Facebook

I have been waiting patiently to get a clue, that the bottom of wave 4 was in place and that clue came yesterday. With a low at 26.34 it have bottomed just 2,85% above my ideal target at 25.61 and we should now be looking for a break above 28.94 to confirm, that wave 5 is under way towards 33.71 and likely even higher towards 35.44

Thursday, February 28, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The odds still favor, that the X-wave did terminate with the test of 121.83 yesterday, but we still need a break below 120.40 to confirm, that the third and last zig-zag combination is unfolding. For the short term I'm looking for resistance at 121.48 to protect the upside for a break below 120.81 and of cause more importantly a break below 120.40, which confirms, that the last decline since the 127.70 high is unfolding for a move down to my ideal target at 117.28, where wave 4 will have corrected 38.2% of wave 3. That said, any break above 121.48 will delay the downside pressure for one last push higher to 122.74 before the next decline sets in.

I'm looking for a very powerful decline unfolding any time soon now. A break below 1.5776 will likely be the catalysts for for this decline, until we break below 1.5776 will must accept a more or less directionless trading between 1.5776 and 1.5847, but once support at 1.5776 gives away we should be looking for a decline to at least 1.5638 and will not be surprised to see this level break without a fight for a continuation lower towards 1.5509. That said, we must be aware of the possibility for a move above 1.5847, but it will likely only be to 1.5867 before the downside pressure takes over again.

Wednesday, February 27, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

With a top at 1.5933 my call for a rally towards 1.5930 was almost perfect. We are now looking for minor resistance at 1.5879 to protect the upside for the next powerful decline. It should be remembered, that expanded flat corrections is a forewarning of the next move being very powerful and extended, this is exactly what we are expecting here. The only possible way for wave c of red wave d to reach close to 1.5200 it will be if it extends. As minor resistance at 1.5879 protects the upside we are looking for a break below 1.5788 and more importantly a break below 1.5708, which confirms the decline to 1.5592 on the way down to 1.5363 and 1.5234.

With the break above 121.36 we knew, that the triangle was a B-wave triangle and that we needed one more rally higher in wave c of X. As can be seen on the chart, a triple zig-zag combination is developing and it should be a matter of time before we break back below 118.78. The reason I'm are so sure this will be the outcome is the B-wave triangle. Triangles can never be second waves and therefore the rally from 118.78 must be a corrective X-wave. That leaves us with the big question, how high will this X-wave go. Looking at the short structure, there is a very high possibility, that it finished already at 121.83, but we need a break below 120.95 and more importantly below 120.40 to confirm that. A break below 120.40 will call for a new decline down to 118.78 on the way to the ideal target at 117.28, where wave 4 will have corrected 38.2% of wave 3. However, as long as we have not seen a break below 120.95 and more importantly below 120.40 we must accept the possibility, that this X-wave could move higher towards 122.74 before the next move down.

EUR/NZD

With a top at 1.5933 my call for a rally towards 1.5930 was almost perfect. We are now looking for minor resistance at 1.5879 to protect the upside for the next powerful decline. It should be remembered, that expanded flat corrections is a forewarning of the next move being very powerful and extended, this is exactly what we are expecting here. The only possible way for wave c of red wave d to reach close to 1.5200 it will be if it extends. As minor resistance at 1.5879 protects the upside we are looking for a break below 1.5788 and more importantly a break below 1.5708, which confirms the decline to 1.5592 on the way down to 1.5363 and 1.5234.

Tuesday, February 26, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We are currently locked within a triangle consolidation, which should ultimately break towards the downside for a test of our ideal corrective target at 117.28, where wave 4 will have corrected 38.2% of wave 3. Short term a break below 118.97 confirms, that the triangle consolidation is over and the final decline lower towards 117.28 is ongoing. However as long as minor support at 120.00 and more importantly support at 118.97 protects the downside we could see a move higher towards 120.77, but at no time should we see a break above 121.36 as that would indicate, the this is a b-wave triangle and call for a move higher to 122.74 before the final down move to 117.28 is seen.

EUR/NZD

The move above 1.5851 was a major surprise, but it does not change my call for a new powerful decline towards at least 1.5363 and more likely even lower towards 1.5234 once this ongoing expanded flat wave b correction is over. Short term I'm looking for one last minor rally towards 1.5930 before the final c-wave down takes over. That said, we should be aware, that a direct break below 1.5788 and more importantly a break below 1.5769 indicates, that wave c down is already developing.

We are currently locked within a triangle consolidation, which should ultimately break towards the downside for a test of our ideal corrective target at 117.28, where wave 4 will have corrected 38.2% of wave 3. Short term a break below 118.97 confirms, that the triangle consolidation is over and the final decline lower towards 117.28 is ongoing. However as long as minor support at 120.00 and more importantly support at 118.97 protects the downside we could see a move higher towards 120.77, but at no time should we see a break above 121.36 as that would indicate, the this is a b-wave triangle and call for a move higher to 122.74 before the final down move to 117.28 is seen.

EUR/NZD

The move above 1.5851 was a major surprise, but it does not change my call for a new powerful decline towards at least 1.5363 and more likely even lower towards 1.5234 once this ongoing expanded flat wave b correction is over. Short term I'm looking for one last minor rally towards 1.5930 before the final c-wave down takes over. That said, we should be aware, that a direct break below 1.5788 and more importantly a break below 1.5769 indicates, that wave c down is already developing.

Elliott wave analysis on Silver - Long term count

Silver

Dojitrader asked for my long term view on silver. Which I have presented above. Looking at the monthly chart first it looks like we have seen wave 4 end with the test of 26.12 and have begun the final rally higher in wave 5. That said, we are clearly in the very early stages of wave 5 and is likely near or at a low risk buying opportunity (stop below 26.12). However, to confirm that wave 5 is indeed developing we need a break above 30.75 and more importantly a break above 32.47. A break above the later will confirm the next rally higher towards 49.79 with a ideal target for wave 5 near 54.00.

Looking at the daily chart the rally from 26.12 to 35.39 it clearly has impulsive characters, which is what we would expect if wave 5 is developing and the decline from 35.39 down to 28.28 is clearly corrective also what we would expect. So to sum it all up I do expect support at 26.12 to protect the downside for a break above 30.75 indicating that wave 5 towards a new high above 49.79 is developing. A break below 26.12 will invalidate my count and call for a deeper decline towards 24.22 before the next strong support is met.

Monday, February 25, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

After a little detour to 125.22 first, we where ready for the powerful decline in wave c of the second zig-zag. As we have taken out support at 121.26, which marked the 23.6% corrective target of wave 3, we should now be looking for a continuation down to 117.28, where wave 4 will have corrected 38.2% of wave 3. The big question now should be, whether we do need another x-wave first and then the last zig-zag down to reach our target? As long as minor resistance at 120.87 and more importantly 121.40 protects the upside we does not need another x-wave to fulfill our target at 117.28. However, if we break resistance at 121.40 we already are building this x-wave and should see a move closer to 122.42 and maybe even up to 124.05 if it becomes extreme, before the last zig-zag combination down to our target at 117.28.

After a little detour to 125.22 first, we where ready for the powerful decline in wave c of the second zig-zag. As we have taken out support at 121.26, which marked the 23.6% corrective target of wave 3, we should now be looking for a continuation down to 117.28, where wave 4 will have corrected 38.2% of wave 3. The big question now should be, whether we do need another x-wave first and then the last zig-zag down to reach our target? As long as minor resistance at 120.87 and more importantly 121.40 protects the upside we does not need another x-wave to fulfill our target at 117.28. However, if we break resistance at 121.40 we already are building this x-wave and should see a move closer to 122.42 and maybe even up to 124.05 if it becomes extreme, before the last zig-zag combination down to our target at 117.28.

EUR/NZD

My call for a minor correction to 1.5849 before the next powerful decline worked perfectly. We saw a move to 1.5851 (just two very small pips above the ideal target) before the floor was draged away for a powerful decline. Short term I'm looking for minor support at 1.5637 to protect the downside for a move closer to 1.5752 before the next powerful decline sets in, for a move lower towards 1.5300. Short term a break above 1.5671 will confirm the minor rally to 1.5752. That said we must accept the possibility of a direct break below 1.5592 leaving us with only a sub-normal correction, before the next decline towards 1.5300.

Elliott wave analysis of GBP/JPY

GBP/JPY

I had a request for GBP/JPY and my opinion. As can be seen on the chart above, my count shows, that we currently is in a wave 4 correction, which ideally will find support near the bottom of wave iv of one lessor degree. The bottom of red wave iv comes in at 139.18 however, a slightly deeper correction towards 137.60 should not be ruled out. Once the ongoing wave 4 is over we should see wave 5 take us higher towards at least 150.19 and likely even higher towards 153.61 and maybe even 157.07 before wave 5 is in place.

I had a request for GBP/JPY and my opinion. As can be seen on the chart above, my count shows, that we currently is in a wave 4 correction, which ideally will find support near the bottom of wave iv of one lessor degree. The bottom of red wave iv comes in at 139.18 however, a slightly deeper correction towards 137.60 should not be ruled out. Once the ongoing wave 4 is over we should see wave 5 take us higher towards at least 150.19 and likely even higher towards 153.61 and maybe even 157.07 before wave 5 is in place.

Sunday, February 24, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

There should be no doubt in anybodies mind, that the decline from the 127.70 high is corrective. The structure is overlapping , it is slow and it is confined within the boarders of the channel. That said we are still missing wave c down in the second zig-zag correction, therefore I'm looking for one last decline down to at least 121.26, where wave 4 will have corrected 23.6% of wave 3. However, a more normal corrective target would be at 117.28, where wave 4 will have corrected 38.2% of wave 3. For the short term I'm expecting minor support near 123.62 for a minor rally towards 124.57 and maybe even towards 124.82 before the next powerful decline to below 123.07 and more importantly below 122.55 confirming the decline towards 121,26.

EUR/NZD

My call for a decline to 1.5682 worked out perfectly, as we saw a decline to 1.5686 followed by the expected rally. I'm still look for a test of strong resistance near 1.5849 before wave c down is ready to take over. That said, a break below 1.5746 will be the first warning, that wave c down to 1.5467 and more likely 1.5176 is under way. A break below support at 1.5701 will confirm that wave c has taken over for the next powerful decline in this expanded ending diagonal.

There should be no doubt in anybodies mind, that the decline from the 127.70 high is corrective. The structure is overlapping , it is slow and it is confined within the boarders of the channel. That said we are still missing wave c down in the second zig-zag correction, therefore I'm looking for one last decline down to at least 121.26, where wave 4 will have corrected 23.6% of wave 3. However, a more normal corrective target would be at 117.28, where wave 4 will have corrected 38.2% of wave 3. For the short term I'm expecting minor support near 123.62 for a minor rally towards 124.57 and maybe even towards 124.82 before the next powerful decline to below 123.07 and more importantly below 122.55 confirming the decline towards 121,26.

EUR/NZD

My call for a decline to 1.5682 worked out perfectly, as we saw a decline to 1.5686 followed by the expected rally. I'm still look for a test of strong resistance near 1.5849 before wave c down is ready to take over. That said, a break below 1.5746 will be the first warning, that wave c down to 1.5467 and more likely 1.5176 is under way. A break below support at 1.5701 will confirm that wave c has taken over for the next powerful decline in this expanded ending diagonal.

Copper is breaking down

Copper

Has broken below a long term support-line and is sending us a signal, that everything might not be as rosy as it seems. The first target is the strong support-line near 3.25, which has protected the downside since late 2011, but if this line gives away too, then a well defined Shoulder/Head/Shoulder top will be activated for a decline towards 2.00, but for now lets concentrate on the coming test of support near 3.25 and see what happens...

Thursday, February 21, 2013

Facebook is close to a bottom

Facebook

Is close to ending wave 4 and we should soon see the final wave 5 rally higher. I still think we will see wave 4 down to 25.60, but be awave, that we are at strong support and we now have a five wave decline since the high at 31.99. If at any time we see a break above 28.94 wave v of c of 4 is in place and wave 5 is under way.

Is close to ending wave 4 and we should soon see the final wave 5 rally higher. I still think we will see wave 4 down to 25.60, but be awave, that we are at strong support and we now have a five wave decline since the high at 31.99. If at any time we see a break above 28.94 wave v of c of 4 is in place and wave 5 is under way.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

With the break below 1.5838 we knew, that the extreme time-extended correction since September 2012 was not over yet and more downside could be expected. But what is this monster? The best way to describe it is, that an expanded triangle is developing and if this is the case we need one more new low below 1.5390 to finish wave e of the triangle. The ideal target for this e-wave is likely near 1.5176, but it could extend all the way down to 1.5032. Not only are we looking at a major expanding triangle developing. since the 1.6359 we have likely been developing an expanding ending diagonal, which also calls for one last decline towards 1.5176. Short term I will be looking for one more decline towards 1.5682 to end wave a of red e followed by a correction in wave b of red e higher towards 1.5849 and then the final extended decline in wave c of red wave e down to 1.5176.

We have seen the expected pressure building towards the downside and is close to my first target at 121.26, which marks the 23.6% corrective target of wave 3. However, looking at the short term structure since the 125.90 we are currently working on wave iv and should soon see the final fifth wave down towards 121.71 as the first target for wave v and 121.26 as the next. As we now have a cluster calling for a decline to 121.26 I will expect to see this support tested soon, once tested we should then look for a correction higher towards 123.42 before the final move lower towards the ideal target at 117.28.

EUR/NZD

With the break below 1.5838 we knew, that the extreme time-extended correction since September 2012 was not over yet and more downside could be expected. But what is this monster? The best way to describe it is, that an expanded triangle is developing and if this is the case we need one more new low below 1.5390 to finish wave e of the triangle. The ideal target for this e-wave is likely near 1.5176, but it could extend all the way down to 1.5032. Not only are we looking at a major expanding triangle developing. since the 1.6359 we have likely been developing an expanding ending diagonal, which also calls for one last decline towards 1.5176. Short term I will be looking for one more decline towards 1.5682 to end wave a of red e followed by a correction in wave b of red e higher towards 1.5849 and then the final extended decline in wave c of red wave e down to 1.5176.

Wednesday, February 20, 2013

Elliott wave analysis on EUR/USD; GBP/USD; DJI; Gold and Crude Oil

EUR/USD

As we have seen a break below the channel support-line odds favors, that we have seen the top at wave E at 1.3711 and that a thrust out of the triangle is developing. The first real confirmation, that wave E is indeed in place will come by a break below support at 1.2998. The decline from 1.3711 should be impulsive in character. I will look for a decline down to 1.2930 followed by a correction towards 1.3183 from where the next powerful decline should take place.

Long term we should be looking for a decline towards the triangle support-line near 1.2100 and lower towards 1.0900 if the triangle count holds true.

GBP/USD

Here we have seen a powerful decline below important support at 1.5234, which has confirmed the trust out of the triangle to the downside. As can be seen on the 8 hour chart the decline from 1.6381 is clearly impulsive and wave v of 1 waves an extended wave, as it became equal in length to the distance traveled from the top of wave i to the bottom of wave iii. Extended fifth waves normally calls for a sharp correction once finished and it seems at we have seen the bottom of wave v and 1 at 1.5169 today. I would be looking for wave 2 towards 1.5609 and maybe even 1.5688. At 1.5609 wave 2 will have corrected 38.2% of wave 1 and it's also in wave (ii) of v, which is a common target for the correction following an extended fifth wave.

Longer term we should be looking for a continuation down to the long term support-line near 1.4100.

Dow Jones Industrial Index

Could have finally peaked at 14,058, just below the invalidation point for the ending diagonal at 14,098 (please see my post from February 5 here: http://theelliottwavesufer.blogspot.dk/2013/02/blog-post.html) However, we need some more confirmation, that a top really is in place and that confirmation will be given if we break below 13,365 and more importantly on a break below 12,883.

That doesn't mean you shouldn't be prudent and turn more risk adverse here. What I'm saying is, that we need more confirmation, that a important long term top is in place for a much deeper decline.

Gold

Took another hit today and we are now closing in on very strong support at 1,526 if this support is broken clearly we could see a continuation down towards 1,300, but we should observe the strong support at 1.526 carefully first as this might well act as a springboard for the next rally higher.

Crude Oil

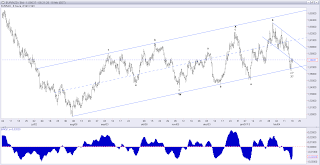

What is there to say... As you can see on the chart above. The price action since the low near 84.00 lacks impulsiveness and I'm afraid we are going to see an even more narrow price-behavior for the coming months. To get things started we need a break out of the triangle. As long as we stay inside the triangle we must accept an erratic price-action with no real direction.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

With the break below short term important support at 124.54 we should now see downside pressure building for a new test of 122.89 on the way down to the first target at 121.26, which marks the 23.6% corrective target for wave 3. However, I think that a continuation down to the more normal correction target at 117.28, which marks the 38.2% correction target of wave 3. would be more likely. Short term I expect that the former support at 124.54, which now has turned into resistance will protect the upside for the next decline towards 122.89. It is also worth noticing, that we have broken below the channel, which has described the entire rally since 105.97.

EUR/NZD

Has a new uptrend begun or are we still locked in the complex correction from 1.6359? Both possibilities are still open. Yes we did break above 1.5978, but only slightly and not enough to confirm that this move up from 1.5640 is a new uptrend. That said, I'm more in favor of a new uptrend than not and if this is the case, we should see support at 1.5838 protect the downside for the next rally higher through 1.5927 and more importantly 1.5947, which will confirm a new test of 1.6024 on the way towards 1.6134 and higher. However, a break below 1.5838 will favor the scenario, where we still are locked in the complex correction since the 1.6359 high and call for a new decline towards 1.5640 and maybe even lower.

Tuesday, February 19, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

After only a shallow wave ii we broke clearly above resistance at 1.5848, which confirmed the next rally higher. Short term I will look for a minor set-back to 1.5928 and maybe 1.5898 before the next rally higher through 1.5978 for a rally towards 1.6060 and 1.6112 as the next minor targets. That said, we must still be aware, that this rally could be part of the complex correction, that began at 1.6359 and if this is the case we most likely will only see a move slightly above 1.5978 before a decline breaks below 1.5802, which will confirm that the complex correction still is ongoing.

Important short term support at 124.54 protected the downside for a new move higher to 125.90, but I should only be a question of time before support at 124.54 is broken and the downside pressure is building for a new decline towards 122.89 and lower towards 121.26 and finally the ideal wave 4 target at 117.28. Short term I expect resistance at 125.49 for a break below 124.90, which will confirm the next attach on important support at 124.54. Ideally resistance at 125.90 will protect the upside for now, but only a break above 126.95 will invalidate my count and call for a new rally back towards 127.70 and higher.

EUR/NZD

After only a shallow wave ii we broke clearly above resistance at 1.5848, which confirmed the next rally higher. Short term I will look for a minor set-back to 1.5928 and maybe 1.5898 before the next rally higher through 1.5978 for a rally towards 1.6060 and 1.6112 as the next minor targets. That said, we must still be aware, that this rally could be part of the complex correction, that began at 1.6359 and if this is the case we most likely will only see a move slightly above 1.5978 before a decline breaks below 1.5802, which will confirm that the complex correction still is ongoing.

Monday, February 18, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With a high at 125.90 there is a good possibility, that the expected X-wave has finished and the downside pressure again is building. That said, we need a clear break below 124.54 to confirm the top and building of renewed downside pressure. Looking at the correction since the 127.70 high, we have seen a zig-zag correction, but I do think it is to small to correct all of wave 3, therefore I'm looking for a new zig-zag correction developing, that would likely take us down to 121.26 as the first target. At 121.26 wave 4 will have corrected 23.6% of wave 3, but a more normal corrective target will be at the 38.2% corrective target at 117.28, which also marks the bottom of wave iv of one lessor degree. For this count to stay valid, at no point should we see a break above 126.95 as a break above here would call for a new rally higher towards 127.70.

EUR/NZD

Here we only saw a rally to 1.5858 followed by a shallow correction down to 1.5764. The question is, was this correction enough? I will have to say yes, even though the correction could have been deeper. I have noticed in this currency-pair, that wave two can be very shallow and only retrace the absolut minimum. I will now be on guard for a break above 1.5848 that would confirm the next rally higher towards 1.5947 and 1.6088. However, the risk is a break below 1.5764 that would call for a deeper correction towards 1.5745 and possibly even 1.5723 before the next rally high.

With a high at 125.90 there is a good possibility, that the expected X-wave has finished and the downside pressure again is building. That said, we need a clear break below 124.54 to confirm the top and building of renewed downside pressure. Looking at the correction since the 127.70 high, we have seen a zig-zag correction, but I do think it is to small to correct all of wave 3, therefore I'm looking for a new zig-zag correction developing, that would likely take us down to 121.26 as the first target. At 121.26 wave 4 will have corrected 23.6% of wave 3, but a more normal corrective target will be at the 38.2% corrective target at 117.28, which also marks the bottom of wave iv of one lessor degree. For this count to stay valid, at no point should we see a break above 126.95 as a break above here would call for a new rally higher towards 127.70.

EUR/NZD

Here we only saw a rally to 1.5858 followed by a shallow correction down to 1.5764. The question is, was this correction enough? I will have to say yes, even though the correction could have been deeper. I have noticed in this currency-pair, that wave two can be very shallow and only retrace the absolut minimum. I will now be on guard for a break above 1.5848 that would confirm the next rally higher towards 1.5947 and 1.6088. However, the risk is a break below 1.5764 that would call for a deeper correction towards 1.5745 and possibly even 1.5723 before the next rally high.

Sunday, February 17, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We saw a decline slightly below my ideal target at 123.00 on Friday, but the following rally has been much more dynamic and higher than I expected. Therefore I have adjusted my short term count slightly. I do think that wave four will take more time and be deeper than what we have seen and therefore regard the rally from the 122.89 low as an X-wave and will expect a new decline to take place shortly. Short term I'm looking for one last minor high to near the 125.90 - 126.05 area followed by a break below 125.00 and more importantly a break below 124.54 to confirm the next decline lower. For this count to stay valid we should not see a break above resistance at 126.95. Any break above 126.95 will indicate a new rally higher towards 127.70

EUR/NZD

We saw a decline slightly below my ideal target at 123.00 on Friday, but the following rally has been much more dynamic and higher than I expected. Therefore I have adjusted my short term count slightly. I do think that wave four will take more time and be deeper than what we have seen and therefore regard the rally from the 122.89 low as an X-wave and will expect a new decline to take place shortly. Short term I'm looking for one last minor high to near the 125.90 - 126.05 area followed by a break below 125.00 and more importantly a break below 124.54 to confirm the next decline lower. For this count to stay valid we should not see a break above resistance at 126.95. Any break above 126.95 will indicate a new rally higher towards 127.70

EUR/NZD

We have seen the expected bottom in the 1.5650 - 1.5700 area with a low at 1.5640 and the following break above 1.5803 is the first indication, that a bottom might be in place. That said, we expect on more new high near 1.5880 before a deep correction sets in. This correction should at least take us down to 1.5762 and likely even down to 1.5711 before we can expect the next upswing to take place. Even though I do expect a bottom to be in place we need a break above 1.5945 and more importantly a break above 1.6134 to confirm the bottom for the next rally higher towards 1.6359 and higher.

Elliott wave analysis of EUR/USD; GBP/USD and Gold

EUR/USD

First see my last post on EUR/USD here: http://theelliottwavesufer.blogspot.dk/2013/01/elliott-wave-analysis-of-eurusd-dji.html

EUR/USD made it to 1.3711,where it has topped out for now, but have we seen the top of wave E of the major B-wave triangle, that began way back in October 2008? I might well be the case, but if the top is in place we will soon see a much more powerful decline through the support-line at 1.3275. As long as the support-line at 1.3275 protects the downside we must accept the possibility of a new upswing towards 1.3792 and maybe even higher towards the triangle resistance-line near 1.4600.

If we have seen the top of wave E we should have started a new major down leg to below 1.1842 for a move towards 1.0024 as the ideal target.

GBP/USD

Continues to pressure the downside and the break of support at 1.5600 is something to be noticed, but my preferred count has not yet been invalidated, as only a break below 1.5234 will do that. Until a break below 1.5234 is seen I will keep the above count as my preferred count and look for a break above 1.5691 and more importantly a break above 1.5879, which will confirm that a bottom is in place for a new rally higher towards important resistance at 1.6381 and higher in wave C

Gold

Has again catched everybody's eye, but this time not in a positive way. The break below 1,652 and more importantly below 1,626 has opened up the downside, but the question is - how much downside can we expect? We will find good support already here at 1,589 and very strong support at 1,527 only a clear break below here will open up the downside for a much deeper decline. As long as support at 1,527 protects the downside we should be looking for a break above 1,696 as indication, that a bottom is in place for a test of very strong resistance at 1,797 and only a break above here will open the upside for the next big move higher. So all in all we are locked in in quite a big range between 1.527 and 1.797 and only a break on either side of this range will indicate the next big move.

First see my last post on EUR/USD here: http://theelliottwavesufer.blogspot.dk/2013/01/elliott-wave-analysis-of-eurusd-dji.html

EUR/USD made it to 1.3711,where it has topped out for now, but have we seen the top of wave E of the major B-wave triangle, that began way back in October 2008? I might well be the case, but if the top is in place we will soon see a much more powerful decline through the support-line at 1.3275. As long as the support-line at 1.3275 protects the downside we must accept the possibility of a new upswing towards 1.3792 and maybe even higher towards the triangle resistance-line near 1.4600.

If we have seen the top of wave E we should have started a new major down leg to below 1.1842 for a move towards 1.0024 as the ideal target.

GBP/USD

Continues to pressure the downside and the break of support at 1.5600 is something to be noticed, but my preferred count has not yet been invalidated, as only a break below 1.5234 will do that. Until a break below 1.5234 is seen I will keep the above count as my preferred count and look for a break above 1.5691 and more importantly a break above 1.5879, which will confirm that a bottom is in place for a new rally higher towards important resistance at 1.6381 and higher in wave C

Gold

Has again catched everybody's eye, but this time not in a positive way. The break below 1,652 and more importantly below 1,626 has opened up the downside, but the question is - how much downside can we expect? We will find good support already here at 1,589 and very strong support at 1,527 only a clear break below here will open up the downside for a much deeper decline. As long as support at 1,527 protects the downside we should be looking for a break above 1,696 as indication, that a bottom is in place for a test of very strong resistance at 1,797 and only a break above here will open the upside for the next big move higher. So all in all we are locked in in quite a big range between 1.527 and 1.797 and only a break on either side of this range will indicate the next big move.

Thursday, February 14, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The price-action since yesterday has been very much as I expected. Once we broke below 125.21 there was no looking back and we saw a quick decent to support at 123.79. After a small consolidation in the 123.80 - 124.39 area we have seen the next move lower, which I believe will find good support at 123.00 of a correction back towards 124.39. Resistance at 124.39 will ideally protect the upside for the next decline lower towards 122.70. My long term target for the ongoing wave 4 is at minimum 120.71 and more likely 117.24. At 117.24 wave 4 will have corrected 38.2% of wave 3 and at the same time this marks the bottom of wave four of one lessor degree. Two very common targets for wave 4.

EUR/NZD

The price-action since yesterday has been very much as I expected. Once we broke below 125.21 there was no looking back and we saw a quick decent to support at 123.79. After a small consolidation in the 123.80 - 124.39 area we have seen the next move lower, which I believe will find good support at 123.00 of a correction back towards 124.39. Resistance at 124.39 will ideally protect the upside for the next decline lower towards 122.70. My long term target for the ongoing wave 4 is at minimum 120.71 and more likely 117.24. At 117.24 wave 4 will have corrected 38.2% of wave 3 and at the same time this marks the bottom of wave four of one lessor degree. Two very common targets for wave 4.

EUR/NZD

We have seen the expected decline back to the channel support-line near 1.5700 and we should expect support in this area to be much stronger. I do not see any evidence of a bottom yet, but I will look for a bottom to form in the 1.5650 - 1.5700 area for a break above resistance at 1.5803, which will be the first indication, that a bottom is in place. That said, we will have to accept that this decline could go even lower towards 1.5540 before the bottom is in place. Remember we are in a very complex correction since the 1.5902 high back in early September.

Wednesday, February 13, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

I'm currently looking for a break below minor support at 125.21 and more importantly below support at 124.77 to confirm the next move lower in wave c of 4. This next move lower should be quite powerful and will likely reach 123.79 quickly once we break below 125.21. However, my longer term target for wave c is at 117.24, but we must expect, that strong support at 120.71 will put up a real fight. Short term we are looking for resistance at 125.97 to protect the upside for a break below 125.50. If however, we break above 125.97 resistance at 126.57 should do the job and protect the upside otherwise we will likely have to reevaluate our count.

EUR/NZDWe have seen the expected move lower towards strong support at 1.5750. As can be seen in the chart above, the decline from 1.6359 is clearly corrective in character and once this decline comes to an end we will likely seen a fast rally towards the upside. However, for now we should keep our focus towards the downside for a move closer to 1.5750. Short term we will likely see a little rally towards 1.5918 before the next decline lower towards 1.5790 and 1.5750.

Tuesday, February 12, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

My count has pretty much worked out as expected. Yesterday we did see minor support at 125.50 protect the downside for one last rally higher. This last rally did go a little higher than the expected 126.78 (the high was at 126.95). The following decline from 126.95 does have impulsive characters, which tells me that the downside is where my main focus have to be at the moment. This is in sink with my count, which says that wave 4 is unfolding and is correcting the previous wave 3. The ideal target for this wave 4 is at 117.24, which also marks the bottom of wave four of one lessor degree. Short term I'm looking for minor resistance at 125.64 to protect the upside for a break below 124.52, that will confirm the next decline to 123.43 and 122.83.

EUR/NZD

The picture here is very muddy, but with the break below the support-line from 1.5506 my main focus is towards the downside and a new test of the base-channel support-line near 1.5700. In the larger picture I regard the entire overlapping structure since the high at 1.5905 in September 2012 as wave 2. That said it has taken much longer, than we could normally expect. Short term we will find resistance at 1.6038, which I expect will hold for a break below 1.5941 confirming a continuation lower towards 1.5898 and 1.5824 as the next minor targets.

My count has pretty much worked out as expected. Yesterday we did see minor support at 125.50 protect the downside for one last rally higher. This last rally did go a little higher than the expected 126.78 (the high was at 126.95). The following decline from 126.95 does have impulsive characters, which tells me that the downside is where my main focus have to be at the moment. This is in sink with my count, which says that wave 4 is unfolding and is correcting the previous wave 3. The ideal target for this wave 4 is at 117.24, which also marks the bottom of wave four of one lessor degree. Short term I'm looking for minor resistance at 125.64 to protect the upside for a break below 124.52, that will confirm the next decline to 123.43 and 122.83.

EUR/NZD

The picture here is very muddy, but with the break below the support-line from 1.5506 my main focus is towards the downside and a new test of the base-channel support-line near 1.5700. In the larger picture I regard the entire overlapping structure since the high at 1.5905 in September 2012 as wave 2. That said it has taken much longer, than we could normally expect. Short term we will find resistance at 1.6038, which I expect will hold for a break below 1.5941 confirming a continuation lower towards 1.5898 and 1.5824 as the next minor targets.

Monday, February 11, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

There was no time for one last decline in wave a, which the break above minor resistance 124.50 confirmed. Currently wave b is unfolding and we could see one last move higher towards 126.78 as long as support at 125.50 has not been penetrated. A break below support at 125.50 will be the first indication, that wave b is over and wave c down has taken over. The final confirmation that wave c indeed is in motion will be a break below 124.52. The first target for wave c once it takes over will be at 122.37. The ideal target for this ongoing wave 4 will be at 117.24.

EUR/NZD

Strong resistance at 1.6072 was pierced, but important resistance at 1.6147 was never in any danger of being broken. We are now looking for a break below minor support at 1.5889 to confirm the next leg lower towards strong support at 157.50. The next move down will likely be very powerful a dynamic in its character and we should see a quick decline to 1.5892 once support at 1.5989 is broken. Short term we will find resistance at 1.6058, which ideally will protect the upside for the break below support at 1.5989.

There was no time for one last decline in wave a, which the break above minor resistance 124.50 confirmed. Currently wave b is unfolding and we could see one last move higher towards 126.78 as long as support at 125.50 has not been penetrated. A break below support at 125.50 will be the first indication, that wave b is over and wave c down has taken over. The final confirmation that wave c indeed is in motion will be a break below 124.52. The first target for wave c once it takes over will be at 122.37. The ideal target for this ongoing wave 4 will be at 117.24.

EUR/NZD

Strong resistance at 1.6072 was pierced, but important resistance at 1.6147 was never in any danger of being broken. We are now looking for a break below minor support at 1.5889 to confirm the next leg lower towards strong support at 157.50. The next move down will likely be very powerful a dynamic in its character and we should see a quick decline to 1.5892 once support at 1.5989 is broken. Short term we will find resistance at 1.6058, which ideally will protect the upside for the break below support at 1.5989.

Sunday, February 10, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

With the break below 124.01 we got the final confirmation, that wave 3 did indeed end at 127.70 and wave 4 now is in force. Wave 4 corrects wave 3 and as wave 3 clearly was an extended wave we should at least see a 23.6% retracement of wave 3, that would mean a correction down to 121.24. A more normal correction would be a 38.2% correction of wave 3, which would take us down to 117.24 this levels also marks the bottom of wave four of one lessor degree and is a very common retracement target. As wave 2 was a running flat correction we will be looking for a more simple structure in wave 4, something like a simple zig-zag correction. Short term we are looking for a break below support at 123.42 for a continuation down to 122.98, where we expect wave a of 4 to end. only a break above 124.50 will invalidate that call for a move towards the 125.70 - 126.05 area before down again.

EUR/NZD

The break below 1.5990 invalidated my bullish count and I have had to change my count to a more bearish count. This count says we are still in a very complex wave 2 correction, which should take us lower towards the base-channel support-line near 1.5700. Short term we are looking for strong resistance near 1.6072, which we expect will protect the upside for a break below 1.5988 and more importantly a break below 1.5945 confirming a continuation down towards 1.5750. A break above 1.6072 would be a surprise, but at no point can a break above 1.6147 be allowed under this count.

With the break below 124.01 we got the final confirmation, that wave 3 did indeed end at 127.70 and wave 4 now is in force. Wave 4 corrects wave 3 and as wave 3 clearly was an extended wave we should at least see a 23.6% retracement of wave 3, that would mean a correction down to 121.24. A more normal correction would be a 38.2% correction of wave 3, which would take us down to 117.24 this levels also marks the bottom of wave four of one lessor degree and is a very common retracement target. As wave 2 was a running flat correction we will be looking for a more simple structure in wave 4, something like a simple zig-zag correction. Short term we are looking for a break below support at 123.42 for a continuation down to 122.98, where we expect wave a of 4 to end. only a break above 124.50 will invalidate that call for a move towards the 125.70 - 126.05 area before down again.

EUR/NZD

The break below 1.5990 invalidated my bullish count and I have had to change my count to a more bearish count. This count says we are still in a very complex wave 2 correction, which should take us lower towards the base-channel support-line near 1.5700. Short term we are looking for strong resistance near 1.6072, which we expect will protect the upside for a break below 1.5988 and more importantly a break below 1.5945 confirming a continuation down towards 1.5750. A break above 1.6072 would be a surprise, but at no point can a break above 1.6147 be allowed under this count.

Elliott wave analysis of the German DAX Index

German DAX Index

CJ asked me if I would take a look at the German Dax.

Here is my count for the German DAX. As can be seen I regard the entire price-action since the 2007 high at 8,151.57 as corrective. The high we have just seen at 7,871.79 is in my view wave b of an expanding flat correction, which began at 7,441.82, that means we should be looking for a powerful c-wave decline to below 4,965.80.

CJ also asked if I think a top is in place at 7,871.79 and I do think it's the case. The decline from the 7,871.79 does look impulsive in character, meaning that the decline is in five wave down. Short term I would look for a slight recovery towards 7,694.42, which marks the top of wave iv of one lessor degree and at the same time marks the 50% correction target of the decline from 7,871.79 to 7,537.29. Once wave ii is over we should see a powerful decline in wave iii down to 7,166 as a minimum.

CJ asked me if I would take a look at the German Dax.

Here is my count for the German DAX. As can be seen I regard the entire price-action since the 2007 high at 8,151.57 as corrective. The high we have just seen at 7,871.79 is in my view wave b of an expanding flat correction, which began at 7,441.82, that means we should be looking for a powerful c-wave decline to below 4,965.80.

CJ also asked if I think a top is in place at 7,871.79 and I do think it's the case. The decline from the 7,871.79 does look impulsive in character, meaning that the decline is in five wave down. Short term I would look for a slight recovery towards 7,694.42, which marks the top of wave iv of one lessor degree and at the same time marks the 50% correction target of the decline from 7,871.79 to 7,537.29. Once wave ii is over we should see a powerful decline in wave iii down to 7,166 as a minimum.

Saturday, February 9, 2013

Novo Nordisk A/S a Textbook Elliott wave five wave rally

Novo Nordisk A/S

Today I would like to present a very interesting chart from Denmark's biggest company Novo Nordisk. If you don't know them they are making Insulin and accounts for about 1/3 of the Danish main index OMXC20 and therefor is more important, that any other stock in the index.

The rally from its low in mid-2002 at 80.50 is an Elliott wave textbook rally of almost 1,400%.

The chart is information packed, but let us take it step by step.

Alone wave 1 from 80.50 to 349.00 in late 2007 is a wonder rally of 433.5% and it took just over Fibonacci 5.5 years. 5 is a Fibonacci number, but so is 55.

Wave 2 was a complex correction combined by first a flat correction and then a zig-zag, which corrected a little more than 38.2% of wave 1 at 248.60. Wave 2 took 1.3 years, which is 23.6% of 5.5 years.

Wave 3 was clearly a much more powerful rally, which broke above the base-channel (in blue) and never looked back. Wave 3 was almost 2 times longer than wave 1 at 724.59. A rally of 300% in slightly less than 2 years (1.9 years to be exactly) a Fibonacci number too.

Wave 4, which alternated with wave 2 in being a simple zia-zag correction, corrected 38.2% of wave 3 at 524.03 in just 6 months. Which was 23.6% of the time it took to build wave 3.

Finally we are at the ongoing wave 5, which we normally would expect to end at either 38.2% or 61.8% the length from the bottom of wave 1 to the top of wave 3 added to the bottom of wave 4. However we have clearly broken above both and is headed towards the 100% length of the distance traveled from the bottom of wave 1 to the top of wave 3. Therefore we have a double extension as both wave 3 and wave 5 is extending and this is where its get really exciting.

When we deal with an extending wave 5 R.N. Elliott said we will get what, he called, a double retracement, but the most important thing to know, when wave 5 is extending is, that once wave 5 is over we should expect a swift decline to wave ii of 5, which would mean a decline to at least 770.00 and possibly even a decline to 648.00 in wave A. But the is more, if wave A was a zig-zag correction the following B wave will not go all the way back to the top of wave A.

Not alone do we know, that we soon can expect a decline in Novo Nordisk of no less than 31%, but it will be swift and give us a possible target where to buy for a large wave B correction.

Would you bet on a continuation higher towards 1,400 (31% up from here) or would you sell you holdings here or even sell-short to gain 31% from near 1,126? By the way take a look at EWO-indicator what a massive divergence on this last rally higher. You choice....

Today I would like to present a very interesting chart from Denmark's biggest company Novo Nordisk. If you don't know them they are making Insulin and accounts for about 1/3 of the Danish main index OMXC20 and therefor is more important, that any other stock in the index.

The rally from its low in mid-2002 at 80.50 is an Elliott wave textbook rally of almost 1,400%.

The chart is information packed, but let us take it step by step.

Alone wave 1 from 80.50 to 349.00 in late 2007 is a wonder rally of 433.5% and it took just over Fibonacci 5.5 years. 5 is a Fibonacci number, but so is 55.

Wave 2 was a complex correction combined by first a flat correction and then a zig-zag, which corrected a little more than 38.2% of wave 1 at 248.60. Wave 2 took 1.3 years, which is 23.6% of 5.5 years.

Wave 3 was clearly a much more powerful rally, which broke above the base-channel (in blue) and never looked back. Wave 3 was almost 2 times longer than wave 1 at 724.59. A rally of 300% in slightly less than 2 years (1.9 years to be exactly) a Fibonacci number too.

Wave 4, which alternated with wave 2 in being a simple zia-zag correction, corrected 38.2% of wave 3 at 524.03 in just 6 months. Which was 23.6% of the time it took to build wave 3.

Finally we are at the ongoing wave 5, which we normally would expect to end at either 38.2% or 61.8% the length from the bottom of wave 1 to the top of wave 3 added to the bottom of wave 4. However we have clearly broken above both and is headed towards the 100% length of the distance traveled from the bottom of wave 1 to the top of wave 3. Therefore we have a double extension as both wave 3 and wave 5 is extending and this is where its get really exciting.

When we deal with an extending wave 5 R.N. Elliott said we will get what, he called, a double retracement, but the most important thing to know, when wave 5 is extending is, that once wave 5 is over we should expect a swift decline to wave ii of 5, which would mean a decline to at least 770.00 and possibly even a decline to 648.00 in wave A. But the is more, if wave A was a zig-zag correction the following B wave will not go all the way back to the top of wave A.

Not alone do we know, that we soon can expect a decline in Novo Nordisk of no less than 31%, but it will be swift and give us a possible target where to buy for a large wave B correction.

Would you bet on a continuation higher towards 1,400 (31% up from here) or would you sell you holdings here or even sell-short to gain 31% from near 1,126? By the way take a look at EWO-indicator what a massive divergence on this last rally higher. You choice....

Thursday, February 7, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

As expected support at 125.73 protected the downside for a break above 126.83, but the failure to break above the former top at 127.70 shows us, that the loss of upside momentum is serious. The following break below 125.73 is the first indication, that we could have seen a top for wave 3. If this is the case we should see minor resistance 125.92 protect the upside for a new decline below 124.50 and ideally below 124.01 to confirm that the top is in place and wave 4 has taken over. However, as long as important support at 124.01 has not been broken there is a risk of a new rally higher towards 127.70 and possibly even towards the 128.98 - 129.19 area, where I expect a top will be found.

EUR/NZD

Here we saw the expected break above the minor resistance-line from 1.6359, but it was clearly a failure-break, which is of concern to my overall bullish count. That said, a break below 1.5990 is needed to invalidate my count and cause a reevaluation to a more bearish count. However, as long as important support at 1.5990 protects the downside I will be looking for a break above 1.6081 and more importantly a break above 1.6147, which will confirm a new rally higher towards 1.6278 and 1.6359 towards the ideal target at 1.6524.

As expected support at 125.73 protected the downside for a break above 126.83, but the failure to break above the former top at 127.70 shows us, that the loss of upside momentum is serious. The following break below 125.73 is the first indication, that we could have seen a top for wave 3. If this is the case we should see minor resistance 125.92 protect the upside for a new decline below 124.50 and ideally below 124.01 to confirm that the top is in place and wave 4 has taken over. However, as long as important support at 124.01 has not been broken there is a risk of a new rally higher towards 127.70 and possibly even towards the 128.98 - 129.19 area, where I expect a top will be found.

EUR/NZD

Here we saw the expected break above the minor resistance-line from 1.6359, but it was clearly a failure-break, which is of concern to my overall bullish count. That said, a break below 1.5990 is needed to invalidate my count and cause a reevaluation to a more bearish count. However, as long as important support at 1.5990 protects the downside I will be looking for a break above 1.6081 and more importantly a break above 1.6147, which will confirm a new rally higher towards 1.6278 and 1.6359 towards the ideal target at 1.6524.

Subscribe to:

Comments (Atom)