We saw a decline slightly below my ideal target at 123.00 on Friday, but the following rally has been much more dynamic and higher than I expected. Therefore I have adjusted my short term count slightly. I do think that wave four will take more time and be deeper than what we have seen and therefore regard the rally from the 122.89 low as an X-wave and will expect a new decline to take place shortly. Short term I'm looking for one last minor high to near the 125.90 - 126.05 area followed by a break below 125.00 and more importantly a break below 124.54 to confirm the next decline lower. For this count to stay valid we should not see a break above resistance at 126.95. Any break above 126.95 will indicate a new rally higher towards 127.70

EUR/NZD

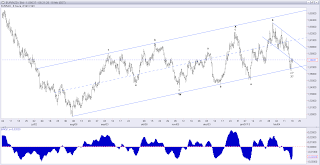

We have seen the expected bottom in the 1.5650 - 1.5700 area with a low at 1.5640 and the following break above 1.5803 is the first indication, that a bottom might be in place. That said, we expect on more new high near 1.5880 before a deep correction sets in. This correction should at least take us down to 1.5762 and likely even down to 1.5711 before we can expect the next upswing to take place. Even though I do expect a bottom to be in place we need a break above 1.5945 and more importantly a break above 1.6134 to confirm the bottom for the next rally higher towards 1.6359 and higher.

No comments:

Post a Comment