Facebook

Just a quick note on Facebook before I'm of to Barcelona.

We should be very close to a bottom now. Under no circumstance can a break below 23.37 be accepted at that would leave us with an overlap between wave 1 and 4, which is not allowed under the EWP.

I'm still looking for wave 5 higher to 33.80

Therefore the current levels also represent a low risk buying opportunity, with a close just below 23.37.

Saturday, May 25, 2013

Friday, May 24, 2013

Vacation time - Barcelona here we come

Time for a Little vacation, I will be in Barcelona for the next week and enjoy all its beauty.

Take care and trade well...

Elliott wave analysis of DJI - Is the market toasted?

Dow Jones Industrial Index

Are the stock markets toasted?

I'm not sure they have gotten the right amount of heat yet. I'm looking for a move slightly above 16,000 before wave D, of the major expanded triangle, that has been Building since 2000, is finally done.

Short term I'm looking for wave iv Down to 14,355 from where I will be looking for the last rally higher to just above 16,000 to end wave v and major wave D.

If major wave D already has peaked we will see a swift break below support at 14,355 and more importantly a break below the top of wave i at 13,653 pretty soon and if that happens, then this market is clearly toast...

Thursday, May 23, 2013

Elliott wave analysis of EUR/USD

EUR/USD

Just a quick Little update on this major cross.

Short term we should see a move lower towards 1.2719, where we will end wave i of 3, this should be followed by a wave ii correction to 1.2998 (or a Little lower would be ideal) and the acceleration to the downside in wave iii of 3 down to at least 1.2295 or more likely lower to 1.1704.

That said we should be aware of the mounting downside pressure that could/will emerge, when we break below the triangle support-line near 1.2040.

Just a quick Little update on this major cross.

Short term we should see a move lower towards 1.2719, where we will end wave i of 3, this should be followed by a wave ii correction to 1.2998 (or a Little lower would be ideal) and the acceleration to the downside in wave iii of 3 down to at least 1.2295 or more likely lower to 1.1704.

That said we should be aware of the mounting downside pressure that could/will emerge, when we break below the triangle support-line near 1.2040.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

We are in a position where an acceleration higher towards 1.6481 could take place any time. Short term I will be looking for a break above 1.6040 as the possible catalyst for this acceleration higher. Support is now found at 1.5955 and strong support at 1.5922, which I expect will protect the downside for the break above 1.6040 and an acceleration towards the target for red wave iii at 1.6481. Only a break below support at 1.5842 will confuse the overall bullish Picture.

We have seen a nice five wave decline from 133.81 down to 129.97, which marked wave i. The following correction of wave i has been a double zig-zag correction from 129.97 up to 132.52. the correction to 132.52 was slightly above the 61.8% retracement target for wave i at 132.34, this correction marks wave ii and we should now see a very powerful wave iii towards at least 128.67, but it will be more likely, that we would see an extension lower to 126.29, before wave iii is over. The following wave iv correction should be a shallow correction to 128.67 and then the final wave v of A down to 124.92. This five wave decline in wave A should be followed by a 61.8% correction in wave B to 130.41 before wave C lower takes over for a decline down to 121.52. This will be the road map for the unfolding wave II correction over the coming weeks.

EUR/NZD

We are in a position where an acceleration higher towards 1.6481 could take place any time. Short term I will be looking for a break above 1.6040 as the possible catalyst for this acceleration higher. Support is now found at 1.5955 and strong support at 1.5922, which I expect will protect the downside for the break above 1.6040 and an acceleration towards the target for red wave iii at 1.6481. Only a break below support at 1.5842 will confuse the overall bullish Picture.

Wednesday, May 22, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

Weekly

8 Hourly

EUR/JPYWith the test of 133.81 yesterday, we have seen the end of wave 5 and wave I of the entire rally since the July 24 - 2012 low at 94.10. We are now entering a major correction as wave II. This correction should ideally correct to the bottom of wave 4 which comes in at 118.73, that (if you take a look at the chart above) will also be an almost a perfect 38.2% correction of the rally from 94.10 to 133.81. The rally from 94.10 to 133.81 has taken 44 week (Fibonacci number) and has corrected slightly more than 50% of the decline from 168.88 down to 94.10 (see the weekly chart above).

Short term we have already seen a 50% retracement of the decline from 133.81 - 131.94 with the test of 132.87 and should expect the next decline to at least 131.08 any time now. That said we must accept the possibility, that support at 131.94 protects the downside for a slightly higher correction to 133.10, but that is not my preferred count at this point.

As we have entered the powerful wave iii of 3 we should an acceleration towards the upside. We have seen a break above the base-channel resistance line as would be expected as wave three unfolds. The first target I'm looking for is at 1.6481, but longer term I'm looking for much higher levels as major wave C unfolds.

Short term minor resistance at 1.6024 could protect the upside for a minor and likely sub-normal correction towards 1.5979 and maybe 1.5939 before the next swing higher towards 1.6085 and 1.6134 on the way towards 1.6481.

Tuesday, May 21, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

It finally seems as we are going to see the last part of the rally towards the ideal target near 134.47. Over the last week a small wave iv of v of 5 triangle has been developing and we have seen the start of the thrust towards the upside. Short term we are looking for support near 132.32 to protect the downside for a break above resistance at 132.77, which will open the upside for a continuation higher towards 133.54 and 134.47 as the ideal target. As I expect this to be the final rally higher, we should Work with stops in as close as possible and look for sings, that the entire rally since the 94.10 low is coming to and end.

EUR/NZD

As we saw a break below support at 1.5744, we saw a little detour to 1.5702 before we saw the next move higher. With the break above resistance at 1.5840 we should now see the upside pressure increase. We are looking for support at 1.5820 to protect the downside for a break above 1.5854, which will confirm the next test of resistance at 1.5924, but this time we should see a clear break above this resistance for a continuation higher towards 1.6481. However, if support at 1.5820 is broken it will delay the rally higher for a slightly deeper correction towards 1.5764 before the next rally higher.

It finally seems as we are going to see the last part of the rally towards the ideal target near 134.47. Over the last week a small wave iv of v of 5 triangle has been developing and we have seen the start of the thrust towards the upside. Short term we are looking for support near 132.32 to protect the downside for a break above resistance at 132.77, which will open the upside for a continuation higher towards 133.54 and 134.47 as the ideal target. As I expect this to be the final rally higher, we should Work with stops in as close as possible and look for sings, that the entire rally since the 94.10 low is coming to and end.

EUR/NZD

As we saw a break below support at 1.5744, we saw a little detour to 1.5702 before we saw the next move higher. With the break above resistance at 1.5840 we should now see the upside pressure increase. We are looking for support at 1.5820 to protect the downside for a break above 1.5854, which will confirm the next test of resistance at 1.5924, but this time we should see a clear break above this resistance for a continuation higher towards 1.6481. However, if support at 1.5820 is broken it will delay the rally higher for a slightly deeper correction towards 1.5764 before the next rally higher.

Elliott wave analysis on Gold and Silver

Gold

I'm looking for a series of lower Lows in the coming days weeks and wave C continues lower. I would expect wave C hit just below 1,165 where wave C is 1.618 times longer than wave A and we could even see it lower towards the 1,012 - 1,045 area.

You can see my last post regarding gold from April 17 here: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-on-gold-crude-oil.html

Silver

Is already making new Lows and will like continue to 18.63 and possibly even towards 13.83 in wave C of Y.

The break below support at 21.34 has confirmed the long term corrective rally from 4.00 in November 2001. If we had counted this rally as impulsive we would now have an overlap between wave 1 and 4, which is not allowed under the Elliott Wave Principle. The former support near 26.00 will now act as strong resistance if tested.

Please see my post from April 25 here: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-on-silver.html

I'm looking for a series of lower Lows in the coming days weeks and wave C continues lower. I would expect wave C hit just below 1,165 where wave C is 1.618 times longer than wave A and we could even see it lower towards the 1,012 - 1,045 area.

You can see my last post regarding gold from April 17 here: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-on-gold-crude-oil.html

Silver

Is already making new Lows and will like continue to 18.63 and possibly even towards 13.83 in wave C of Y.

The break below support at 21.34 has confirmed the long term corrective rally from 4.00 in November 2001. If we had counted this rally as impulsive we would now have an overlap between wave 1 and 4, which is not allowed under the Elliott Wave Principle. The former support near 26.00 will now act as strong resistance if tested.

Please see my post from April 25 here: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-on-silver.html

Monday, May 20, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We did see support at 131.55 protect the downside for a break above 132.13, which indicates, that we should see a new challenge of resistance in the 132.55 - 132.77 area, if this resistance is overcome we can expect a continuation higher towards 133.54 and the ideal target near 134.47. If however, support at 131.55 is broken and more importantly if support at 130.94 is broken we will have to consider the possibility of a fifth wave failure at 132.55 and that the rally from 94.10 is over and a major correction is ongoing.

EUR/NZD

We did see support at 131.55 protect the downside for a break above 132.13, which indicates, that we should see a new challenge of resistance in the 132.55 - 132.77 area, if this resistance is overcome we can expect a continuation higher towards 133.54 and the ideal target near 134.47. If however, support at 131.55 is broken and more importantly if support at 130.94 is broken we will have to consider the possibility of a fifth wave failure at 132.55 and that the rally from 94.10 is over and a major correction is ongoing.

EUR/NZD

I'm still looking for strong support at 1.5744 to protect the downside for a break above resistance at 1.5812 and more importantly resistance at 1.5840, which will confirm the next rally higher to 1.5924 on the way towards the ideal target for red wave iii at 1.6481. That said a break below 1.5744 would likely be very short lived and will delay the next rally higher, but it should only be a matter of time before the next rally takes of and we will see the break above 1.5840.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

I'm still looking for the last rally higher towards the ideal target near 134.47, where I expect the entire rally, since the 94.10 low, to end and mark the top of wave I. Once we have wave I in place I will be looking for wave II lower to the bottom of wave 4 of one lessor degree, which comes in at 118.73. Short term I would like to see support at 131.55 protect the downside for a break above 132.13 to confirm the next rally higher towards 132.77 and higher to 133.54 on the way to the ideal target near 134.47. That said only a break below support at 130.97 will indicate, that wave v of 5 ended early and the major wave II correction is already ongoing.

EUR/NZD

We have seen the expected correction down to 1.5770 (it has been a little deeper with a test of 1.5749), but we should be ready for the next rally higher and are looking for a break above minor resistance at 1.5840 to confirm the next strong rally higher. On this next rally higher I'm also looking for a clear break above the base-channel resistance line confirming that we are in red wave iii, which ideally should make it to at least 1.6481 and possibly even higher. That said, as long as minor resistance at 1.5798 and more importantly resistance at 1.5840 protects the upside, we must allow for a decline lower towards 1.5735, but I do favor the rally higher from here.

I'm still looking for the last rally higher towards the ideal target near 134.47, where I expect the entire rally, since the 94.10 low, to end and mark the top of wave I. Once we have wave I in place I will be looking for wave II lower to the bottom of wave 4 of one lessor degree, which comes in at 118.73. Short term I would like to see support at 131.55 protect the downside for a break above 132.13 to confirm the next rally higher towards 132.77 and higher to 133.54 on the way to the ideal target near 134.47. That said only a break below support at 130.97 will indicate, that wave v of 5 ended early and the major wave II correction is already ongoing.

EUR/NZD

We have seen the expected correction down to 1.5770 (it has been a little deeper with a test of 1.5749), but we should be ready for the next rally higher and are looking for a break above minor resistance at 1.5840 to confirm the next strong rally higher. On this next rally higher I'm also looking for a clear break above the base-channel resistance line confirming that we are in red wave iii, which ideally should make it to at least 1.6481 and possibly even higher. That said, as long as minor resistance at 1.5798 and more importantly resistance at 1.5840 protects the upside, we must allow for a decline lower towards 1.5735, but I do favor the rally higher from here.

Saturday, May 18, 2013

Elliott wave analysis of the USD - Today it's the USD Index; EUR/USD; GBP/USD; USD/JPY; AUD/USD and NZD/USD

USD Index

Is the USD Index about to close above the resistance line from late 2005? If we get a monthly close above this resistance line we should expect the USD Index to move much higher.

On the weekly chart I have showed my bullish Count for the USD Index, but we still have some major hurdles to clear to confirm this is the right Count, but this Count calls for much more upside in the USD Index too.

EUR/USD

All we need is a clear break below 1.2745 to confirm that wave 3 is developing for a decline towards 1.1650 and at the same time a clear break below 1.2745 will trigger the S/H/S top.

GBP/USD

I know that many is looking for much more downside in this cross, but that possibility does not fit into my long term Count and therefore I still keep my much more bullish Count open until it has been proven wrong. A new break below 1.4831 will be the first warning, that my bullish Count is wrong and a break below 1.4258 will be the last nail in the coffin and I will have to adopt the bearish Count. But for now I'm holding my ground and keep my bullish GBP Count.

USD/JPY

There is no doubt here. JPY is toasted for a very long term, but that does not mean it will be straight forward and just a one way ticket. Yes it has been that way since September 2012, but we can't expect this rally to keep on going forever, but where do we have the next possible upside target? At 106.20, where red wave iii will be 3.618 times longer than red wave i. However, even if we does see a short term top at 106.20 we should not expect more than brief correction Down to 99.38 and maybe 95.08 before the next rally higher.

AUD/USD

What just happened here a lot of AUD bulls are thinking to them self's. We where looking for wave e of the major wave 4 triangle, but all there is left is hope... Hope that support at 0.9581 doesn't break because a break below here will break the back on every AUD bull out there.

It has in no way been an easy Count and I have had a lot of doubts myself along the way, but the wave 4 triangle just never fitted into any of my Counts, however, the major top at 1.1080 was a perfect Count and that a major downside pressure was close by.

You can see my long term Count here: http://theelliottwavesufer.blogspot.dk/2012/07/audusd-in-long-term-bullish-or-bearish.html

So where are we going from here? I'm looking for decline to at least 0.8544, but I would not be surprised to see a decline down to 0.7940, where we should expect strong support. However for the short term the important level is 0.9581.

NZD/USD

The Picture here is more clear than the Picture for AUD. I'm looking for a long term decline to below 0.7369 ideally to 0.7240 as the first downside target, but Again I wouldn't be surprised to see it lower to the 0.6375 - 0.6400 area. Short term I'm looking for wave iii Down to 0.7801, where wave iii will be 2.618 times longer than wave i.

Friday, May 17, 2013

Elliott wave analysis on EUR/AUD - Short term top, but still much more upside to cover...

EUR/AUD

Please see my post from April 10 here first: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-of-euraud.html

And my long term Count from September 7 - 2012 here: http://theelliottwavesufer.blogspot.dk/2012/09/euraud-long-term-view-multi-year-new.html

As we now have broken above the top of wave i at 1.3190 wave iii is confirmed, but as you can see above we are still in the very early stages of wave iii. we have much more upside to cover.

Wave i of 3 wave an expanded leading diagonal and following an diagonal triangle we should expect the next impulsive wave to extend. In this case that Means a rally at least 1.618 times wave i and that leaves us with the first possible target for wave iii at 1.3883.

However, short term we will likely see a minor top at 1.3268, but remember it will only be a minor top and we should always expect shallow and even sub-normal correction as wave iii progresses.

Please see my post from April 10 here first: http://theelliottwavesufer.blogspot.dk/2013/04/elliott-wave-analysis-of-euraud.html

And my long term Count from September 7 - 2012 here: http://theelliottwavesufer.blogspot.dk/2012/09/euraud-long-term-view-multi-year-new.html

As we now have broken above the top of wave i at 1.3190 wave iii is confirmed, but as you can see above we are still in the very early stages of wave iii. we have much more upside to cover.

Wave i of 3 wave an expanded leading diagonal and following an diagonal triangle we should expect the next impulsive wave to extend. In this case that Means a rally at least 1.618 times wave i and that leaves us with the first possible target for wave iii at 1.3883.

However, short term we will likely see a minor top at 1.3268, but remember it will only be a minor top and we should always expect shallow and even sub-normal correction as wave iii progresses.

Elliott wave analysis on EUR/JPY and EUR/NZD - Follow up from this mornings brief update

EUR/JPY

I'm still looking for the final wave higher towards the ideal target near 134.47 at which point I think the entire rally since the 94.10 low will end wave I and wave II will take over. As wave v of 5 moves higher we now must be on high alert to signs, that wave I is over. Once wave II takes over we should expect a powerful decline towards the bottom of wave 4 of one lessor degree, which comes in at 118.73. However, for now we should still look for the last rally higher and for the short term support at 131.28 and more importantly support at 131.18 should protect the downside for a break above 132.08 for next move higher trough 132.77 towards 133.54 and finally 134.47.

EUR/NZD

I'm still looking for the final wave higher towards the ideal target near 134.47 at which point I think the entire rally since the 94.10 low will end wave I and wave II will take over. As wave v of 5 moves higher we now must be on high alert to signs, that wave I is over. Once wave II takes over we should expect a powerful decline towards the bottom of wave 4 of one lessor degree, which comes in at 118.73. However, for now we should still look for the last rally higher and for the short term support at 131.28 and more importantly support at 131.18 should protect the downside for a break above 132.08 for next move higher trough 132.77 towards 133.54 and finally 134.47.

EUR/NZD

There was no time for red wave ii to develop into a deeper correction and the break above the top of red wave i indicated, that red wave iii was developing. We should soon see a clear break above the base-channel resistance line, which will confirm that red wave iii is developing. As red wave i wave a leading diagonal, we should expect red wave iii to extend and the first extension target will come in at 1.6481, where red wave iii will be 1.618 times red wave i. Short term we could see a decline to 1.5770, but from there or upon a break above 1.5924 we should see the next very powerful rally higher towards 1.5970 and 1.6023.

Thursday, May 16, 2013

Elliott wave analysis on SunPower

SunPower

Just a quick note on SunPower too.

With the test of 22.38 we have seen the top of wave iii of 3 and should now see wave iv back to 19.45 and maybe 17.64. As wave ii of 3 wave a deep correction we should expect a shallow wave iv and after an extension of 4,236 times wave i in wave iii we should not expect much more than the absolute minimum retracement in wave iv, which will be a 23.6% retracement of wave iii and that means a target near 19.45 however we could see a deeper correction in wave iv towards the 38.2% retracement, which would target 17.64 or just below the base-channel resistance line.

I think the most likely target will be 19.45 and the higher in wave v of 3 towards the first target for wave 3 near 25.11.

Just a quick note on SunPower too.

With the test of 22.38 we have seen the top of wave iii of 3 and should now see wave iv back to 19.45 and maybe 17.64. As wave ii of 3 wave a deep correction we should expect a shallow wave iv and after an extension of 4,236 times wave i in wave iii we should not expect much more than the absolute minimum retracement in wave iv, which will be a 23.6% retracement of wave iii and that means a target near 19.45 however we could see a deeper correction in wave iv towards the 38.2% retracement, which would target 17.64 or just below the base-channel resistance line.

I think the most likely target will be 19.45 and the higher in wave v of 3 towards the first target for wave 3 near 25.11.

Elliott wave analysis of EUR/JPY and EUR/NZD

I will update the text later today, sorry for the delay

EUR/NZD

Just a quick note here.

It seems wave ii ended early with a low at 1.5577 and that means wave iii is likely already developing. And looking at the rally of the 1.5577 low it has all the right impulsive characters. A break above the base-channel line will confirm that we are in wave iii higher towards 1.6481.

As Manuel pointed out yesterday, that after an diagonal triangle we should expect an extended wave to follow. In this case it would to the upside as wave i wave a leading diagonal and at 1.6481 wave iii will be 1.618 times longer than wave i. Could it be longer? YES, but we will have to wait and see how wave iii develops.

EUR/JPY

A quick note.

I still looking for the last rally in wave v of 5 towards 134.47.

Ideally support at 131.28 will protect the downside, but at no point should we see a break below 130.28 as that would indicate, that wave v ended early with the high at 132.77.

As you can see on the weekly chart above on the EWO indicator, then the divergence is becoming pronounced and is a warning of a clear loss of momentum and caution is warranted.

Just a quick note here.

It seems wave ii ended early with a low at 1.5577 and that means wave iii is likely already developing. And looking at the rally of the 1.5577 low it has all the right impulsive characters. A break above the base-channel line will confirm that we are in wave iii higher towards 1.6481.

As Manuel pointed out yesterday, that after an diagonal triangle we should expect an extended wave to follow. In this case it would to the upside as wave i wave a leading diagonal and at 1.6481 wave iii will be 1.618 times longer than wave i. Could it be longer? YES, but we will have to wait and see how wave iii develops.

Wednesday, May 15, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

The deep correction from 132.78 indicates, that wave iii of 5 ended early and that wave iv of 5 is ongoing. Wave iv of 5 could already have ended at 131.18, which a break above 131.91 will confirm. However, until we have a clear break above 131.91 we must accept, that wave iv could retrace a little more of wave iii, with a deeper correction down to 130.88 and maybe 130.43 (not likely), before wave v of 5 takes over. As wave iii ended a little early (below our ideal target at 133.59) we should expect wave v to end a little lower too. Wave v should as a minimum reach 133.20, but it is more likely, that we will see a top at 134.47.

EUR/NZDThe deep correction has forced me to change my count. Instead of a series of waves one's and two's the rally from 1.5261 has been a leading diagonal. This type of impulsive, is the only one that allows overlapping waves and still is impulsive. That means, that we currently are in red wave ii, which we expect will terminate in the 1.5466 - 1.5532 area, from where the powerful red wave iii is expected. Short term we will be looking for a move higher towards the 1.5667 - 1.5696 area from where we expect one more decline down to the 1.5466 - 1.5532 area, with 1.5466 as the most likely target, before red wave iii takes over.

Tuesday, May 14, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

After one last decline in minor wave four of iii down to 131.53 we saw the expected rally higher through resistance at 132.40. We are now in wave five of iii of 5 and I still expect this rally in wave five of iii to reach its ideal target near 133.59 before we will see wave iv of 5 take over. As wave ii 5 was a flat correction I will be looking for a quick zig-zag correction towards 131.79 before the final rally higher in wave v of 5, which will have an ideal target near 135.47, this final rally will end the entire rally since the 94.10 low.

EUR/NZD

After one last decline in minor wave four of iii down to 131.53 we saw the expected rally higher through resistance at 132.40. We are now in wave five of iii of 5 and I still expect this rally in wave five of iii to reach its ideal target near 133.59 before we will see wave iv of 5 take over. As wave ii 5 was a flat correction I will be looking for a quick zig-zag correction towards 131.79 before the final rally higher in wave v of 5, which will have an ideal target near 135.47, this final rally will end the entire rally since the 94.10 low.

EUR/NZD

We keep making new highs, but we still lack the acceleration, that we would normally expect in wave three. I still think, that once the real momentum in the ongoing wave iii is released, it should be no problems breaking above the base channel resistance line for a very powerful rally higher. Once we have cleared the strong resistance in the 1.5918 - 1.5938 area we should see the top at 1.6359 tested soon after. Short term I'm looking for minor support at 1.5736 to protect the downside for a break above minor resistance at 1.5767 and a break above here confirms the next rally higher. However, if support at 1.5736 is broken it open for a slightly deeper correction to 1.5718 before the next rally higher.

Monday, May 13, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

EUR/NZD

We are still headed for resistance near 133.59 short term, were we will likely find the top of wave iii of 5 and after a brief correction in wave iv down to the 131.56 - 131.79 area we should see the final rally higher in wave v of 5 towards 135.47. As we are getting closer to the ideal target for the entire rally from 94.10 we should be aware of signs, that this major rally is coming to an end and wave 2 is ready to take over. However, for now we should still be focused towards the upside and the expected test of 133.59 soon.

EUR/NZD

Red wave iii of iii is progressing nicely, but we would still like to see some real acceleration through the base channel resistance line to confirm that wave iii will extend. Short term we would like to see support at 1.5680 protect the downside for a break above 1.5742 and more importantly a break above 1.5770, which will confirm the next rally higher to 1.5918. That said a break below 1.5680 will open for a slightly deeper correction to 1.5648 before the next move higher will be seen.

Sunday, May 12, 2013

Elliott wave analysis on Facebook and SunPower

Facebook

Should be ready for the next rally higher in red wave iii towards 32.60. The ideal target for the ongoing wave 5 is at 34.10.

Sun Power

The clear break above the base channel resistance line has forced me to change my Count. Instead of this rally being a wave v of 1, wave 1 ended at 13.45 and wave 2 ended at 9.35 and wave 3 higher is currently developing. I expect wave 3 to be an extended wave and continue higher towards 25.08.

Should be ready for the next rally higher in red wave iii towards 32.60. The ideal target for the ongoing wave 5 is at 34.10.

Sun Power

The clear break above the base channel resistance line has forced me to change my Count. Instead of this rally being a wave v of 1, wave 1 ended at 13.45 and wave 2 ended at 9.35 and wave 3 higher is currently developing. I expect wave 3 to be an extended wave and continue higher towards 25.08.

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

We are getting close to one of the big hurdles near 1.3359, which will likely mark the top of wave iii of 5, we should see a brief correction down to 131.61 in wave iv of 5, before the final rally higher to 135.47 in wave v of 5 and the entire rally from 94.10 should terminate wave I and wave II take over.

As we are getting closer to the ideal target for this entire rally, we will have to look closely for signs, that this rally could end early or maybe even overshoot the ideal target, but for now we should still stay focused towards the upside as wave 5 progresses.

EUR/NZD

I'm still looking for an acceleration higher as red wave iii takes over. I expect to see a break above the base channel as red wave iii develops towards 1.6142 and maybe even higher. Short term we should ideally see support in the 1.5620 - 1.5630 protect the downside for a clear break above 1.5692 and more importantly a break above 1.5717, that confirms the target of 1.6142. A break below 1.5620 will delay the possible acceleration towards the upside for a decline to 1.5597 before higher.

We are getting close to one of the big hurdles near 1.3359, which will likely mark the top of wave iii of 5, we should see a brief correction down to 131.61 in wave iv of 5, before the final rally higher to 135.47 in wave v of 5 and the entire rally from 94.10 should terminate wave I and wave II take over.

As we are getting closer to the ideal target for this entire rally, we will have to look closely for signs, that this rally could end early or maybe even overshoot the ideal target, but for now we should still stay focused towards the upside as wave 5 progresses.

EUR/NZD

I'm still looking for an acceleration higher as red wave iii takes over. I expect to see a break above the base channel as red wave iii develops towards 1.6142 and maybe even higher. Short term we should ideally see support in the 1.5620 - 1.5630 protect the downside for a clear break above 1.5692 and more importantly a break above 1.5717, that confirms the target of 1.6142. A break below 1.5620 will delay the possible acceleration towards the upside for a decline to 1.5597 before higher.

Elliott wave analysis of EUR/USD - Have wave 3 down begun?

EUR/USD

Quim has asked me for my EUR/USD Count. The above charts, show my long term count, which shows that we most likely have finished wave E of a major B-wave triangle.

Since wave E ended at 1.3711 we have seen wave 1 Down to 1.2745 and likely wave 2 to 1.3243. and we have now entered wave 3 down. If my count is correct we will see an acceleration towards the downside as wave 3 progresses and should soon see a break below the base channel support line. However, the alternate count is, that we only have seen wave a of 2 and wave b is unfolding and if this is the case we will soon see wave c higher, but that is my alternate count.

Where can we expect wave 3 to end. Wave 3 should at least decline to 1.2280, but I would expect wave 3 to be an extended wave and decline to 1.1683 and maybe even lower, but time will show. When will we know if wave 3 is unfolding. If we break clearly below the mid-line of the new base channel at 1.2840 wave 3 is likely unfolding and a break below 1.2745 confirms wave 3.

Friday, May 10, 2013

Elliott wave analysis of EUR/JPY and EUR/NZD

EUR/JPY

As I expected it was only a question of time before resistance at 130.37 gave away and the underlying upside pressure forced the price higher. We are currently in wave 5 and the ideal target for wave 5 is near 135.47. Breaking down what we have seen of wave 5 so far, we are currently in wave (iii) of iii. I expect wave (iii) to end at 132.12 from where we should see wave (iv) down to 131.58 and maybe 131.15 before wave (v) takes over for a rally towards 133.59 before wave iii of 5 ends.

EUR/NZD

After a little detour to 1.5482 red wave ii finally found its bottom and we should now be in red wave iii higher. This red wave iii is expected to be very powerful and resistance at 1.5658 and at 1.5717 should not cause any trouble, once this wave really gets going. The target for this red wave iii is expected to be near 1.6142 and red wave iv should be a shallow correction to 1.5985 with a possibility of a deeper correction down to 1.5885 before the next powerful rally higher to 1.6299 in red wave v, which just ends wave (iii). Longer term I expect this rally to go much higher and we should at least see 1.7000 tested. However, I would not be surprised to see a continuation higher towards 1.9571 over the next many months.

As I expected it was only a question of time before resistance at 130.37 gave away and the underlying upside pressure forced the price higher. We are currently in wave 5 and the ideal target for wave 5 is near 135.47. Breaking down what we have seen of wave 5 so far, we are currently in wave (iii) of iii. I expect wave (iii) to end at 132.12 from where we should see wave (iv) down to 131.58 and maybe 131.15 before wave (v) takes over for a rally towards 133.59 before wave iii of 5 ends.

EUR/NZD

After a little detour to 1.5482 red wave ii finally found its bottom and we should now be in red wave iii higher. This red wave iii is expected to be very powerful and resistance at 1.5658 and at 1.5717 should not cause any trouble, once this wave really gets going. The target for this red wave iii is expected to be near 1.6142 and red wave iv should be a shallow correction to 1.5985 with a possibility of a deeper correction down to 1.5885 before the next powerful rally higher to 1.6299 in red wave v, which just ends wave (iii). Longer term I expect this rally to go much higher and we should at least see 1.7000 tested. However, I would not be surprised to see a continuation higher towards 1.9571 over the next many months.

Thursday, May 9, 2013

Elliott wave analysis on Sunpower - Follow up

SunPower

As we have made a new high today, I have changed my count slightly. I still think we are close to a top in wave v of 1 and is looking for a move closer to 17.30, that any break below 15.07 will indicate, that wave 1 is in place and wave 2 is developing. The ideal target for wave 2 will be close to 9.36, which marks the bottom of wave iv of one lessor degree.

Could I be wrong and the on going rally is "only" wave 3? Yes of cause, but to confirm that possibility we need a clear break above the base channel resistance-line and accelerates higher. If this outcome is confirmed wave 1 ended at 13.45 and wave 3 should at least reach 19.09, but will more likely continue higher towards 25.11. This is still not my preferred Count, but we will have to stay flexible.

As we have made a new high today, I have changed my count slightly. I still think we are close to a top in wave v of 1 and is looking for a move closer to 17.30, that any break below 15.07 will indicate, that wave 1 is in place and wave 2 is developing. The ideal target for wave 2 will be close to 9.36, which marks the bottom of wave iv of one lessor degree.

Could I be wrong and the on going rally is "only" wave 3? Yes of cause, but to confirm that possibility we need a clear break above the base channel resistance-line and accelerates higher. If this outcome is confirmed wave 1 ended at 13.45 and wave 3 should at least reach 19.09, but will more likely continue higher towards 25.11. This is still not my preferred Count, but we will have to stay flexible.

Elliott wave analysis on GBP/NZD - Long term bottom in place?

Monthly chart

Daily Chart

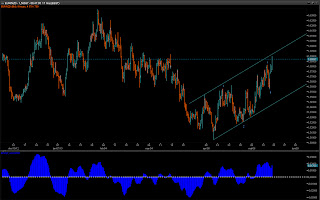

GBP/NZDAs I was looking over my charts today I found this cross very interesting.

As we can see on the monthly chart, a major zig zag decline has been unfolding since October 2000. Wave C is almost equal to wave A and last month we saw a morning star candle develop. A morning star is signaling a possible change in the trend, as it's with all candles they need to be confirmed, which of cause is also the case here. A bullish candle i May will indicate, that an important bottom is in place at 1.7699 and a rally towards strong resistance at 2.4262 could be developing.

If we zoom in on the last part of the decline (see the daily chart) we can see a similar zig-zag as on the monthly chart. We even have fractal bottoms in February 2012 and in April 2013. Wave C was equal, within 23 small pips, to wave A. On the daily chart we have a confirmed divergence, which also indicates, that an important bottom is in place. That said, I would like to see a break above the base channel resistance line, which will indicate, that wave iii is developing. At this point I would like to see support at 1.8180 protect the downside, but only a break below 1.7921 will invalidate my bullish call and indicate that a new low is needed.

Subscribe to:

Comments (Atom)