EUR/USD

Continues to rally higher as expected. We have now tested the minimum target near 1.3485, but I do expect a continuation higher towards 1.3792, where wave C will be equal in length to wave A. That said, we must accept a move even higher closer to 1.4200 before wave E of the large triangle terminates.

EUR/JPY

The strong rally above 121.28 and more importantly 121.75 does call for a continuation higher towards 1.2452, where wave v of 3 will be 0.382 times the length of the rally from the bottom of wave i of 3 to the top of wave iii of 3.

That said, we should remember that we will encounter strong resistance at 123.27, which was the top back in April 2011.

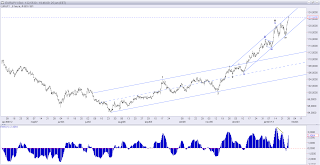

Dow Jones Industrial Index.

Continues to move higher, but we will see a break above important resistance at 14,093? Taken into consideration, that we are extremely overbought, that the VIX is at a 17 month low and the leverage is at an all time high. I doubt that we will see a break, but if we do, then the ending diagonal is not a valid count and we must accept a new all time high. However, I find it more likely that a deep correction is looming and could be initiated at any time now. A break below 13.778 will be the first indication, that a top is in place, while a break below 13.365 is needed to confirm the top.

Gold

The failure to break above resistance at 1,695 is disappointing in regards to the bullish count. The failure raises the risk of a deeper decline towards strong support at 1,527 before the next rally can be expected. Only a direct break above minor resistance at 1.695 eases the downside pressure and indicates a rally higher towards strong resistance at 1,796

Crude Oil

Is still headed towards strong resistance near 105.00. It's still undecided whether we have seen a finished triangle or the rally towards 105 only finishes wave D and one more decline in wave E later on, but for now we should stay focused towards the upside and a test of resistance near 105.00.

No comments:

Post a Comment