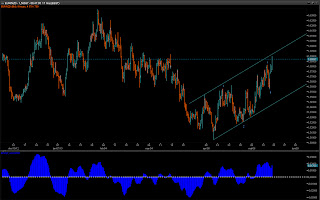

EUR/JPY

A quick note.

I still looking for the last rally in wave v of 5 towards 134.47.

Ideally support at 131.28 will protect the downside, but at no point should we see a break below 130.28 as that would indicate, that wave v ended early with the high at 132.77.

As you can see on the weekly chart above on the EWO indicator, then the divergence is becoming pronounced and is a warning of a clear loss of momentum and caution is warranted.

Just a quick note here.

It seems wave ii ended early with a low at 1.5577 and that means wave iii is likely already developing. And looking at the rally of the 1.5577 low it has all the right impulsive characters. A break above the base-channel line will confirm that we are in wave iii higher towards 1.6481.

As Manuel pointed out yesterday, that after an diagonal triangle we should expect an extended wave to follow. In this case it would to the upside as wave i wave a leading diagonal and at 1.6481 wave iii will be 1.618 times longer than wave i. Could it be longer? YES, but we will have to wait and see how wave iii develops.

No comments:

Post a Comment