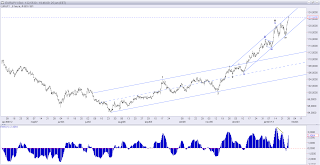

I still expect important short term support at 125.73 will protect the downside for a break above minor resistance at 126.83, which will confirm a new rally higher towards 127.70 and higher towards the next strong resistance target at 128.98. However, we are fast closing in on the possible top for wave 3 and should be careful about our expectation for this ongoing uptrend. Short term a break below 125.73 will be the first indication, that wave 3 has topped, but it will take a break below 124.01 to confirm the top and that wave 4 has taken over.

EUR/NZDImportant support at 1.5752 protected the downside well and we are currently testing the minor resistance-line from 1.6359. A break above this resistance-line will confirm the next rally higher towards 1.6278 and 1.6359 on the way towards the ideal target at 1.6524, where blue wave iii will be 1.618 times longer than blue wave i. Short term we will find support at 1.6043 and important support at 1.5990. Any break below 1.5990 will indicate a much deeper decline and that my count is wrong.