. That said, I don't expect the all important support at 1.5390 to yield at any time and is more focused on a break above 1.5543 and 1.5602 for a rally higher towards 1.5927 as the first major resistance.

Sunday, December 9, 2012

Elliott Wave Analysis on EUR/JPY and EUR/NZD

EUR/JPY

As we have seen a 23.6% retracement of wave i of 3 we could have seen the end of wave ii. However, it would take a break above 107.08 to ease the downside pressure and more importantly we need a break above 107.67 to confirm the bottom and at the same time indicate that wave iii of 3 is developing. That said, we shall remember that we are in wave 3 and correction during wave 3 tend to be small and even sub-normal. As long as we have not broken above 106.67 we must accept, that we could see a deeper correction of wave i down to the 38.2% retracement target at 105.04 before wave ii is finally over.

EUR/NZD

I'm still looking for wave ii to end soon as the room towards the downside is becoming very limited. Therefore I'm looking for a reversal above minor resistance at 1.5543 as the first minor clue, that a bottom is in place. However I would like to see a break above 1.5602 before I feel more confident that wave ii is indeed over and wave iii of 3 is developing towards 1.5927 and higher. The good thing is, that we know exactly where our invalidation point is. A break below 1.5390 will invalidate our count and call for a much deeper decline towards the bottom at 149.67 and maybe even lower.

As we have seen a 23.6% retracement of wave i of 3 we could have seen the end of wave ii. However, it would take a break above 107.08 to ease the downside pressure and more importantly we need a break above 107.67 to confirm the bottom and at the same time indicate that wave iii of 3 is developing. That said, we shall remember that we are in wave 3 and correction during wave 3 tend to be small and even sub-normal. As long as we have not broken above 106.67 we must accept, that we could see a deeper correction of wave i down to the 38.2% retracement target at 105.04 before wave ii is finally over.

I'm still looking for wave ii to end soon as the room towards the downside is becoming very limited. Therefore I'm looking for a reversal above minor resistance at 1.5543 as the first minor clue, that a bottom is in place. However I would like to see a break above 1.5602 before I feel more confident that wave ii is indeed over and wave iii of 3 is developing towards 1.5927 and higher. The good thing is, that we know exactly where our invalidation point is. A break below 1.5390 will invalidate our count and call for a much deeper decline towards the bottom at 149.67 and maybe even lower.

Subscribe to:

Comments (Atom)